After the latest Quarterly Refunding presentation by the TBAC dedicated a substantial portion of the prepared materials to the risk of a basis trade exploding, leading to catastrophic damage to the Treasury market, it should not come as a surprise that moments ago the SEC revealed that going forward hedge funds and prop trading firms that regularly trade US Treasuries - often with 20x leverage or more to greatly magnify moves as little as one basis point (here LTCM flashbacks should come flooding in)- are set to be labeled as dealers by the US regulator, a tag that will bring with it unwelcome scrutiny and attention not to mention greater compliance costs and scrutiny.

It's also why demand for the basis trade, which has been so instrumental in allowing all the massive debt supply to be easily digested and remain liquid, may soon collapse leading to unexpected and jarring consequences to the Treasury complex just as US debt is growing by tens of billions every single day.

As Bloomberg reported first, on Tuesday the SEC - best known for being unable to keep its X account safe after voluntarily turning off 2FA and getting hacked one day before a historic bitcoin ETF announcement in what may be the most humiliating moment in the agency's history - decided in a 3 to 2 vote to boost oversight of rates trading by the firms, which are increasingly responsible for liquidity in the world’s biggest government bond market but only because they use trillions in leverage. The new regulations would also apply to market participants in additional government bonds, equities and other securities.

With Liz Warren's SEC lackey, Gary Gensler, having homed in on the Treasuries market and the private-funds industry as needing more guardrails, the Tuesday overhaul could force dozens of firms to register as dealers and face new regulations, something they are unlikely to do.

Since it was the catastrophic implosion of the basis trade - or rather the leverage the kept it viable - in Sept 2019 and again in March 2020 that sparked a panicked emergency reaction by the Fed, it is not a surprise that regulators had been looking for ways to glean more insight into the books of hedge funds that dabble in the trade.

Under the rules, dealers would include firms that buy and sell securities for their own account as part of the regular course of their business. the label also carries more oversight from the industry-backed Financial Industry Regulatory Authority.

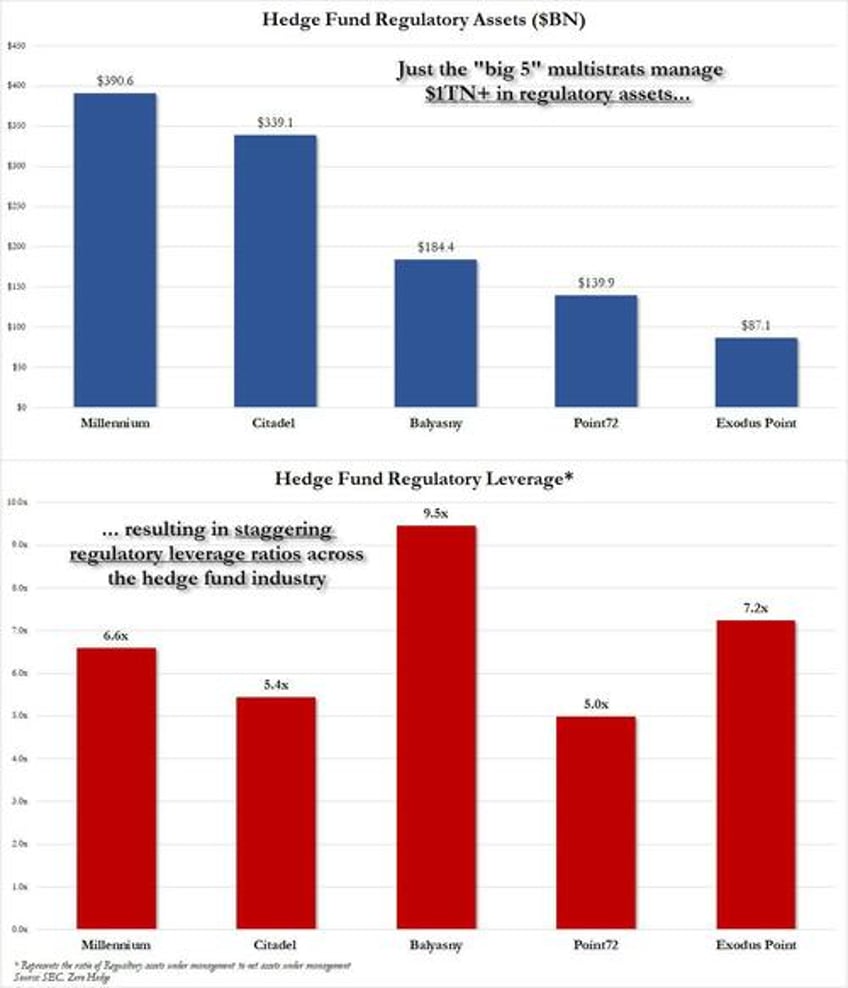

The new rules would apply to many trading firms that earn revenue from capturing bid-ask spreads, or those that express interest at or near the best available prices on both sides of the market for the same security. Those that manage $50 million or less in assets would be exempt, according to the commission. Of course, those firms are irrelevant, and the ones that do matter are the multistrat hedge funds which have allocated hundreds of billions in regulatory asset (really leverage) to arbing the Treasury cash-futures basis - hedge funds are long the underlying cash TSY and short the TSY future in one giant basis trade hence the name - and capitalizing on tiny mispricings.

Some of the hedge funds that are the most aggressive in basis trading are the who's who of multi-strat and "pod" names such as Millennium, Citadel, Balyasny, Point73 and Exodus Point. As shown in the chart below, the top 5 names collectively sport over $1 trillion in regulatory assets, which represents 6.3x regulatory leverage on their underlying net assets!

It's not just us warning that the violent unwind of the basis trade will be the basis for the next mega-crash...

btw this is where the next really big crash will start https://t.co/XcK2RezYEk

— zerohedge (@zerohedge) February 1, 2024

... in its Jan 30 TBAC presentation warned that leverage across the basis trading hedge fund sector is surging and concluded that "relative-value trading strategies are the most likely driver of structural leveraged fund shorts in Treasury futures and propose some relevant relationships for Treasury to monitor on the Treasury futures basis trade."

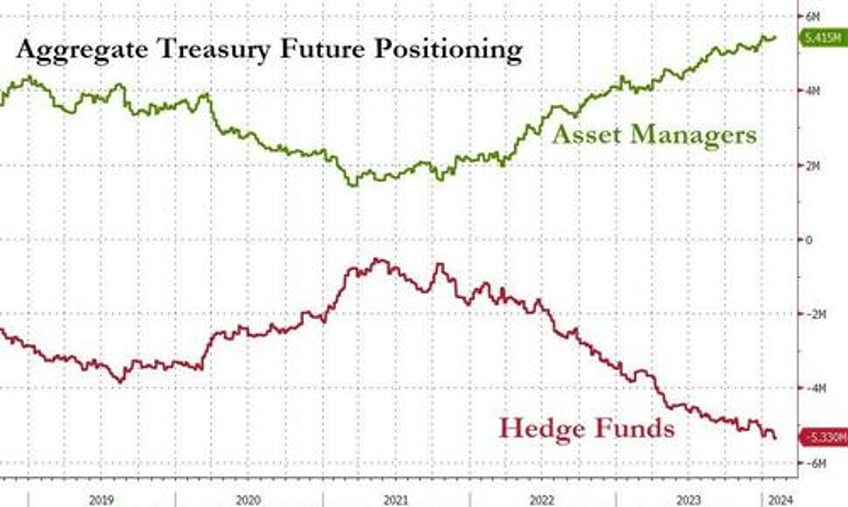

Some of the highlights from that presentation (full pdf below). starting with the recent dramatic changes in TSY future positioning by investor type, particularly asset managers (who are long futs) and leverage funds, or hedge funds (who are short):

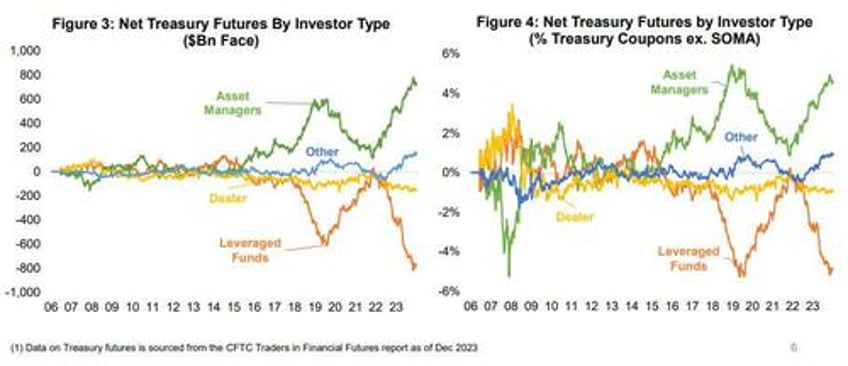

- Recently there have been large increases in both asset manager and leveraged fund positions in Treasury futures.

- Since November 2021, asset managers (AM) have increased their net position from $100bn to over $700bn, while leveraged funds (LF) have moved from flat to short almost $800bn.(1)

- When normalized by the size of the Treasury market in Figure 4, recent trends look similar. One interesting thing to note is the size of AM and LF positions is similar to 2019 peak (not larger).

- In the 2006-2007 period, AM and LF relative positions were flipped. This change could indicate a structural evolution in the ecosystem and how different investors behave.

Some more details:

- Most of the net position in futures is concentrated in shorter duration contracts (TU, FV, and TY) likely due to larger amounts of Treasuries outstanding in these maturity buckets.

- Currently, these three contracts represent 80% of the net asset manager notional position and 55% of the net TY equivalent position.

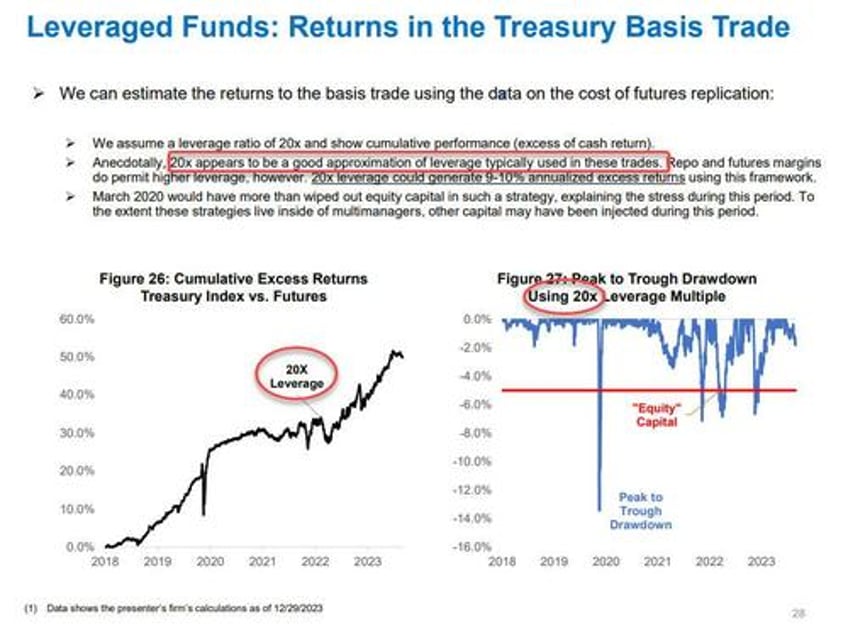

The presentation then goes on to discuss some of the fundamentals in the basis trade (must read for anyone unfamiliar with the reasons why hedge funds are so drawn to it) and then turns its attention to the type of returns hedge funds generate in the TSY basis trade as well as the associated leverage. Here is where we find out that "indicatively", the leverage involved is a whopping 20x, or in other words a mere 5% positional drawdown on the pair trade - which was saw repeatedly during the March 2020 covid shock - is enough to wipe out all the equity in the trade!

And what is even more terrifying is that TBAC's quiet, tacit admission that "repo and futures margins do permit higher leverage", which is why one can be certain that many hedge funds use that, or even higher leverage than 20x!

Why? Because as the TBAC points out in the very next sentence, "20x leverage could generate 9-10% annualized excess returns using this framework" which is great assuming nothing bad ever happens, but as LTCM will vouch and as events in March 2020 showed that's never the case, and in fact...

March 2020 would have more than wiped out equity capital in such a strategy, explaining the stress during this period. To the extent these strategies live inside of multimanagers, other capital may have been injected during this period.

One final question: how big is the basis trade (after all we need some context to quantify the systematic risk). Well, the answer is nobody knows because the breakdown of how much regulatory capital is allocated to basis trades is secret, and is why the SEC is now demanding more clarity and will start treating basis traders as dealers.

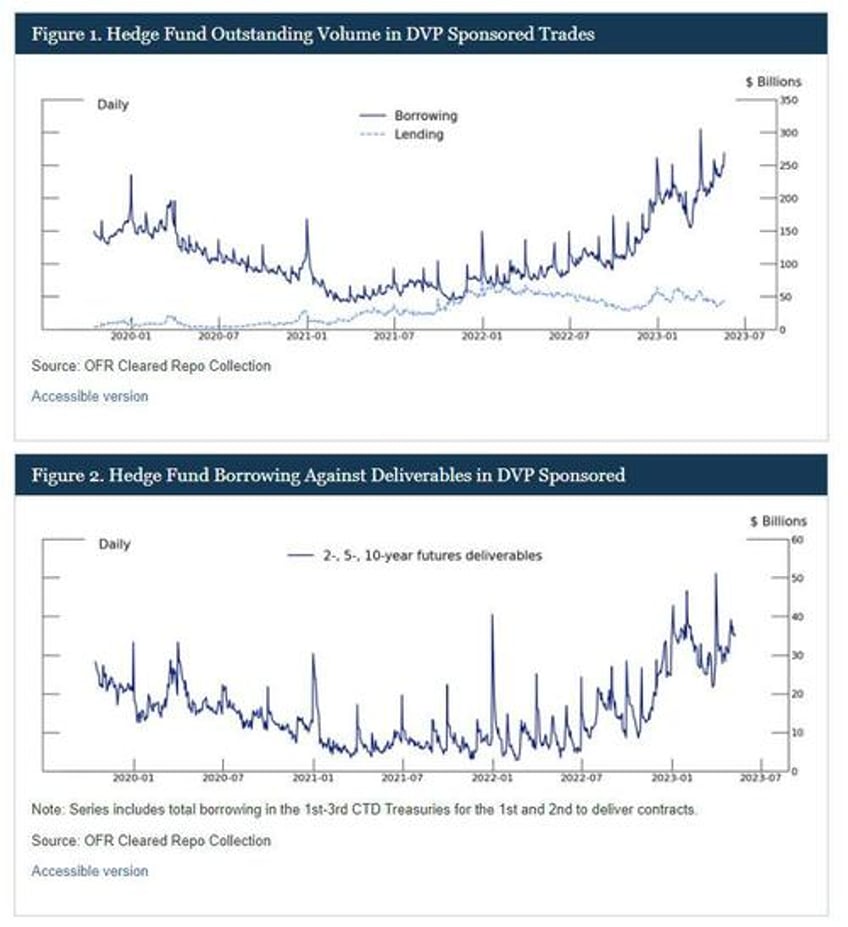

According to the TBAC, recent research from the Fed suggests that the basis trade has grown in size lately, similar to levels seen in 2018-2019. They cite the futures data, but also show some evidence from the sponsored repo market and collateral posting data, shown below:

Another piece of research released in September of 2023 quantifies the basis trade at $550BN. The authors used data from form PF, and the size seems fairly consistent with size of futures exposure at the time.

Bottom line, the TBAC writes, "estimating size of relative-value AUM is hard especially as a large portion of capital pursuing these strategies may be embedded in multimanager hedge-funds, where little public data on sub-strategy allocations is available."

Which explains why the SEC is now scrambling to figure out just how much capital is truly allocated to basis trades within multi-manager/multi-strat hedge funds, but based on our quick look at regulatory leverage, the actual amount allocated to basis is orders of magnitude greater than $550BN, more likely in the $2+ trillion ballpark across the entire global hedge fund industry.

And there you have it: all the basis trade is, is the latest manifestation of the "collecting pennies in front of a steamroller" trade, because when it works it generates 10% returns every year like clockwork, with the only gating factor being how much leverage a hedge fund has access to.

However, during a crisis, such as the Sept 2019 repo fiasco or the March 2020 crash, it all goes to hell... and the Fed rushes to bail out not just bank but hedge funds which are now so tightly interwoven in the financial fabric (via ultra loose and generous Prime Brokerage linkages) that central banks have no choice but to bail out everyone, including the billionaires who run the hedge funds that have put on trillions of basis trades on!

* * *

Understandably, the hedge fund industry had lobbied aggressively against the rules since they were proposed in 2022. Industry groups even went as far as calling the proposed requirements an "existential threat" to certain trading strategies as it would expose much more information on how much leverage hedge funds utilize, thus leaving them vulnerable to raids by their peers. They said the changes, if enacted, could spur firms to leave markets to avoid the additional costs.

And now the question is whether they were telling the truth, because if that is indeed the case, then the liquidity in the treasury market will evaporate just when it is most needed: when the US Treasury is adding trillions in gross debt every quarter to keep up with the Biden admin's ravenous demands for fiscal stimulus.

That said, the SEC’s final plan eliminates some elements that drew the most ire from industry, such as a trigger for registration of $25 billion in monthly securities transactions, however most of the top names trade this threshold many times over. Still, it’s unclear whether the changes will be enough to stave off a legal challenge. The private-funds industry is already suing the SEC over other new regulations.

For its part, the SEC has maintained that registering is necessary because firms that make up such a large amount of Treasuries trading volume Bloomberg reports. The regulator said the plan will ensure that firms engaged in similar activities are regulated in a similar way as many firms active in the market are already labeled as dealers.

The rule, which was adopted after a close 3-2 vote, will go into effect 60 days after publication in the Federal Register. Companies would have to comply with the registration requirements one year after that date. At that time, liquidity in the bond market may disappear.

The full must-read TBAC basis trade presentation is below (pdf link).