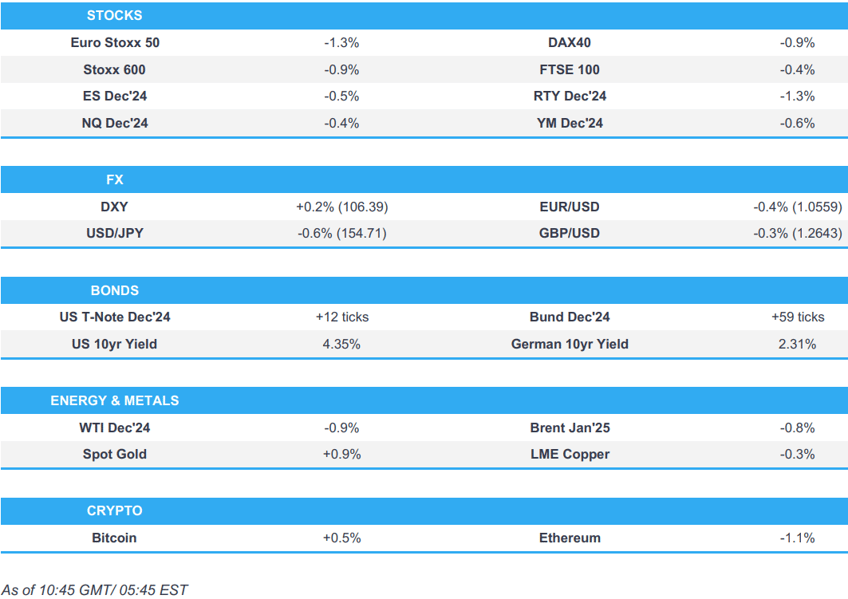

- Equities are entirely in the red with sentiment hit following remarks by Russia’s Kremlin, which said "Russia reserves the right to use nuclear weapons in an event of aggression".

- Dollar is firmer vs most peers, but weaker against the JPY which caught a bid owing to its safe-haven status.

- Bonds have soared to session highs following comments by the Russian Kremlin that it could respond to aggression in a nuclear manner.

- Crude is on the backfoot, XAU bid given the risk-off environment.

- Looking ahead, Canadian CPI, US Building Permits, NBH Policy Announcement, Comments from Fed's Schmid, Earnings from Walmart, Lowe's & Medtronic.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses opened on a mixed/modestly firmer footing. Thereafter, Russia’s Kremlin said "Russia reserves the right to use nuclear weapons in an event of aggression". This sparked a safe-haven bid, with equities selling-off to session lows, whilst the JPY and bonds soared to highs. This move has since stabilised, with equities currently residing at lows.

- European sectors opened entirely in the green, but sentiment has since slipped and now shows a mostly negative picture in Europe. A clear defensive bias is seen in Europe; Utilities top, whilst Autos and Consumer Products lags.

- US equity futures are entirely in the red, with sentiment hit following comments via Russian Kremlin that noted it could respond to aggression in a nuclear manner.

- Goldman Sachs lowers its 12 month Stoxx 600 target to 530 from 540 (currently 502). Cuts FTSE 100 target to 8500 from 8800 (currently 8138)

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is firmer vs. peers (ex-JPY) after a sluggish start to the session which appeared to be a signal of USD consolidation from its post-election run of gains. However, the risk-off move prompted by Russian Kremlin comments managed to provide some reprieve.

- EUR/USD has been swept up in the broader risk-averse move which provided the USD some reprieve. Today's EZ HICP (Final) metrics were unrevised, and as such had little impact on the Single-currency. EUR/USD briefly slipped below the bottom end of yesterday's 1.0529-1.0607 range.

- JPY attempting to claw back some of yesterday's lost ground vs. the USD with Japanese Finance Minister Kato attempting to lend a helping hand, with familiar jawboning overnight. USD/JPY selling exacerbated with the pair breaking below the bottom end of yesterday's 153.84-155.35 range due to risk-aversion prompted by comments from the Russian Kremlin.

- GBP struggling against the USD, pulling back below the 1.2650 level and hovers just above yesterday's trough at 1.2611. The TSC Hearing is currently ongoing at time of publish; so far, BoE's Mann has repeated her familiar hawkish rhetoric, whilst Governor Bailey largely reiterated comments made at the last BoE meeting.

- Antipodeans are both softer vs. the USD with both currencies hampered by the current risk environment and scaling back some of yesterday's gains. AUD/USD managed to advance to a high of 0.6523 earlier but has since pulled back below 0.65 (vs. yesterday's trough at 0.6447).

- PBoC set USD/CNY mid-point at 7.1911 vs exp. 7.2305 (prev. 7.1907).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs have marched higher in early trade with a safe-haven bid emerging from comments by the Russian Kremlin that it could respond to aggression in a nuclear manner. Fresh US-specific macro drivers are currently lacking in what is set to be a week that contains a light data slate. Dec'24 UST cleared a slew of highs from last week as well as the 110 mark and matched the 12th November high at 110.04.

- Bunds are higher in-fitting with global counterparts as macro updates from the Eurozone remain light for today's session thus far; focus ultimately lies on Flash PMIs on Friday. Bunds have taken out a slew of highs from last week with the next upside target coming via the 133 mark with the 30th October high just above at 133.02.

- Ahead of the BoE TSC Hearing, the 2038 Gilt auction was fairly weak vs the prior outing (pre-Budget). Gilts topped 94.50, but has since edged back below that level to a current 94.25. The TSC Hearing is currently ongoing at time of publish; so far, BoE's Mann has repeated her familiar hawkish rhetoric, whilst Governor Bailey largely reiterated comments made at the last BoE meeting.

- UK sells GBP 3.25bln 3.75% 2038 Gilt: b/c 2.74x (prev. 3.28x), average yield 4.558% (prev. 4.131%) & tail 0.6bps (prev. 0.1bps)

- Click for a detailed summary

COMMODITIES

- WTI and Brent are on the back foot, having initially started the European session with incremental losses. Pressure in the complex accelerated following commentary from Russia’s Kremlin which noted that, "Russia reserves the right to use nuclear weapons in an event of aggression". On the supply front, Equinor said production has restarted at its Johan Sverdrup oilfield. Brent’Jan 25 sits towards the bottom end of a USD 72.72-73.53/bbl range.

- Precious metals are on a firmer footing continuing the price action seen overnight. XAU specifically caught a bid owing to its safe-haven status, following the aforementioned geopolitical updates via Russia’s Kremlin.

- Base metals began the European session entirely in the green, benefiting from the positive risk tone overnight and amid support pledges by Chinese officials. Some pressure, with sentiment hit following the above geopolitical related headlines.

- Equinor (EQNR NO) says production has restarted at its Johan Sverdrup oilfield; expects the oilfield to produce at 2/3 of normal capacity during morning hours today. Still working to restore full output capacity.

- Chinese October crude iron ore output -4.1% Y/Y at 86.45mln tonnes, according to stats bureau. Alumina output +5.4% Y/Y at 7.43mln metric tons. Lead output -5.3% Y/Y at 661k tons. Zinc output -9.5% at 565k tons.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HICP Final MM (Oct) 0.3% vs. Exp. 0.3% (Prev. -0.1%); HICP Final YY (Oct) 2.0% vs. Exp. 2.0% (Prev. 2.0%); HICP-X F&E Final YY (Oct) 2.7% vs. Exp. 2.7 (Prev. 2.7%); HICP-X F, E, A, T Final MM (Oct) 0.2% vs. Exp. 0.2% (Prev. 0.2%); HICP-X F,E,A&T Final YY (Oct) 2.7% vs. Exp. 2.7% (Prev. 2.7%)

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer announced the relaunch of UK-India free trade talks, while it was also reported that Starmer met with Japanese PM Ishiba and agreed to start "2 + 2" economic and trade cooperation talks between the UK and Japan.

- ECB's Panetta says the ECB should move to a neutral monetary stance, or expansionary if necessary; forthcoming change in the US govt adds uncertainty to the inflation outlook. Still a long way from the neutral rate. ECB needs to give more explicit indications of its policy rate intention.

- BoE Governor Bailey says services inflation is still above level that is compatible with on-target inflation. Says BoE must watch services inflation carefully. Says a gradual approach to removing monpol restraint will help observe risks to the inflation outlook.

- BoE Deputy Governor Lombardelli says we have seen a fall in services inflation and wage settlements; sees risks to inflation on both sides.

- BoE's Taylor says disinflation is unfolding as we should expect.

- BoE's Mann says forward-looking price and wage indicators have been flat and above target for four months, raises risk of inflation persistence. Says financial market inflation expectations suggest BoE will not get to 2% inflation in the forecast horizon. Latest Budget offers opportunity for firms to realise price increases that are inconsistent with 2% inflation target. Even before the Budget, higher minimum wage was causing firms problems in maintaining wage differentials.

- Moody's says total industry costs from Britain's review into motor finance commissions could reach GBP 30bln

NOTABLE US HEADLINES

- US President-elect Trump is said to be pressuring senators to confirm Matt Gaetz as Attorney General, according to Axios. However, it was also reported that Trump admitted Gaetz may not be confirmed by the Senate, according to NYT.

GEOPOLITICS

- Against the backdrop of Amos Hochstein's visit to Beirut - the US administration is warning "not to read too much" his visit as a sign that a deal may be imminent - as negotiations are ongoing, via Kann News's Stein

- Iranian Foreign Minister says "We consider the recent Israeli aggression on our territory a new attack and deserves a response from our side"

- Lebanon and Hezbollah agreed to the US proposal for a ceasefire with Israel with 'some comments' on content, according to a senior Lebanese politician who stated the US ceasefire proposal is the most serious attempt yet to end the fighting.

- Hezbollah said it bombarded a gathering of Israeli enemy forces south of the town of Khiam, according to Al Jazeera.

- Israeli Foreign Minister urged the UN to pressure Iraq after attacks by pro-Iran factions and said the government of Iraq is responsible for any actions that occur within or from its territory, according to Sky News Arabia and Asharq News.

- Iran's Foreign Ministry said new EU and UK sanctions against Iran are unjustified, baseless and contradict international law.

- Iranian Ambassador to Russia said there are no obstacles to concluding a strategic cooperation agreement between Russia and Iran, according to Asharq News.

OTHER

- Russia's Kremlin says the updated nuclear doctrine signed by Putin is a "very important text", "Russia reserves the right to use nuclear weapons in an event of aggression"

- Ukraine reportedly makes first ATACMS strike inside Russia, according to Ukraine press.

- US Ambassador to the UN said on Monday that the US will announce additional security assistance for Ukraine in the coming days, according to Reuters.

- French President Macron said US President Biden's decision to allow Ukraine the use of US-provided weapons to strike inside of Russia is a good decision, according to Reuters.

- Kremlin spokesperson said Russia is ready to normalise ties with the US but will not tango alone, while a spokesperson also said that Russia's amendments to its nuclear doctrine have been formulated but not formalised yet, according to TASS.

- Russia and Chinese foreign ministers discussed 'unprecedented' strategic bilateral relations on the sidelines of the G20 meeting in Brazil, according to Russian agencies cited by Reuters.

- EU foreign chief Borrell said the role of China is becoming bigger and bigger in the Ukraine war and without Iran and China, Russia could not support its military effort.

CRYPTO

- Bitcoin is in consolidation mode and sits comfortable above USD 90k.

- US President-elect Trump is to meet privately with Coinbase (COIN) CEO Brian Armstrong, according to WSJ.

APAC TRADE

- APAC stocks traded mostly in the green following the similar performance stateside although gains were capped amid relatively quiet newsflow with no major fresh macro catalysts to drive price action.

- ASX 200 outperformed and notched a fresh record high with all sectors in the green and the advances led by a tech resurgence and strength in gold miners, while there were recent amiable Xi-Albanese comments and Morgan Stanley raised its ASX 200 target.

- Nikkei 225 traded higher and shrugged off a firmer currency as Japan aims for cabinet approval of an economic package soon.

- Hang Seng and Shanghai Comp swung between gains and losses despite better-than-expected earnings from Xiaomi which failed to lift shares in the smartphone/EV maker, while support pledges by regulators did little to boost sentiment and the EU is also reportedly to demand tech transfers from Chinese companies in return for EU subsidies which would apply to batteries but could be expanded to other green sectors.

NOTABLE ASIA-PAC HEADLINES

- PBoC asks financial institutions to stop buying offshore Local Government Financing Vehicle (LGFV) bond under southbound connect scheme, via Reuters citing sources

- PBoC's Zhu said China will deepen Qualified Foreign Institutional Investor and Renminbi Qualified Foreign Institutional Investor reforms, while it will support Hong Kong to develop the offshore yuan market.

- Chinese Vice Premier He Lifeng said they will support more quality enterprises to list and issue bonds in Hong Kong, as well as support Chinese financial institutions in Hong Kong to expand their business.

- China's NFRA chief said Chinese banks have sufficient buffers for risk and they will implement the new CNY 60bln limit on local government debt and support financial institutions in debt restructuring to ease pressure on local governments. Furthermore, efforts will focus on improving financial service facilitation in the Greater Bay Area through interoperability of regulatory mechanisms and targeted policy issuance, while there are encouraging Chinese-funded banks and insurance institutions to set up their regional headquarters in Hong Kong to support its economic development.

- China CSRC Chairman Wu Qing said they will support listings inside and outside of the mainland.

- EU is reportedly to demand technology transfers from Chinese companies in return for EU subsidies, while the requirements would apply to batteries but could be expanded to other green sectors, according to FT.

- Hong Kong jailed all 45 Hong Kong pro-democracy campaigners in the city's largest security trial with legal scholar Benny Tai sentenced to 10 years in prison for subversion and student leader Joshua Wong sentenced to 4 years and 8 months, while it was later reported that the US strongly condemned the jailing of the democracy activists, according to AFP.

- Japanese Economic Revitalisation Minister Akazawa said they are aiming for cabinet approval of the economic package soon and it is crucial to boost pay for all generations with the package, while DPP head Tamaki also said that they aim for cabinet approval of economic measures by Friday.

- Japanese Finance Minister Kato said it is important for currencies to move in a stable manner reflecting fundamentals and they will continue to take appropriate action against excessive forex moves. Kato stated there is absolutely no change to their stance on forex and they have been seeing somewhat one-sided, sharp moves in the forex market since late September, while he reiterated they are closely watching FX moves with the utmost sense of urgency.

- RBA Minutes from the November 5th meeting stated the Board is vigilant to upside inflation risks and policy is needed to remain restrictive, while it saw no immediate need to change the Cash Rate and reiterated it is not possible to rule anything in or out on future changes in the Cash Rate. RBA Minutes noted their forecasts were based on the technical assumption for the Cash Rate to stay steady until mid-2025 and the Board considered what might warrant future change in cash rate or prolonged steady period, as well as discussed scenarios where policy would need to stay restrictive for longer or tighten further but also considered scenarios where a rate cut would be justified, including weak consumption. Furthermore, RBA noted the supply gap might be wider than assumed, necessitating tighter policy and rates might need to rise if the Board judged policy was not as restrictive as assumed, while it also stated that the Board had "minimal tolerance" for inflation above forecasts and would need more than one good quarterly inflation report to justify rate cut.

- Xpeng (XPEV/ 9868 HK) Q3 (RMB): adj eps -1.62 (prev. -1.61), revenue 10.1bln (prev. 9.91bln), vehicle deliveries 87-91k (+44.6-51.3% Y/Y).

- China's chip advances stall as US curbs hit Huawei AI products, via Bloomberg.