Household spending has kept the US economy afloat, but as growth slows a continued rise in oil and gas prices is poised to push personal consumption expenditure (PCE) lower and thus trigger a near-term recession - with stocks and bonds unpriced for such an outcome.

Once again it has been the redoubtable consumer that has thus far kept a recession at bay. However, Bloomberg Economics (BBE) pointed out in a recent article that negative household sentiment – in confluence with other drivers of household spending – suggests that we should already be in a recession.

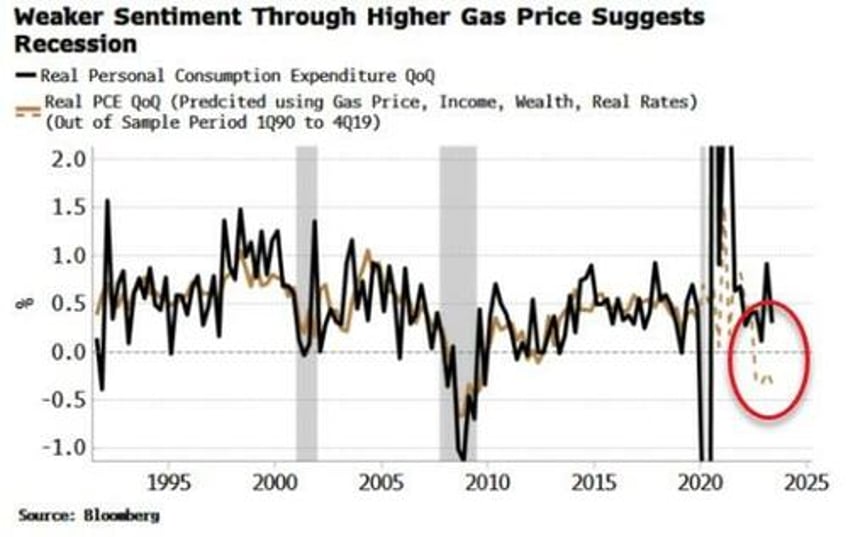

A regression model (using income, wealth and real rates) pins PCE growth roughly where it is. But if we add in the University of Michigan’s Consumer Sentiment index, it indicates much weaker PCE growth and thus an economy that would likely be already be in the midst of a slump.

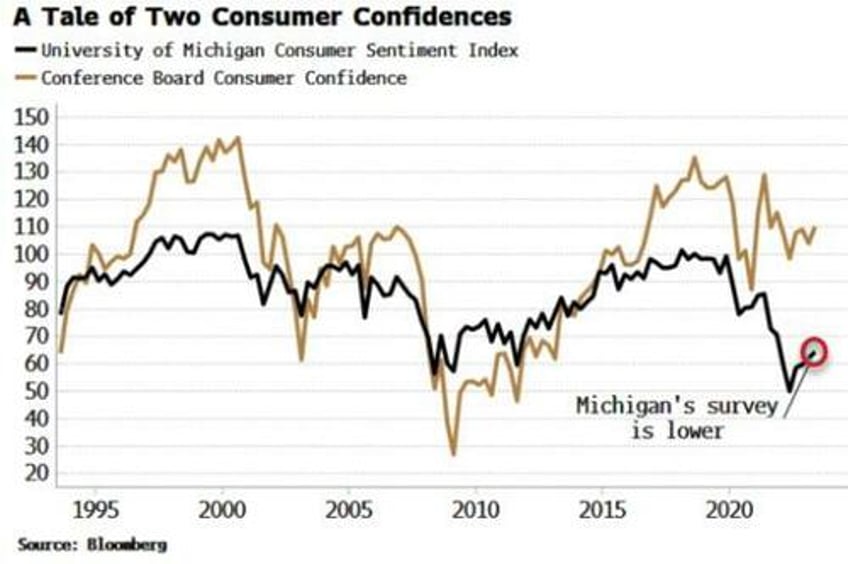

I recreated BBE’s model and got something similar. I then substituted in the Conference Board’s Consumer Index instead of the Michigan survey. This also improves the fit of the original model, but does not paint as negative a picture for PCE. The reason is that the Conference Board’s measure has not deteriorated as much as the Michigan survey.

Why? The divergence between the two likely comes from the Michigan’s greater emphasis on frequent expenditures and business conditions, while the Conference Board’s index is more focused on the jobs market. As an employee, the jobs market has looked pretty good, boosting the Conference Board’s index, while the Michigan survey is more influenced by rising prices and conditions for small-business holders, which have been less rosy.

The Michigan survey is in fact very sensitive to gas prices. In the model, I added the average gas price to the model’s original inputs (i.e. ex Michigan). Doing so also improves the model’s fit, and as the chart below shows, implies notably weaker, and negative, PCE growth – and therefore an economy that would likely already be in a recession.

This highlights that the US economy is potentially on thin ice, with that ice represented by hitherto positive consumer sentiment, driven in no small part by gas prices (and sentiment on how high they are perceived to be) that remain comparatively cheap to the levels they reached last year.

But oil has been rising, driven by excess liquidity, falling inventories and supply cuts.

Tailwinds remain for oil, and therefore the nascent recent rise in gas prices is poised to continue as well. That could be the final straw which unseats the US consumer and tips the US into a recession.