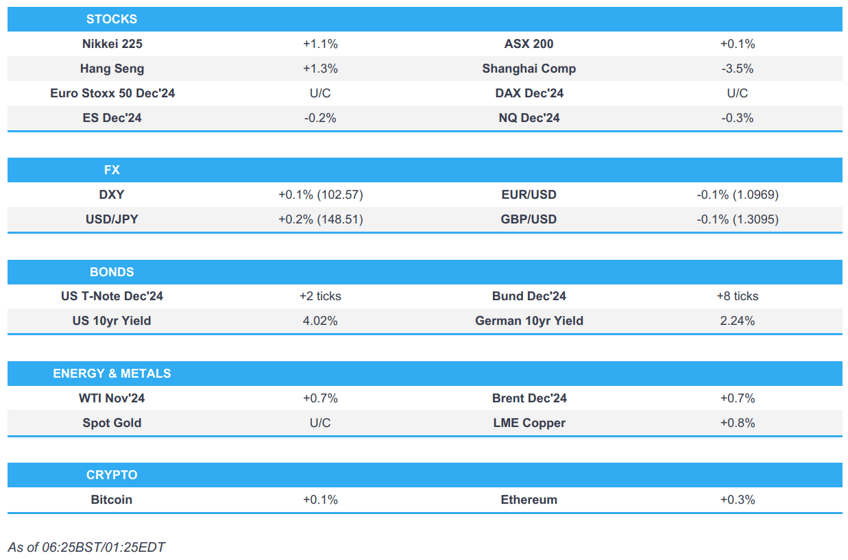

- APAC stocks traded mixed and initially took impetus from the positive performance on Wall St where the major indices were led higher amid a tech rally.

- China's Finance Ministry is to hold a press briefing on fiscal policy and economic development on October 12th at 10:00 local time (03:00BST/22:00EDT), while it will introduce details of intensifying fiscal policy adjustment

- RBNZ cut the OCR by 50bps to 4.75% and the RBI kept the Repurchase Rate unchanged at 6.50%, both as expected.

- US President Biden and Israeli PM Netanyahu will speak on Wednesday; Israeli senior official said they are going to respond to the Iranian attack but will not do it in a way that will start an all-out war with Iran.

- European equity futures are indicative of an uneventful cash open with the Euro Stoxx 50 future flat after the cash market closed lower by 0.4% on Tuesday.

- Looking ahead, highlights include German Trade Balance, US Wholesale Sales, FOMC & NBH Minutes, Speakers including ECB’s Elderson, Fed’s Bostic, Logan, Goolsbee, Jefferson, Barkin, Collins & Daly, Supply from UK, Germany & US.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were bid throughout the US session with advances led by the Nasdaq as tech and other heavyweight sectors outperformed, while the small-cap Russell 2k lagged but still closed in the green. The majority of sectors gained although Energy was the notable laggard as crude prices pared some of the recent geopolitical-induced rally with prices not helped by the lack of fresh stimulus announcement from the Chinese state planner’s press conference which hit the demand side of the equation. Nonetheless, the focus remained on geopolitics and crude prices settled off worst levels after an NBC report suggested that Iranian energy facilities are still a target under consideration by Israel, although a senior Israeli official suggested that they will respond in a way that will not lead to an all-out war with Iran.

- SPX +0.97% at 5,751, NDX +1.55% at 20,108, DJIA +0.30% at 42,080, RUT +0.09% at 2,195.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed Vice Chair Jefferson said the Fed rate cut recalibrated policy to maintain the strength of the labour market and noted that economic growth is solid, inflation has eased substantially, and the labour market has noticeably cooled. Jefferson said he will watch the incoming data, evolving outlook, and balance of risks in considering additional policy rate adjustments and his approach to policymaking is to make decisions meeting by meeting. Furthermore, he said the Fed has not changed its approach to monetary policy and is always thinking about the balance of risks, as well as noted the size of the September rate cut was timely and that the Fed's rate cut was neither proactive nor reactive.

- Fed's Bostic (voter) said the labour market has slowed down, but it is not slow or weak and monthly job creation is above what is needed to account for population growth. Bostic also said the economy is close to the Fed's targets and moving closer, while the inflation rate is still 'quite a ways' above 2%.

- Fed's Collins (2025 voter) said further rate cuts are likely needed, and future action is to be data-driven, while she added that September Fed forecasts predicted 50bps of cuts into year-end. Furthermore, Collins is more confident of inflation being on a durable path of ebbing and said core inflation has moderated but is still elevated.

APAC TRADE

EQUITIES

- APAC stocks traded mixed and initially took impetus from the positive performance on Wall St where the major indices were led higher amid a tech rally, although Chinese stocks clouded over sentiment following the recent stimulus-related disappointment.

- ASX 200 eked marginal gains as strength in tech and telecoms offset the losses in the commodity-related industries.

- Nikkei 225 was underpinned at the open and climbed back above the 39,000 level but with gains capped by a lack of drivers.

- Hang Seng and Shanghai Comp were mixed as the Hong Kong benchmark fluctuated between gains and losses, with a late boost derived from reports China's Finance Ministry is to hold a press briefing on fiscal policy and economic development on October 12th. The mainland was pressured after the recent stimulus-related disappointment and amid China's ongoing trade frictions with the EU and US.

- US equity futures slightly eased back overnight after the prior day's gains and as participants await looming key events.

- European equity futures are indicative of an uneventful cash open with the Euro Stoxx 50 future flat after the cash market closed lower by 0.4% on Tuesday.

FX

- DXY kept within a tight range around 102.50 following the lack of tier-1 releases from the US so far this week, although this is set to change with FOMC Minutes due later today followed by CPI on Thursday and PPI on Friday, while the latest rhetoric from Fed's Bostic, Collins and Jefferson had little sway on price action.

- EUR/USD remained lacklustre after retreating yesterday from resistance near the 1.1000 handle and as ECB rhetoric continues to hint at a cut next week.

- GBP/USD traded indecisively on both sides of the 1.3100 level in the absence of any major pertinent macro catalysts.

- USD/JPY struggled for direction amid a quiet data calendar and with the downside cushioned by a floor around 148.00.

- Antipodeans were mixed in which NZD/USD was the underperformer in the aftermath of the RBNZ's rate decision in which the central bank delivered a widely anticipated 50bps rate cut and noted that the economic environment provides scope to further ease. AUD was later boosted amid reports that China's Finance Ministry is to hold a press briefing on fiscal policy and economic development on October 12th.

FIXED INCOME

- 10yr UST futures marginally extended on a recent rebound in quiet trade as participants awaited the FOMC Minutes, Fed speakers and 10yr supply.

- Bund futures were off the prior day's trough but lacked any meaningful strength ahead of Bund issuances and the latest German trade data.

- 10yr JGB futures demand was subdued amid the positive risk appetite in Japan and the absence of pertinent data releases.

- FTSE Russell added India to the EM bond index effective September 2025, while South Korean government bonds will also be added to the FTSE World Government bond index.

COMMODITIES

- Crude futures regained some composure after yesterday's aggressive pullback with support seen following a report citing US officials that Israel is considering striking energy facilities in Iran, although the rebound was limited following the enormous crude build in the latest private sector inventory data.

- US private inventory data (bbls): Crude +10.9mln (exp. +2.0mln), Distillate -2.6mln (exp. -1.9mln), Gasoline -0.6mln (exp. -1.1mln), Cushing +1.4mln.

- EIA STEO sees US oil production to average 13.32mln BPD in October (prev. 13.25mln BPD in September) and to average 13.51mln BPD in November, while US natural gas production is to average 113.3 BCF/day in October (prev. 113.2 BCF/day) and to average 113.7 BCF/day in November.

- Spot gold lacked demand after its recent slip and with the precious metal also restrained by an uneventful dollar.

- Copper futures attempted to nurse some of the prior day's losses but was thwarted amid China-related headwinds, although some upticks were seen on reports China's Finance Ministry is to hold a press briefing on fiscal policy and economic development.

CRYPTO

- Bitcoin was relatively flat with price action contained within a narrow range above the 62,000 level.

NOTABLE ASIA-PAC HEADLINES

- China's Finance Ministry is to hold a press briefing on fiscal policy and economic development on October 12th at 10:00 local time (03:00BST/22:00EDT), while it will introduce details of intensifying fiscal policy adjustment.

- RBNZ cut the OCR by 50bps to 4.75%, as expected, while it stated that New Zealand is now in a position of excess capacity and that low import prices have assisted disinflation. RBNZ noted that the Committee assessed annual consumer price inflation within its 1-3% target and it was appropriate to cut the OCR by 50bps to achieve and maintain low and stable inflation. RBNZ Minutes stated the Committee confirmed future changes to the OCR would depend on its evolving assessment of the economy and noted the OCR of 4.75% is still restrictive and leaves monetary policy well-placed to deal with any near-term surprises. Furthermore, the Committee discussed the respective benefits of a 25bps cut versus a 50bps cut in the OCR and stated that a 50bps cut at this time is most consistent with the mandate of maintaining low and stable inflation, while it added the economic environment provides scope to further ease the level of monetary policy restrictiveness.

- RBI kept the Repurchase Rate unchanged at 6.50%, as expected via a 5-1 vote (prev. 4-2) and it unanimously voted to switch its stance to neutral (prev. remaining focused on the withdrawal of accommodation), while Governor Das stated that macroeconomic parameters of inflation and growth are well balanced although the moderation in headline inflation is expected to reverse in September and remain elevated in the near term. Das also noted that the growth story remains intact, and prospects of private consumption look bright but added that there is difficulty in navigating the last mile of disinflation and significant risks to inflation still stare at them.

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu confirmed that Israel took out Nasrallah's successor, while it was separately reported that PM Netanyahu summoned ministers for security consultations on Tuesday evening.

- Israeli PM Netanyahu had set two conditions for Defence Minister Galant to travel to the US and refused to approve the trip to Washington that had been planned for Tuesday night until he receives a phone call with President Biden and the Israeli cabinet approves the response to Iran's missile attack, according to Axios sources.

- Israeli Defence Minister Gallant postponed his trip to Washington after PM Netanyahu's objection, while advanced talks are underway to hold a phone call between US President Biden and Israeli PM Netanyahu on Iran in the coming days, according to Axios citing sources. It was later reported that US President Biden and Israeli PM Netanyahu will speak on Wednesday.

- Israeli senior official said they are going to respond to the Iranian attack and there is no question about it but will not do it in a way that will start an all-out war with Iran, according to Axios. It was also reported that Israeli officials cited by Washington Post said that the country is preparing a significant military response to Iran's attack.

- Israeli officials stated that Israel is capable of harming Iran but the possibility of its response requires coordination with the US, while Defence Minister Galant and security leaders push to strike Iran militarily and have already submitted the plans to the political leadership.

- Israel was reportedly considering striking energy facilities in Iran, according to Al Arabiya citing comments by US officials to NBC.

- Israel's Channel 12 reported that Washington and Arab countries are discussing with Tehran a proposal for a ceasefire on all fronts except Gaza which would be conditional on Hezbollah's withdrawal to northern Litani and the dismantling of military structure near the border, according to Sky News Arabia.

- White House said the US continues to have discussions with Israel on its response to the Iranian attack. It was separately reported that the White House said despite the fighting, they are working with Israel and Lebanon to define a process for a return to ceasefire negotiations,according to Asharq News

- US officials cited by NBC do not believe that Israel has made a final decision on the details of the response to Iran and discussions with Tel Aviv included Washington providing intelligence support or even launching air strikes. However, Washington has not decided on any action despite its intention to support Israel's right to defend itself and Israel did not inform Washington of plans to retaliate against Iran.

- US officials feared that Israel will implement its response to Iran during the planned Israeli Defence Minister Gallant's visit to Washington although the visit has since been postponed.

- Israeli aggression targeted a residential building in Syria's Damascus with injuries reported, according to Syrian state news agency. Furthermore, NYT also reported that Israel raided an apartment building near the Iranian embassy in Syria which targeted a senior member of Hezbollah involved in arms smuggling, citing Israeli officials.

- Islamic Resistance in Iraq said it attacked with drones a vital target in the north of the occupied territories, according to Al Jazeera.

- Iran told Gulf states it would be unacceptable if they allowed their airspace to be used against Iran, according to Reuters.

OTHER

- North Korea's army said it is to completely cut off roads and railways connected to South Korea from October 9th, according to KCNA.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves is pushing ahead with plans to borrow billions of pounds extra for infrastructure investment despite concerns about an increasing cost of UK government debt, with Reeves likely to free up GBP 10bln-20bln worth of borrowing room for capital investment by excluding the losses incurred by the state from the BoE's previous asset purchase programs when calculating debt, according to The Guardian.

- ECB's Nagel said inflation is on the decline but must remain vigilant due to high core readings, while Nagel also commented that he is open to an October rate cut.

- ECB's Stournaras sees the case for two more rate cuts in the Eurozone this year and further easing in 2025, while he said inflation could be on track to meet the ECB's target in H1 2025, according to FT.

- EU is to robustly challenge at the WTO level the announced imposition of provisional anti-dumping measures by China on imports of Brandy from the EU and is to assess all possibilities to offer appropriate support to EU producers from situations of market disturbance, or threat thereof.

- Italy’s Economy Minister said the budget plan fully complies with requirements set under new EU stability pact rules.