- French Election 1st round saw National Rally make significant gains but the odds of another hung parliament have likely increased

- Sparking outperformance in French-related assets with OATs, CAC 40 & EUR all supported, though the magnitude of this has trimmed into another week of political uncertainty and a still challenging fiscal backdrop

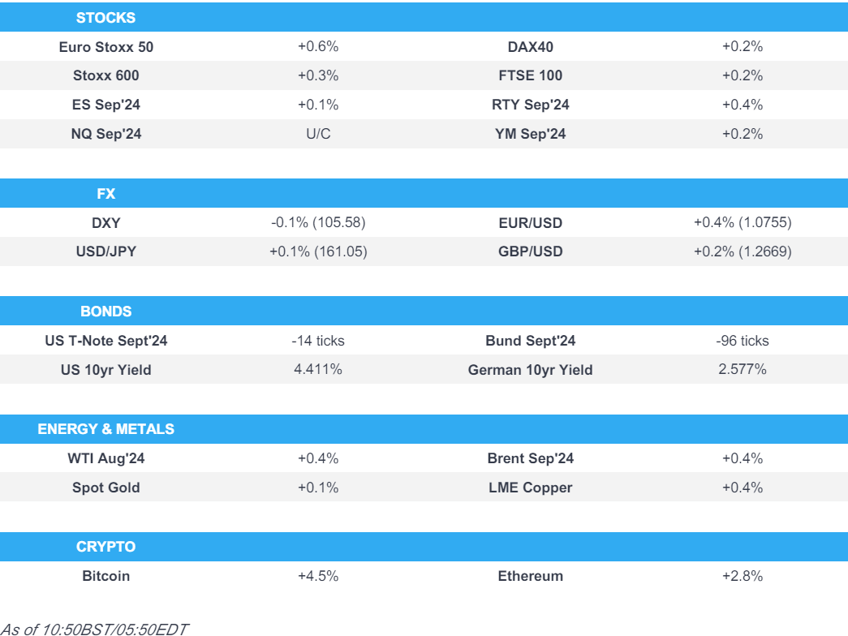

- US futures generally firmer but with some slight pressure in chip names led by Nvidia

- EUR the FX outperformer weighing on DXY, USD/JPY holds above 161.00

- Fixed benchmarks in the red, initial OAT strength has faded with the OAT-Bund spread narrowing on the open to 72bps before re-widening modestly to 75bps

- Crude bid across the board, precious metals mixed while base peers track the broad tone

- Looking ahead, highlights include US Manufacturing Final PMI (June), German Prelim. CPI, US ISM Manufacturing PMI, Comments from ECB’s Lagarde & Fed’s Williams

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

FRENCH ELECTION

- French Election 1st Round: National Rally makes significant gains but the odds of another hung parliament have likely increased.

- Exit polls have National Rally (RN) on 34.5%, the New Popular Front (NFP) on 29%, Macron’s Ensemble (ENS) on 21-23% and Les Republicans (LR) on 10%. When extrapolated into seat projections, there is a slight discrepancy between vendors with the forecast range for RN not encapsulating the 289 majority mark via the IFOP survey and France Televisions-Radio’s calculations; however, estimates from Elabe have an RN majority within the forecast range.

- Immediately after the exit polls dropped, PM Attal outlined a broad call to the centre and left-wing. Calling for voters to prevent RN from winning a second-round majority, to facilitate this he has pledged to stand down ENS candidates who have no chance of winning in the second round to give the non-RN candidate the best chance of victory.

- Into the second round, there are now three main points to look for: Whether Macron shows any sign of wavering from his pledge to stay as President irrespective of the result; The reception of NFP to the call from ENS to cooperate to prevent an RN outright majority, i.e. if they demand the appointment of an ENS PM or similar; Any signs of the non-RN friendly contingent of LR wavering from their position and joining forces with RN, as the addition of their 41-61 projected seats could be enough to secure an outright RN majority.

- Reminder, the second round occurs on 7th July. Exit polls are to be released from 19:00BST/14:00ET with official results emerging from some constituencies immediately but the full picture will not be known until early-Monday.

- Click for the French Election 1st round summary/analysis

EUROPEAN TRADE

EQUITIES

- CAC 40 (+1.8%) is the marked outperformer after the 1st round of the French legislative election, with the rally coming despite marked RN gains as the projections potentially point to increased odds of another hung parliament i.e. no RN majority. Though, initial upside has trimmed somewhat given we have another week of political uncertainty ahead and the fiscal situation remains tense and unfavourable for France.

- Stoxx 600 (+0.3%) and European generally are firmer, but have also trimmed modestly off best levels with newsflow ex-France light or not having much impact. Sectors much the same with the breakdown largely a reflection of the respective weighting of French stocks within the sectors as opposed to a broad trend.

- Stateside, futures are generally in the green (ES +0.1%, NQ -0.1%, RTY +0.3%) as we began a holiday shortened week that is firmly weighted towards NFP on Friday; note, NQ has slipped just into the red amid relatively pronounced pre-market pressure in Nvidia (-2.5%) though seemingly without a fresh fundamental driver.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY weighed on by the firmer EUR. Index down to a 105.42 base, holding above the 25th June low at 105.37. Docket for today is features ISM Manufacturing PMI and Fed's Williams, the pricing component from the PMI and any commentary from Williams on PCE will be keenly sought.

- EUR the outperformer, in a relief-rally after the weekends' French results which show that the far-right may struggle to form a Parliamentary majority, EUR/USD at a 1.0776 peak ahead of the 1.08 figure, a point it has been below since 14th June. Hefty OpEx features on today's NY Cut.

- Cable benefitting from the encouraging risk environment and strengthening to a 1.2689 peak into this week's UK election; however, GBP is softer vs the EUR.

- USD/JPY holding just above 161.00 with havens generally struggling in the morning's risk environment. Last week's multi-year peak stands at 161.28.

- Antipodeans firmer continuing the upside seen in the tail-end of last week, no real follow-through from Chinese PMIs overnight.

- PBoC set USD/CNY mid-point at 7.1265 vs exp. 7.2558 (prev. 7.1268).

- South African President Ramaphosa reappointed Enoch Godongwana as Finance Minister, while he appointed John Steenhuisien as Agriculture Minister and Ronald Lamola as Minister of International Relations and Cooperation, according to Reuters.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- OATs saw gains in excess of 20 ticks at best which alongside pressure in Bunds saw the OAT-Bund 10yr yield spread narrow to 72.4bps from an 80.1bp close on Friday. However, OATs have since come under pressure and are lower by around 20 ticks as the initial relief rally dissipates, a move which has re-widened the spread somewhat to 75bps.

- Bunds pressured as they trim recent strength seen into the French election, down to a 130.55 base. No real reaction to the numerous data points from Germany, with state CPIs broadly chiming with the mainland consensus.

- Gilts weighed on in-line with the above, at an initial low point of 97.14 which printed around the Final Manufacturing PMI that was revised lower and provided some support. Though, internal commentary factored on the hawkish side and has seen the benchmark slip to a fresh 97.07 base.

- US Treasuries are directionally in-fitting with other core players; just off a 109-15 base but remain towards the low-end of a 10 tick range

- Click for a detailed summary

COMMODITIES

- Crude bid across the board given the broader risk appetite and weaker USD. Crude-specific newsflow has been light this morning but as the US hurricane season nears, the desk is keeping an eye on Hurricane Beryl.

- WTI August trades within a USD 81.38-82.29/bbl range, Brent September sits in a USD 84.54-85.74/bbl parameter.

- Saudi Aramco’s strategic gas expansion reportedly progresses with USD 25bln of contract awards.

- Mixed trade across precious metals with spot gold biding time ahead of this week's macro risk events whilst spot silver is underpinned by the softer Dollar.

- Base metals are mostly firmer, though off best, with the softer USD and risk tone assisting, though the magnitude of gains has trimmed alongside a moderation in broader risk appetite.

- NHC says Hurricane Beryl is taking aim at the windward islands, with life-threatening winds and storm surge expected to begin this morning.

- Click for a detailed summary

NOTABLE DATA RECAP

- German North Rhine-Westphalia State CPI YY (Jun) 2.2% (Prev. 2.5%); Core 2.9% (prev. 3.2%). Overall, the state CPIs broadly chime with consensus for the mainland figures which look for a slight moderation in the Y/Y and slight uptick in the M/M.

- EU HCOB Manufacturing Final PMI (Jun) 45.8 vs. Exp. 45.6 (Prev. 45.6)

- German HCOB Manufacturing PMI (Jun) 43.5 vs. Exp. 43.4 (Prev. 43.4)

- UK S&P Global Manufacturing PMI (Jun) 50.9 (Prev. 51.4)

- UK Mortgage Approvals (May) 59.991k vs. Exp. 59.9k (Prev. 61.14k, Rev. 60.821k); Lending 1.212B GB vs. Exp. 0.9B GB (Prev. 2.412B GB, Rev. 2.229B GB)

NOTABLE EUROPEAN HEADLINES

- European Commission President von der Leyen said European companies are signing deals or MOUs worth over EUR 40bln at the Egypt-EU investment conference, according to Reuters.

- Austria’s far-right Freedom Party chief Kickl said they are forming a new political alliance with Orban’s Fidesz in Hungary and Babis’s Czech ANO party, according to Reuters.

- The Sunday Times newspaper endorsed the Labour Party for the upcoming UK election.

NOTABLE US HEADLINES

- US President Biden’s family is urging him to stay in the race and keep fighting despite last week’s disastrous debate performance, according to NYT.

- EU plans to charge Meta Platforms (META) over its 'pay or consent' model, FT reports citing sources; regulators are concerned the model offers consumers a misleading choice, potentially forcing consent to personal data tracking for ads due to financial barriers. Penalties could reach 10% of global turnover, rising to 20% for repeat violations.

GEOPOLITICS

MIDDLE EAST

- US proposed new language in an effort to reach a Gaza hostage-ceasefire deal, according to Reuters.

- Hamas officials said there is no progress in ceasefire talks with Israel but it is still ready to deal positively with any ceasefire proposal that ends the war in Gaza, according to Reuters.

- Iraq's Islamic Resistance reportedly hit an Israeli port with a drone, according to IRNA.

- Israel’s Finance Minister extended the waiver allowing cooperation between Israeli and Palestinian banks in the West Bank for four months, according to a spokesperson cited by Reuters.

- Iran’s UN mission said an obliterating war will ensue if Israel attacks Lebanon and that all options including the full involvement of resistance fronts are on the table.

- Iran will hold a presidential election run-off on July 5th as no candidate secured 50% of votes.

- Israeli Media reports "The end of the war in its current form within 10 days", via Sky News Arabia citing Channel 13.

OTHER

- Russia took control of the settlement of Shumy in Ukraine, while Russian forces also took over Spirne and Novooleksandrivka in Ukraine’s Donetsk region, according to RIA citing the Defence Ministry. It was separately reported that a Ukrainian drone attack killed five people in Russia’s borderline Kursk region, while Russia’s Emergency Ministry said four of its employees were injured in Ukraine’s shelling of Donetsk.

- North Korea condemned ‘Freedom Edge’ joint military drills by the US, South Korea and Japan as provocation, while it said it will make an important announcement and will protect regional peace with an aggressive and overwhelming response, according to KCNA. It was also reported that North Korea conducted a missile launch of a short-range ballistic missile and another ballistic missile, according to Yonhap citing the South Korean military.

- US military raised the alert level of several bases in Europe to its second-highest level, according to the Times of Israel citing multiple American media outlets.

CRYPTO

- A session of gains for BTC & ETH, which have surpassed USD 63.5k and USD 3.5k respectively to the upside.

APAC TRADE

- APAC stocks began the new quarter somewhat varied as participants digested key data releases and markets braced for a busy week ahead culminating in the latest NFP report on Friday.

- ASX 200 was led lower by underperformance in tech amid headwinds from firmer yields although the index was off worst levels owing to resilience in mining stocks.

- Nikkei 225 gained at the open amid initial currency weakness although some of the gains were then faded as participants digested a mixed BoJ Tankan survey.

- Shanghai Comp. swung between gains and losses with price action choppy in early trade after mixed PMI data from China which showed official Manufacturing PMI remained in contraction territory and Non-Manufacturing PMI missed estimates, but Chinese Caixin Manufacturing PMI topped forecasts to print its highest in three years. Meanwhile, Hong Kong markets were shut for a holiday which also meant the absence of Stock Connect flows.

NOTABLE ASIA-PAC HEADLINES

- Indonesia is to impose safeguard duties of 100% to 200% on imports ranging from footwear to ceramics, while it mainly imports apparel and clothing accessories from China, Vietnam and Bangladesh, according to Nikkei.

- India’s government source said it is monitoring cheap Chinese imports, while India’s steel ministry is in talks with the commerce ministry over rising imports and the industry has sought a probe.

- China's Vice Premier is to hold a symposium related to foreign investments on Monday, according to State Media; says China will further expand market access and break unreasonable limit for foreign investments.

DATA RECAP

- Chinese Manufacturing PMI (Jun) 49.5 vs Exp. 49.5 (Prev. 49.5); Non-Manufacturing PMI (Jun) 50.5 vs Exp. 51.0 (Prev. 51.1)

- Chinese Composite PMI (Jun) 50.5 (Prev. 51.0)

- Chinese Caixin Manufacturing PMI Final (Jun) 51.8 vs. Exp. 51.2 (Prev. 51.7)

- Japanese Tankan Large Manufacturing Index (Q2) 13.0 vs. Exp. 12.0 (Prev. 11.0); Outlook (Q2) 14.0 vs. Exp. 13.0 (Prev. 10.0)

- Japanese Tankan Large Non-Manufacturing Index (Q2) 33.0 vs. Exp. 33.0 (Prev. 34.0); Outlook (Q2) 27.0 vs. Exp. 31.0 (Prev. 27.0)

- Japanese Tankan Large All Industry Capex Estimate (Q2) 11.1% vs. Exp. 13.9% (Prev. 4.0%)