By Charlie Zhu and Helen Sun, Bloomberg Markets Live reporters and strategists

Three things we learned last week:

1. China’s bond rally seems unstoppable amid a shortage of quality assets for investments. From government bonds to corporate debentures, traders keep hunting for yields in all maturities.

After pushing the yield on 30-year sovereign debt to the lowest since 2005, investors flocked to the notes issued by local government financing vehicles, once deemed as the riskiest instrument in Asia. That helped to drive LGFV companies’ borrowing costs to record lows.

In light of a decline in mortgage loans, long-term sovereign bonds become a good alternative for banks as long-term assets and provides support to the bond rally until the trend changes, said Becky Liu, head of Greater China macro strategy at Standard Chartered Plc.

As the central bank warned the market again about the potential risks in long-term bonds and pointed to signs of stabilizing economic growth, funds rotated out of the back-end of the curve. The yield on two-year sovereign notes slid to the lowest level since mid-2020. That widened its gap with US Treasury to about 317 basis points, the biggest ever.

2. Market speculation about a devaluation of the yuan emerged. To investors onshore, this is an unlikely scenario given the authorities’ emphasis on maintaining stability, but some offshore traders see signs that the pressure is building.

In addition to the record interest rate gap, China’s stockpiling of commodities including gold and copper has prompted conjecture that policymakers may weaken the yuan in a one-off move.

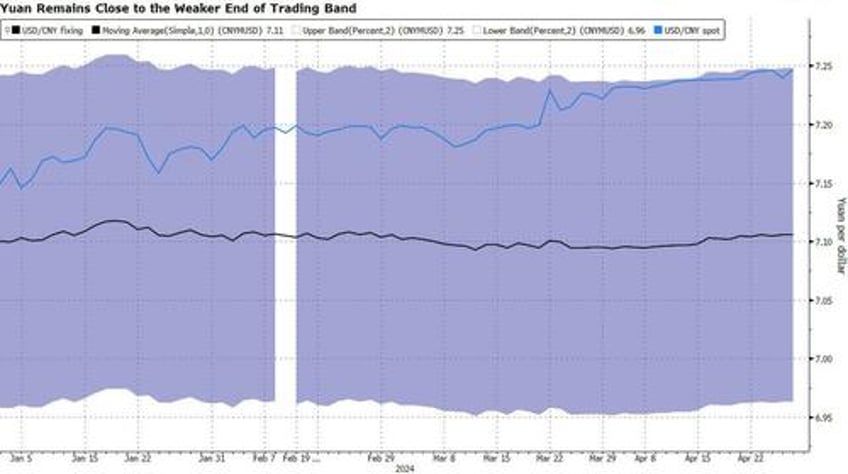

The central bank has been using the daily reference rate to limit the depreciation of the yuan, effectively making it one of the best-performing emerging-market currencies this month. However, the steady fixing kept the spot exchange rate remain close to the 2% daily limit on the weaker side, spurring concerns over the sustainability of the strategy.

3. The US decision on TikTok may bring headwinds to stabilizing relations between Beijing and Washington. President Joe Biden has signed a bill forcing TikTok to find a new owner within a year or face a ban. The move, designed to cut off China’s access to the video app used by 170 million Americans, raised concerns that US firms with large exposure to China’s market, including Apple Inc. and Tesla Inc., may be retaliation targets.

- While China’s response was rather restrained compared with last year, Foreign Minister Wang Yi warned his US counterpart Antony Blinken Friday that “negative factors” were rising between the world’s biggest economies.