By Ven Ram, Bloomberg Markets Live reporter and strategist

The UK’s softer-than-forecast inflation has spurred a rally in front-end gilts, but levels lower than 5% on the two-year maturity are untenable beyond the short term.

The good news was that headline inflation for June came in at 7.9%, lower than the lowest estimate of economists. And given the impending adjustment to household energy bills, inflation may slow next month too. The not-so-good news for bonds was that core inflation proved to be a lot stickier, and at 6.9%, offers scant comfort for the Bank of England.

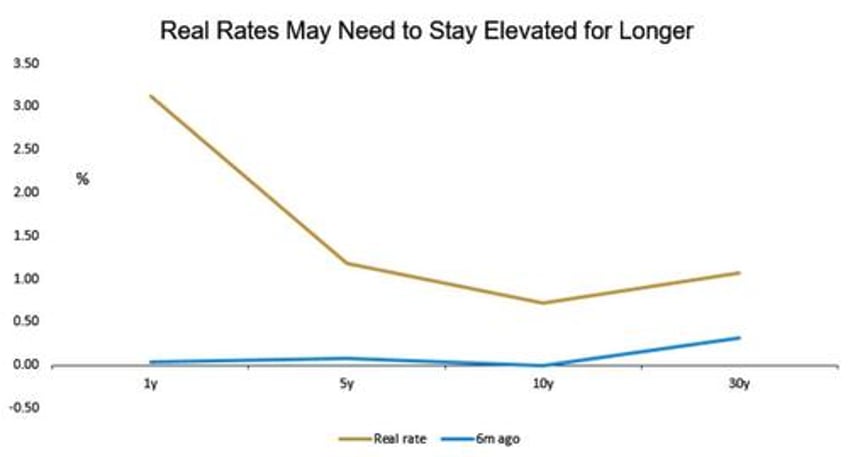

Taken together, the data suggest that the unwinding of bets from the circa 6% terminal rate that the markets were factoring in prior to the release may eventually prove to be premature. Before the data, Bloomberg Economics estimated that core inflation will be 6% by the end of the year, so expectations of any BOE Bank Rate below that via lower inflation-adjusted rates would lead to a premature loosening of financial conditions that would essentially counter the central bank’s efforts to curb inflation.

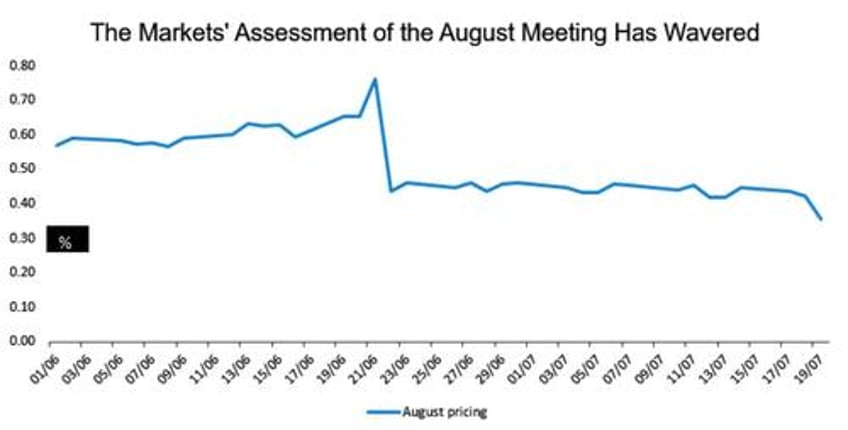

Given the slowing of headline inflation, it isn’t a massive surprise that two-year yields have declined below 5%. The question, though, is how sustainable the drop will be. Interest-rate traders, who were assigning a 84% chance of a 50-basis point increase from the BOE next month before the inflation data, have promptly revised down that probability to around 73% now.

That would be consistent with a two-year gilt yield of 5.27% based on correlations, though the maturity is likely to trade at a premium to that over the next few weeks. Should real rates continue to stay elevated, nominal rates can’t stay dislocated for too long.