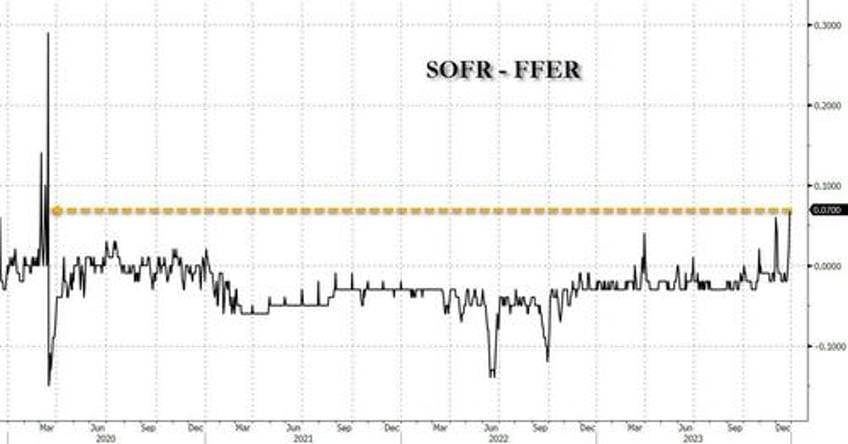

Last Friday, as is customary on the final day of the quarter and year, banks engaged in rather aggressive liquidity "window dressing" as a result of which the Fed's Overnight reverse repo facility shot up above $1 trillion for the first time since early November, up from $830 billion the day prior, and up $300+ billion from the $683 billion low hit on Dec 15. It was this sudden spike in reverse repo - which is a drain on liquidity - that sent the spread between SOFR and the effective Fed Funds rate to the highest level since the March 2020 repo crisis, signaling an immediate blockage in the plumbing of the US financial system if not resolved within days if not hours.

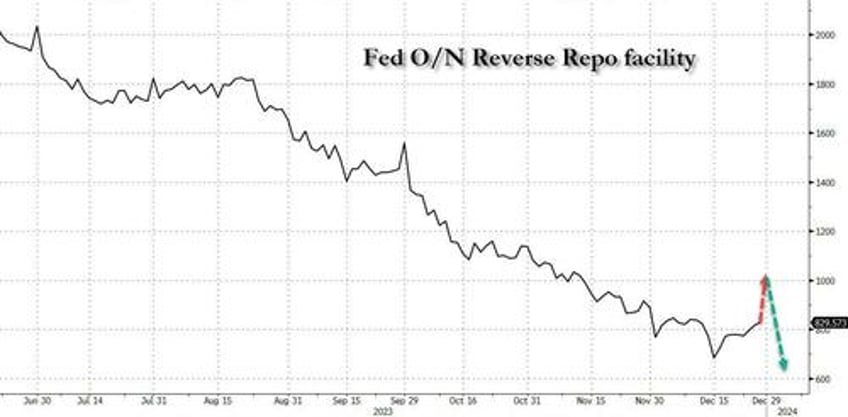

That, we said, was "the bad news." However, we noted that "the good news is that come 2024 in a few hours, and specifically the first day of trading on Jan 2, we expect the reverse repo facility to plummet back to $700 billion once the year-end window dressing is over (especially with total US debt rising above $34 trillion to start the year), and floods the system with fresh liquidity which will stabilize the monetary plumbing at least until reverse repo dips below that key level of $700 billion at which point we expect the SOFR spikes to become a daily occurrence, and one which the Fed will no longer be able to ignore."

And this was the chart we proposed to explain the funding journey in the next few days:

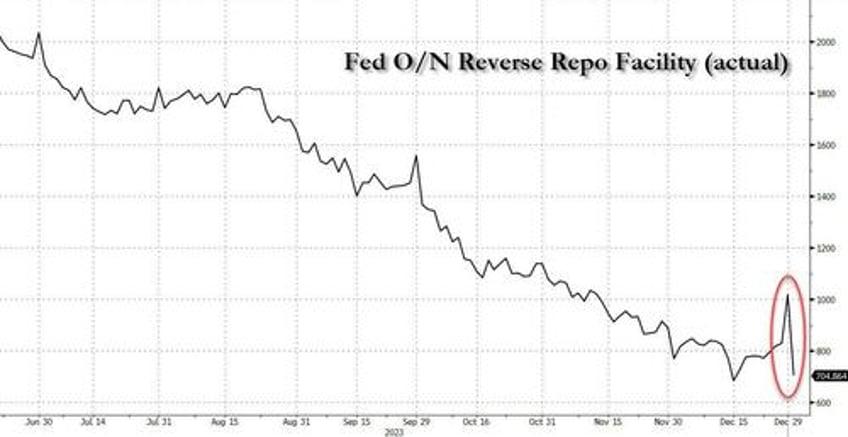

Fast forward to today when we learn that our first prediction for 2024 was spot on, because moments ago the NY Fed reported that in the first reverse repo operation of the year, a whopping $314 billion in liquidity was released as the reverse repo balance collapsed from $1,018 billion to - drumroll - $705 billion, just as we had predicted (ok, so we were off by $5 billion). As for the chart whoing what actually happened, it is a carbon copy of what we said would happen (see above):

What to make of this move? Two things.

First, after hitting a record 5.40% on the last day of 2023, SOFR has dipped but only just modestly, down 2bps to 5.38%. This could be a delayed response to today's reverse repo operation, and if so, tomorrow we expect SOFR to slide back to 5.30%. If it doesn't, then we really have a liquidity problem, even with the reverse repo facility at $700BN.

Second, the plunge in the reverse repo facility is once again back on, and we expect that a reversion to the liquidity draining mean would result in reverse repo sliding to $500BN in a few weeks and all the way to 0 some time in March. And, as regular readers are aware, while stocks can and will buoyant as long as the reverse repo serves as a source of liquidity, once it is tapped out and bank reserves rediscover gravity (as QT supposedly still has a ways to go), that's when the rubber will hit the road, especially if as some speculate, the Fed will be unable to extend the BTFP program which matures in March and which as we documented last week, is now being gamed by banks to arb a risk-free revenue stream courtesy of the Fed, guaranteeing major political pushback against its extension in the coming months.