Today at 830am, the Treasury will publish its laters Quarterly Refunding Announcement in which it is expected to follow through with its guidance from the last QRA for a "final round of increases" to its coupon auction sizes. Analysts expect a similar size of auction increases as announced in November:

2yr and 5yr notes by USD 3bln per month, 3yr notes by USD 2bln per month, and the 7yr notes by USD 1bln per

- month.

- New issue and reopening auctions for 10yr notes by USD 2bln and the 30yr bond by USD 1bln.

- To maintain the 20yr bond new issue and reopening auction sizes unchanged.

That would result in $121bln of new coupon supply for next week's new issue 3yr (54bln), 10yr (42bln), and 30yr (25bln) auctions.

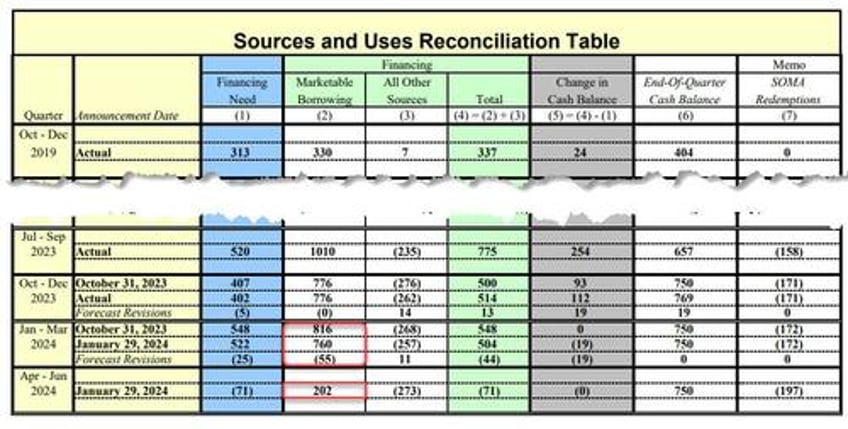

The Treasury released its quarterly financing estimates on Monday, where it said it expects to borrow $760bln in net

marketable debt for January-March period, which was around $100bln less than analyst estimates and down $55bln from its own October 2023 estimate, "largely due to projections of higher net fiscal flows and a higher beginning of quarter cash balance", assuming an end-of-March cash balance of USD 750 billion. It also said it expects to borrow USD 202bln in the April-June period, which was also beneath analyst estimates.

Participants will be looking within the QRA to assess whether the low-sided financing estimates are a function of lower bill issuance, which is most likely, or a result of lower coupon auction sizes than currently thought, which is less likely given the Treasury's preference to avoid surprises in its coupon auctions.

There will also be focus on the Q2 buyback schedule that the Treasury is due to outline this week. Analysts are split between a commencement in February or May. The Treasury is expected to clarify its pricing methodology, frequency of purchases each quarter for each bucket, and scheduling details.

As Bloomberg's Simon White notes, all eyes will be on how much Bill issuance the Treasury expects to ram down the Fed's throat. As White writes, a steeper yield curve and higher term premium this year, along with a slightly lower borrowing estimate for the first quarter, suggest the Treasury will increase longer-term debt auction sizes, but not excessively, and will lower bill issuance in its refunding announcement today. Yields in that case are unlikely to react significantly.

The more important part of refunding announcements is longer-term debt-auction sizes, while the adjustment mechanism is bill-auction sizes. Typically the Treasury won’t want to deviate too much from what the market is expecting in terms of bond-auction sizes as that can trigger market volatility. The larger-than-expected auction sizes in the August announcement were the initial catalyst for the rise in yields through September and October.

Therefore it is likely the lower borrowing estimate will be absorbed by decreasing bill issuance, while bond issuance is likely to rise from the last quarter, but roughly in line with expectations. It’s the prudent thing to do, given the yield curve has been bear steepening, and the increase in yields this year has been driven by a rising term premium. That’s the market’s way of saying to the Treasury, “I’m starting to feel emotional, so don’t do anything triggering.”

Bill issuance has been through the roof, taking them to over 21% of Treasury debt outstanding. Some reduction is due for several reasons, not least as it circumscribes Fed independence.

A fall in bill issuance, along with the retirement of the Bank Term Funding Program in March, will put pressure on reserves and thus liquidity and funding. That has implications for quantitative tightening, but the Treasury announcement is unlikely to have an impact on what the Fed may or may not say on the topic at its meeting later today. More reserve pressure, though, increases the chance of a rate cut in March, at the margin.