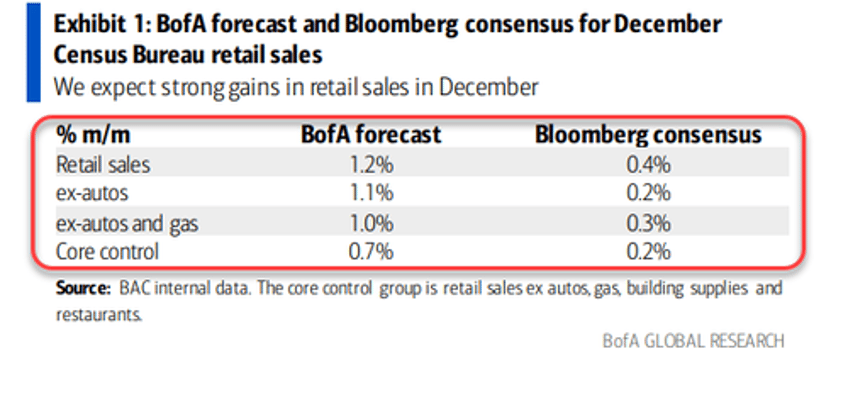

If BofA is right - and they usually have been - this morning's Retail Sales print would be a big beat and provide more questions for those thinking about rate-cuts and soft landings...

And sure enough, after an unexpectedly large rise in November, December saw a 0.6% MoM rise (hotter than the expected 0.4%, but less than BofA's surge expectations). Still, it was the biggest jump since September and lifted the YoY change to +5.6% - its hottest since Jan 2023...

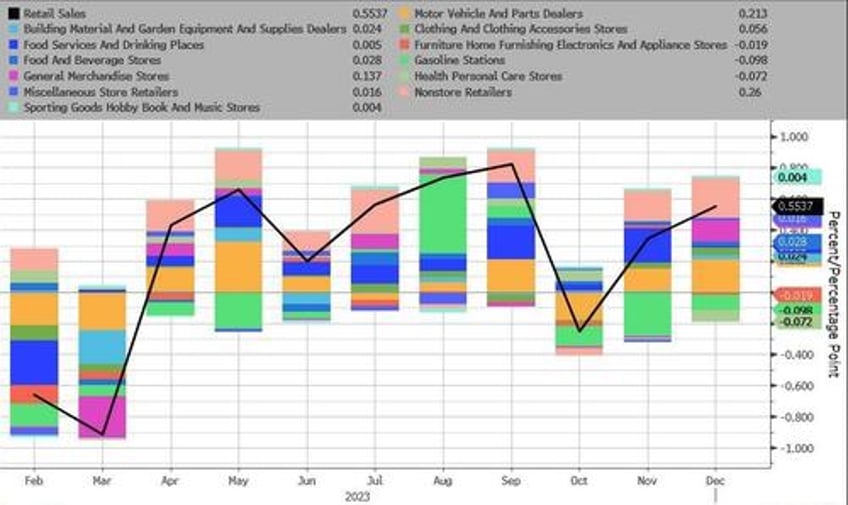

On a MoM basis, Gasoline Stations and Personal Healthcare stores saw sales decline while Motor Vehicle sales surged...

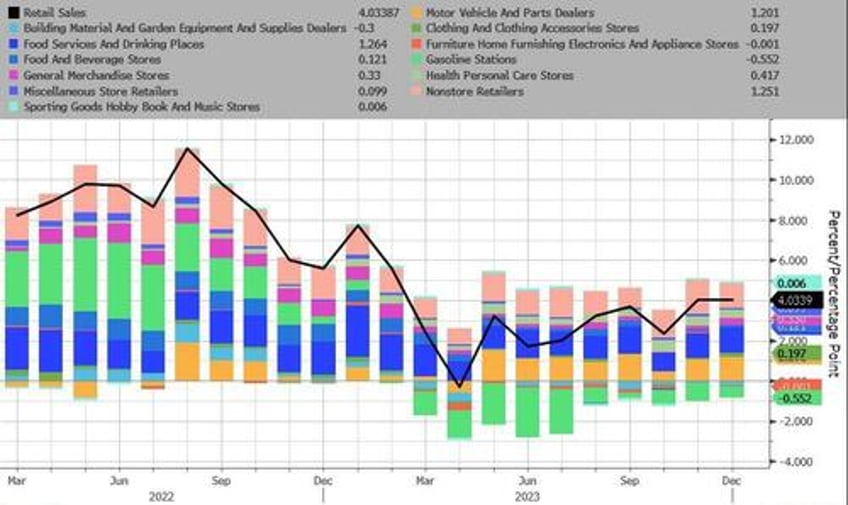

Both headline and core retail sales re-acclerated - ending up 5.6% YoY in 2023...

Gasoline Stations and Building Materials were the only segment that saw retail sales lower in 2023 with motor vehicles and Food Services up most...

Source: Bloomberg

Finally, as a reminder, retail sales data is nominal - i.e. not adjusted for inflation. So is this just a reflection of falling gas prices and soaring food prices?

While not comparing apples and oranges, if we adjust the headline retail sales rise in 2023 for the rise in consumer prices, we see 'real' retail sales rose 2.2% YoY - obviously far better than the real-sales decline in 2022, but it was the weakest year since 2018...

Certainly doesn't help the Goldilocks narrative.