By Michael Msika, Bloomberg Markets Live reporter and analyst

After a massive wave of optimism on European markets, the expected economic improvement that has buoyed stocks now has to be delivered.

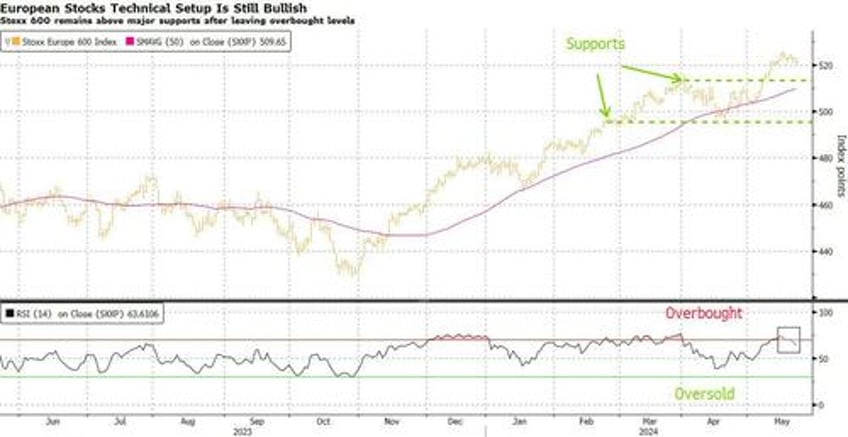

The uptrend is still intact for the Stoxx 600 but signs of overheating have cooled markets, especially after investors priced in a lot more optimism than the economic data actually showed. European preliminary PMIs, due later in the day, might give more clues about the growth outlook, given the still uncertain path of monetary policy.

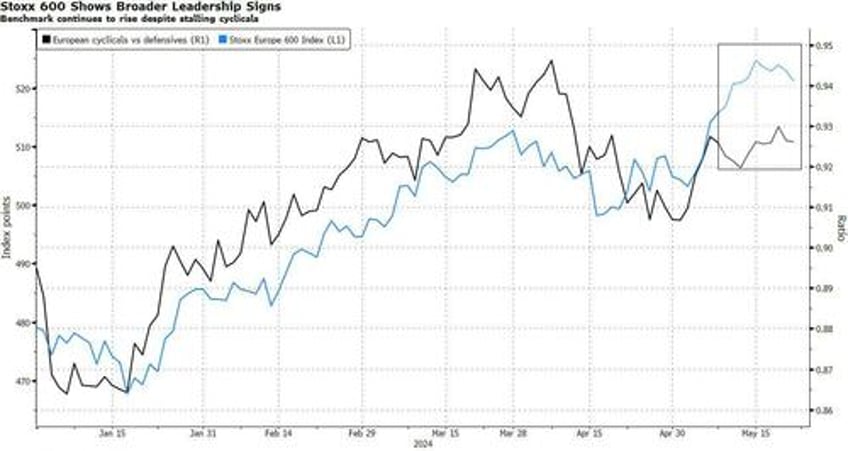

Stalling manufacturing PMIs over the past couple of months were accompanied with a clear wobble in cyclical equities relative to defensives. A similar pattern could be expected without a significant improvement in the data, as the gap with stocks remains very wide.

“We are in favor of high quality exposure over cyclicals,” say UBS strategists Gerry Fowler and Sutanya Chedda, adding that while the date doesn’t yet point to stagflation ahead, markets are underestimating that possibility. “European equities have rallied strongly to reflect the change in sentiment and discount rates but if softer margins offset sales growth, earnings growth may not propel a bull market.”

After a massive outperformance from cyclical equities, mostly backed by earnings delivery and bottoming economic data, things are starting to look stretched. The group is up 30% since the end of October, more than twice the returns of defensives and dwarfing the Stoxx 600’s 20% surge, and the first quarter earnings season has started to show cracks in the bull case.

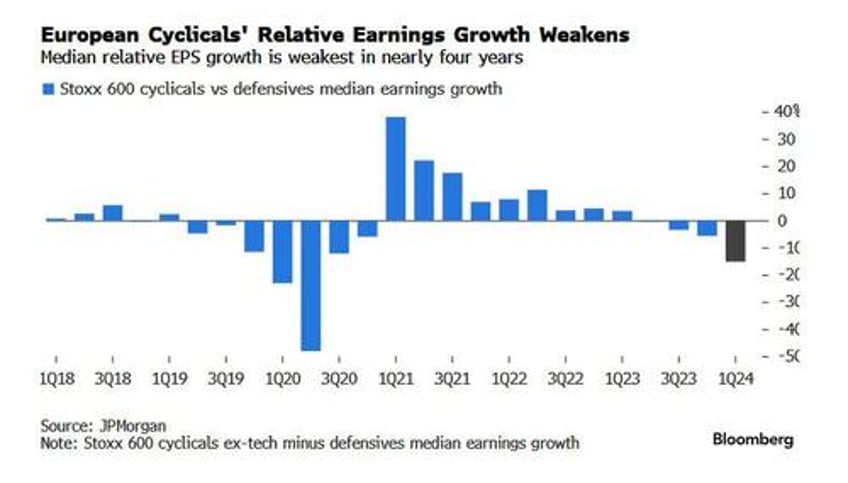

“Cyclical sector earnings are softening vs defensives,” say JPMorgan strategists led by Mislav Matejka, pointing that median cyclical vs defensives EPS growth for the Stoxx 600 is at -15%, the worst print since the second quarter of 2020. The strategists have argued for a rotation into defensives last month, especially into utilities and real estate. They are particularly concerned about the earnings prospects of carmakers, citing pricing, volumes and margin weakness. “European activity momentum is improving vs last year, but is still anemic in the historical context, and some of the margin pressures could emerge,” they say.

Even if Europe is a more cyclical market than the US, that doesn’t mean it can’t perform without a cyclical boost. In fact, the recent performance of the overall stock market has shown a clear broadening, consistent with the uncertainty regarding the economic outlook and the monetary policy.

“Although equities have strongly rebounded, the dovish tape has led to a notable rotation within the market. Leadership has indeed turned more barbell, a healthy and logical development in our view, given that cyclicals were looking extended on a number of macro and fundamental measures,” say Barclays strategists led by Emmanuel Cau. “Irrespective of the volatility of US cut expectations, we believe the growth/policy mix in Europe is getting more favorable. We see green shoots emerging in the economy, while upcoming ECB/BOE cuts should open up opportunities within the market.”

Technically, the picture isn’t worrying yet during this consolidation phase. DayByDay technical analyst Valerie Gastaldy shows that the Stoxx 600 has opened three gaps on the way up to 525.2. She notes that the most recent one has been closed, and the index came to a halt, even though US indexes made new highs.

So how far can it fall? Gastaldy notes that a drop down to 514 would bear “no consequence for the trend. Should prices fall below this level, we would have to assume that the index is correcting either the trend started in January, or the one started at the end of October,” she says. “For the time being, the trends remain bullish, though the correction could extend some 2% below current prices.”