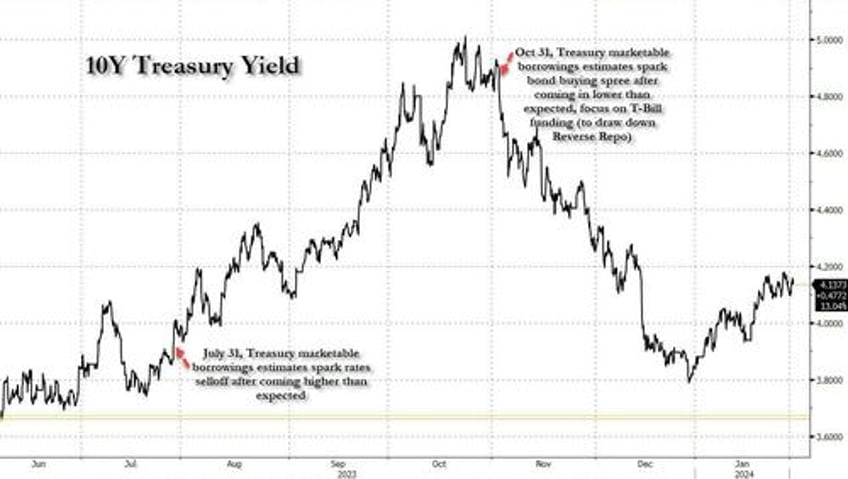

The Treasury's last two Quarterly Refunding Announcements were both a doozy: the first one from July 31, sparked a powerful selloff in Treasuries, pushing yields above the resistance level, after the Treasury estimates much higher supply than the street had expected (more here "Debt Tsunami Begins: US To Sell $1 Trillion In Debt This Quarter, 2nd Highest In History, As Budget Deficit Explodes"); three months later on Nov 1, when yields blew out above 5%, the highest level in almost two decades, in its most recent QRA, the Treasury panicked and promptly reversed direction, estimating less refunding issuance than consensus had expected ($112BN vs $114BN), as well as a ramp up in Bill issuance to facilitate the drainage of the Reverse Repo facility and boost overall market liquidity by focusing on the short-end (more here "US Treasury Reveals Lower Than Expected Rate Of Debt Sales In Quarterly Refunding Plan; Yields Slide"). The result was a sharp drop in rates, which reversed the entire move higher since the Q3 QRA, and after 10Y yields dropped some 120bps they have since stabilized around 4.15%...

Which brings us to the latest Quarterly Refunding Announcement due this week, which along with the FOMC, Friday's payrolls report and the busiest week of Q4 earnings season (32% of market cap reports) including most of Mag 7, will be the highlight of the quarter.