After US PPI yesterday surprised weaker and the US NFIB small business survey hit a six-year high, partly on hopes for lower inflation ahead, today is all about US CPI.

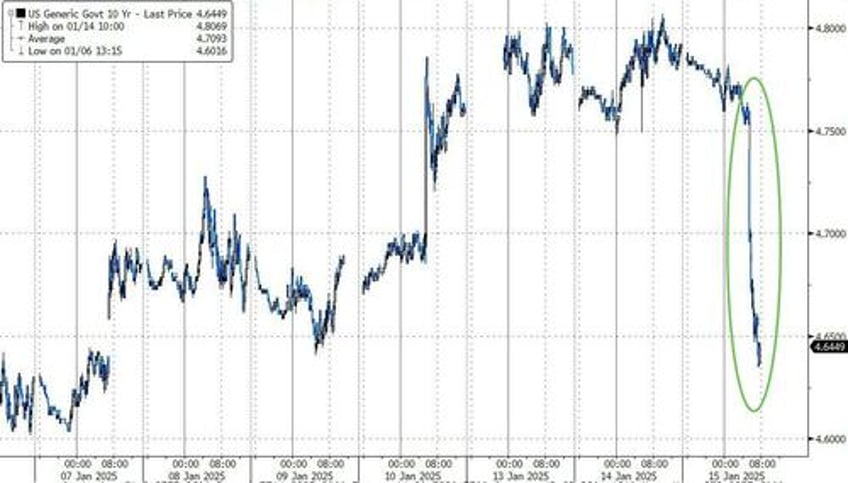

The hope was the data would be soft enough to halt the move higher in bond yields, which shrugged off a drop in oil prices yesterday, the rising dollar, falling stocks, and market chatter of a potential Fed hike in 2025... and a small miss for CPI sent yields careening lower...

However, rather than the higher/lower monthly gameshow, let’s look at the structural factors at play.

Few in markets called the last inflation episode.

March 2021 saw US headline CPI go over 2%, where it has still not returned and is trending higher: today’s consensus is another rise to 2.9%. We can’t claim any prizes as such, but in early June 2021 we warned that “understanding the global inflation outlook is currently more about (geo)politics/geoeconomics than it is about just economics or econometrics: we conclude that when encompassing this logic, the range of potential future inflation outcomes --and market reactions-- varies hugely.”

Then we got the invasion of Ukraine (geopolitics) and the passage of the US Inflation Reduction Act (politics).

Today, inflation is even more about (geo)politics/geoeconomics and the analogue world of farms, factories, trucks, ports, ships, rail, trucks, and warehouses than the fantasy digital one where things just arrive when needed which most economists inhabit.

President-elect Trump just announced a new “EXTERNAL REVENUE SERVICE”:

“For far too long, we have relied on taxing our Great People using the Internal Revenue Service (IRS). Through soft and pathetically weak Trade agreements, the American Economy has delivered growth and prosperity to the World, while taxing ourselves. I am today announcing that I will create the EXTERNAL REVENUE SERVICE [ERS] to collect our Tariffs, Duties, and all Revenue that come from Foreign sources. We will begin charging those who make money off with Trade, and they will start paying, FINALLY, their fair share.”

Chatter is the ERS may come under the Treasury, where economic statecraft, whereas tariffs are currently collected by the Department of Homeland Security. This is still compatible with what I said yesterday about potential US tariffs T+1 or gradually scaled up, to ensure supply chains shift to the US before prices have to rise.

The historic pattern of US revenues --with a smaller state-- is that until WW1 tariffs amounted to around 50%. That dropped sharply post-war as the US tried, and failed, to build a liberal world order to keep it safe and prosperous, and to close to zero after WW2, when it built a partial liberal world order with strong guardrails that won it the Cold War. Today, tariff revenue accounts for very little US revenue, albeit double what it was pre-Trump. Pushing tariff funding back up via the ERS --and domestic taxes down-- reshapes the entire US, and global, economy. It means the US returning to its historic pre-WW2 norm of mercantilism. (When I used that term in 2015 nobody understood it. Many still don’t even though it’s now close to being US policy: then again, how many covering China have read Marx, Lenin, or Mao?)

China is already mercantilist, with a $1 trillion 2024 trade surplus. Indeed, as the US puts geopolitical limits on who gets the best AI chips, China is slowing the transfer of key inputs to firms trying to shift production away from it via its control of other related value chains. This necessitates shifting multiple value chains, at scale, to diversify just one. So, far more trade disruption, with a lag; or China-centric production for the world - and even the Pentagon.

In that light, I repeat that the US may have opened the door to actions vs. Chinese ocean carriers (such as Jones Act-style restrictions on their entry into US ports?), in response to a USTR report underlining how Beijing dominates global maritime industry, from shipping containers to shipbuilding to ocean carriers to ports.

Relatedly, US Defence Secretary nominee Hesgeth’s nomination hearing in Congress stressed a primary focus on rebuilding the lethality of the US military and readopting America’s historic Mahan naval-power maritime strategy. (Which would leave many others truly ‘In Deep Ship’.)

Trump also plans US “energy dominance” to shift from green energy back to fossil fuels, where the US has strategic and comparative advantage vs. China, and to lower US energy prices vs. others – which is obviously disinflationary for at least the US. The problem is US industry executives do not share his enthusiasm to “Drill, baby, drill.” Then again, economic statecraft is not about market forces: if the IRA passed under Biden introduced huge green incentives, what might a Trump counterpoint look like?

In short, this is a de facto geopolitical supply chain war in contrast to the neoliberal assumption that while individual firms compete ruthlessly, all economies are purely neutral parties/playing fields for their actions.

The winners within this new paradigm face structurally higher inflation (in terms of their positive investment cycle and/or immediate tariffs) and then lower inflation (in terms of their higher supply-side capacity; and, where possible, via energy policy).

The losers face structurally higher inflation (in terms of choked-off supply chains; and, where mismanaged, via energy policy, i.e., Germany faces another week-long dunkelflaute with high fossil fuel use and high energy prices) alongside much lower inflation (in terms of the destruction of their domestic industry and employment).

Yes, that’s far more complicated than just saying “0.3% m-o-m”, which is what most wanted to hear about the US CPI consensus today; but as we warned back in mid-2021, things are a lot more complicated than the “So, inflation will come down soon…” crowd are saying.