In a special video released yesterday, Peter discusses the ongoing fallout from President Trump’s tariff policy and the broader implications for the American economy. He outlines how the tariffs are not only ineffective but also counterproductive, worsening the trade deficit and the nation’s competitiveness.

Additionally, Peter highlights the growing demand for gold amidst economic trouble and suggests strategic opportunities for investors looking for sound money alternatives.

Peter opens the video by summarizing market movements before and after yesterday’s tariff pause. These tariffs, he believes, demonstrate a policy blunder masked as victory:

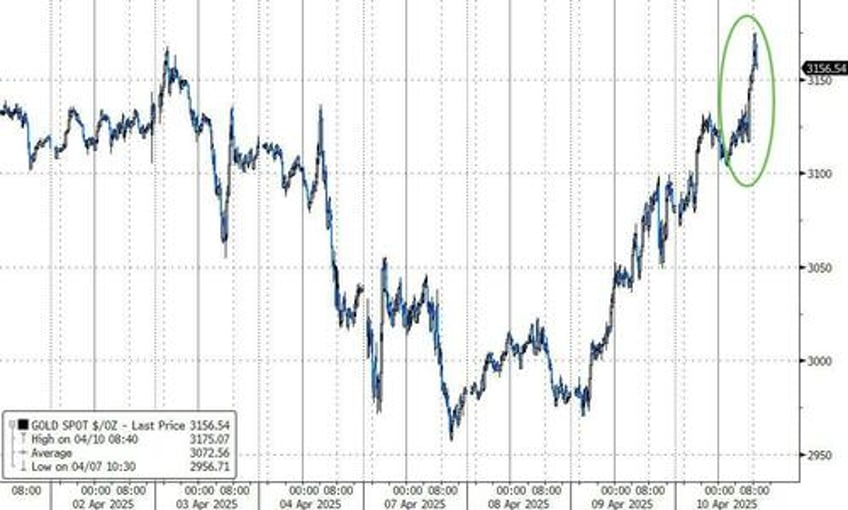

Today the price of gold rose by better than $100 an ounce. This was the biggest one-day dollar increase in the price of gold in the history of gold. And in fact, gold was up better than $100 even before President Trump announced that he was pausing the global trade war that he launched last week.

Now once that news came out, there was a big rally in the stock market.

Gold initially surrendered some of those gains, but it quickly recovered and closed back near the highs just under $3,100 an ounce. … I think the President and his advisors tried to find a way to surrender but make it appear as if they were declaring victory.

Peter then emphasizes the root cause behind America’s persistent trade deficits, highlighting the nation’s lack of savings and investment. He contends that excessive spending and underinvestment at home leaves the country overly dependent on foreign producers:

The reason we have these horrific trade deficits is because as a nation we spend too much and save too little. And so because we don’t save enough, we don’t make the capital investments to build up the factories and the supply chains and the infrastructure.

And so because of that we have to rely on all those factories abroad for the goods that we can’t produce. And because we spend more than we produce, we need to get those goods. And we run these massive deficits that we can’t finance. And so we depend on the world to finance them.

Though he appreciates President Trump’s stated goal of reducing deficits, Peter predicts the tariffs will have the opposite effect. Rather than solving America’s economic weaknesses, tariffs place an extra burden on American consumers and businesses, tipping the economy further into stagflation:

So while I admire Trump’s goal, he is not going to come close to achieving it. In fact, the tariffs that he’s already imposed are going to backfire and they’re going to make the American economy even less competitive than it was before the tariffs. And the tariffs are paid by Americans. They’re not going to be paid by our trading partners. There is no external revenue. It’s all internal. And this tax hike on average Americans is going to weigh down an already weak economy. And so we’re going to have a bigger dose of stagflation.

Shifting his focus to the gold market, Peter notes that worsening economic conditions and stagflation have created an attractive environment for gold investments. He underscores gold mining companies as potentially well-positioned to benefit, given the strong gold price and reduced oil costs:

And that is going to be great for Q2 earnings for the gold mining companies. They’re already going to have great earnings in Q1, but I think they’re going to blow the doors off in Q2 because I think gold is going to hang out near 3,100 or higher and oil is going to be slow to recover. So in the meantime, the profits are going to be huge for these gold mining companies. And I’ve been advocating for a long time that people buy physical gold, and since I started recommending physical gold, it was under $300 an ounce. It’s now over 3,000. So you’ve got a 10X.

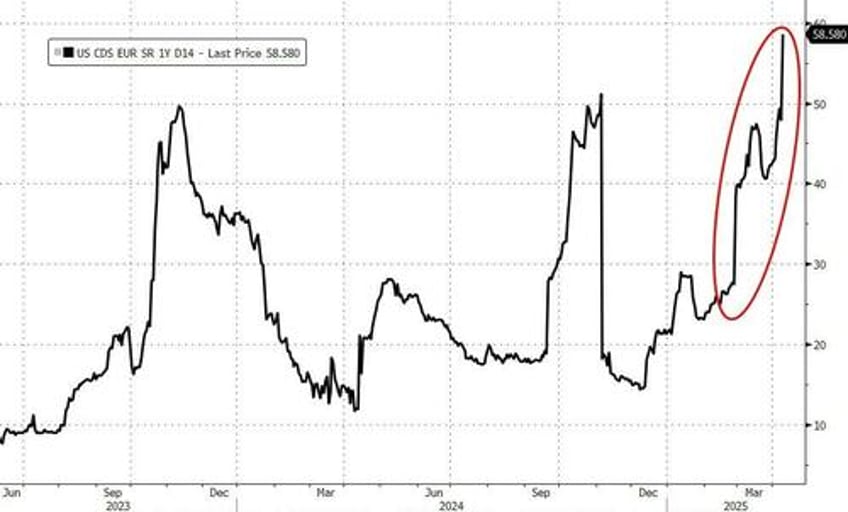

Peter warns about America’s financial vulnerability, stressing the country’s dependence on foreign money to sustain unsustainable living standards. He predicts this dependence will end painfully, as a weakening dollar forces America to lower its consumption and accept a lower standard of living:

It’s America that’s been taking advantage of the world because we rely on the world to live beyond our means.

But the world can only finance that by living beneath its means. Well, that’s going to change.

It’s going to change because the dollar is going to go way down. And so we’re going to consume less and the rest of the world is going to consume more. And that’s how our trade deficits go away as our standard of living declines.

But in the meantime, the world is getting rid of dollars in advance of a major depreciation.

Be sure to check out Peter’s recent interview on Soar Financially!