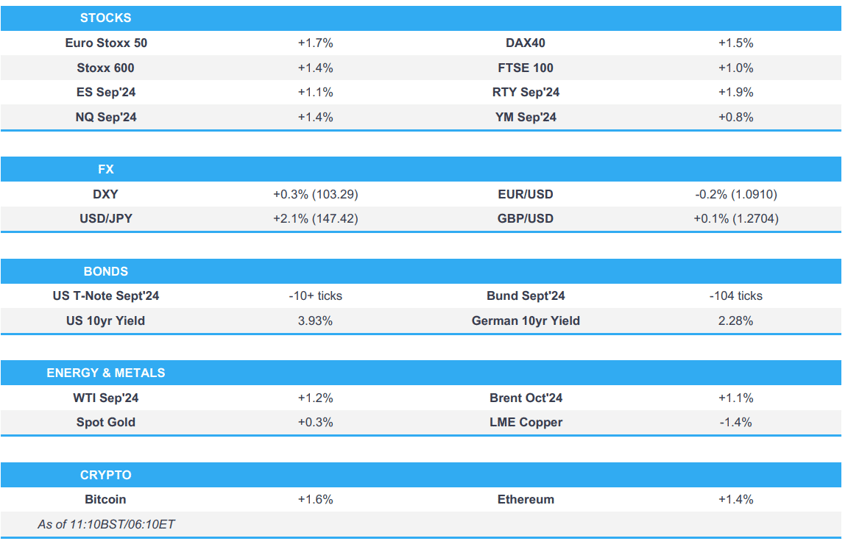

- European bourses are firmer but with divergence in the main benchmarks on account of Novo Nordisk slipping post-earnings, Stoxx 600 +1.1%

- Stateside, futures in the green with action choppy at times as we count down to key earnings incl. DIS; ES +1.1%

- DXY bid and above 103.00 but slightly off best, upside driven by Uchida-driven JPY weakness; USD/JPY over 147.50 in APAC trade

- Fixed benchmarks continue to falter from recent highs and look ahead to US 10yr supply

- Crude in the green with recent drivers continuing to factor, metals mixed and copper leads the downside after Chinese data & a sizeable LME build

- Looking ahead, highlights include BoC Minutes, Comments ECB’s Rehn, Supply from the US, Earnings from Disney.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are firmer intraday, Euro Stoxx 50 +1.7%, with the Stoxx 50 outperforming the Stoxx 600 +1.1% as the latter is weighed on by post-earnings downside in heavyweight Novo Nordisk -3.0%.

- Given this, Healthcare lags after Novo missed on several key metrics incl. Wegovy sales and downgraded some components of its FY guidance. Banks outperform as yields rise and after strong numbers from ABN AMRO.

- Breakdown has the DAX 40 +1.5% supported by Continental, which is lifting the broader Auto sector; Commerzbank bucks the banking trend after missing on numerous metrics.

- Stateside, futures in the green and grinding higher throughout the morning, ES +1.0%, NQ +1.1%; though, action has been choppy at times with newsflow light thus far ex-earnings.

- Elsewhere, Maersk earnings were mixed with the name lower despite noting market demand has been strong but warns of slower global container demand ahead.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD supported with the DXY bid and above 103.00 but off overnight best levels of 103.37. Strength which came as USD/JPY soared above 147.50 after remarks from BoJ's Uchida that they won't hike when markets are unstable.

- As such, JPY is the clear laggard but followed relatively closely by the CHF as the positive tone means haven demand is waning and as yields rally and weigh on the likes of CHF and JPY.

- Sterling modestly firmer, but has been below 1.27 in a 1.2681-1.2718 band. Specifics light but strength coming via EUR downside and associated pressure in EUR/GBP to back below 0.86.

- EUR/USD itself holding around 1.0905 and is close to, but yet to test, the figure to the downside; no real reaction to mixed German data this morning.

- Antipodeans benefit from the risk tone with NZD outperforming after encouraging employment data and as the AUD takes a slight breather from RBA-inspired strength; nonetheless, it remain underpinned with strong Chinese imports assisting.

- PBoC set USD/CNY mid-point at 7.1386 vs exp. 7.1481 (prev. 7.1318).

- Japan's currency intervention amounted to JPY 5.92tln on April 29th and JPY 3.87tln on May 1st, while the April 29th intervention was a single-day record and surpassed the previous record of JPY 5.62tln on 21st October 2002, according to Ministry of Finance data.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Benchmarks continue to falter despite opening the European morning with modest gains. Downside which has pushed Bunds below the 134.00 mark vs. a 136.28 peak on Monday.

- Supply was uneventful in terms of reaction from Germany and the UK, though the latter was a touch softer than recent taps; reminder, US 10yr later.

- Gilts pressured but to a slightly lesser magnitude with little by way of specific driver to note. Further downside brings the 99.00 mark into view and then numerous recent lows below this.

- Amidst this, USTs are also softer but only modestly so with the docket ahead thin ex-earnings until 10yr supply which follows an unremarkable 3yr tap on Tuesday.

- Chinese regulators are reportedly restricting the duration of new bond funds, restrictions target mutual fund managers, according to Reuters sources.

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 2.87x (prev. 3.10x), average yield 3.854% (prev. 4.023%) & tail 0.9bps (prev. 0.9bps)

- Germany sells EUR 0.407bln vs exp. EUR 0.5bln 1.00% 2038 Bund & EUR 1.199bln vs exp. EUR 1.5bln 2.60% 2041 Bund

- Click for a detailed summary

COMMODITIES

- Crude benchmarks began with a mild positive tilt and have been gradually extending on this throughout the morning. WTI and Brent at the top-end of parameters and are holding around USD 74.11/bb and USD 77.42/bbl respectively.

- Benchmarks aided by the USD being slightly off best (though still firmer) and with gepol. risk still a key factor alongside the recent production halt at El Sharara.

- Metals are mixed, spot silver once again underperforms its gold counterpart a touch which itself is approaching a test of USD 2400/oz to the upside. Base metals are primarily weaker after mixed Chinese trade data and with Copper leading the downside after a mammoth LME stock build.

- LME Stocks: Copper +42,175t (prev. +1,225t)

- Chinese gold reserves unchanged M/M at 72.8mln fine troy ounces

- US Private Inventory Data (bbls): Crude +0.2mln (exp. -0.7mln), Distillate +1.2mln (exp. +0.2mln), Gasoline +3.3mln (exp. -1mln), Cushing +1.1mln.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Industrial Output MM (Jun) 1.4% vs. Exp. 1.0% (Prev. -2.5%)

- German Exports MM SA (Jun) -3.4% vs. Exp. -1.5% (Prev. -3.6%)

NOTABLE EUROPEAN HEADLINES

- Novo Nordisk (NOVOB DC) Q2 (DKK): Sales 68.06bln (exp. 68.65bln), EBIT 25.94bln (exp. 26.85bln), Wegovy Sales 11.66bln (exp. 13.54bln). CEO: Wegovy prescriptions in the US more doubled vs the start of the year; CFO says negative impact of net impact to net sales of Wegovy in Q2 is due to rebate adjustments; Competitive dynamics will not have an impact on Wegovy sales in the near future. FY Guidance: Sales growth 22-28% at CER (prev. guided 19-27%); Operating Profit growth 20-28% at CER (prev. view 22-30%), CAPEX ~45bln. FCF 59-69bln

- Maersk (MAERSKB DC) Q2 (USD): EBITDA 2.1bln (exp. 2.27bln), EBIT 963mln (exp. 810mln), EPS 51 (exp. 55.5). Market demand has been strong, Red Sea situation remains entrenched. CEO says they could see some pulling forward of demand, most notably within the US due to the upcoming election and associated uncertainty around future import tariffs. Adds, industrial action following pending union talks in the US could lead to further supply chain disruptions.

- UK Chancellor Reeves aims to follow a "Canadian model" to consolidate GBP 360bln of smaller local government pension schemes to aid in boosting investment and "fire up the economy", according to The Times.

NOTABLE US HEADLINES

- US Election Poll showed Harris leads Trump 51% to 48% in National NPR/PBS/Marist poll.

- US Democratic Presidential nominee Harris confirmed Minnesota Governor Walz as her running mate, according to CNN.

GEOPOLITICS

MIDDLE EAST

- Israel estimates that Hezbollah will attack before Iran, according to Israel's Kann News. Israel Broadcasting Corporation also reported that estimates indicate Hezbollah will carry out the attack before Iran and will use precision missiles, according to Al Arabiya. Furthermore, a source via X reported that Israeli intelligence said a possible Hezbollah attack could occur in the next 24-48 hours.

- Israel's Channel 12 News reported that advanced preparations and planning are underway within the Israeli Military for the launch of pre-emptive strikes against Hezbollah targets in Lebanon, prior to their coordinated attack against Israel with Iran.

- IDF struck a building in a Lebanese village targeting Hezbollah operatives, according to Times of Israel.

- US Secretary of State Blinken said they have communicated directly to Iran and Israel that no one should escalate the conflict in the Middle East, while he added that Gaza hostage negotiations have reached the final stage and it is critical that parties work to finalise the agreement as soon as possible. Blinken also said everyone in the region should understand that further attacks only perpetuate conflict, instability, and insecurity for everyone.

- US Defence Secretary Austin said the US will not tolerate attacks on US personnel in the Middle East and that they are sure Iran-backed militia was behind the attack on US troops in Iraq, according to Reuters. Austin also said they are ready to deploy more troops to the region if they see a threat to their interests and the security of allies, according to Al Arabiya.

- "Iranian News Agency: Equipping the eastern regions of the Iran with radar, air defense systems and drones", according to Sky News Arabia.

- "Sirens sound in Shtula, northern Israel", according to Sky News Arabia.

OTHER

- Australia, Canada, the Philippines and the US are to hold joint maritime exercises on August 7th-8th in the South China Sea. It was later reported that China's military organised a joint combat patrol over the sea and airspace near the Scarborough Shoal in the South China Sea.

CRYPTO

- Bitcoin a touch firmer on the session but with action largely rangebound and well within recent parameters around the USD 56k mark.

APAC TRADE

- APAC stocks continued their recent rebound but with some of the gains capped as markets digested mixed Chinese trade data.

- ASX 200 was positive albeit with the upside limited as participants reflected on the key data from Australia's largest trading partner.

- Nikkei 225 saw two-way price action in which initially suffered losses but then staged a gradual recovery and was further boosted following comments from BoJ Deputy Governor Uchida who said they won't hike rates when markets are unstable.

- Hang Seng and Shanghai Comp. conformed to the upbeat mood although the advances in the mainland are limited after the PBoC refrained from injecting funds and the latest Chinese trade data printed mixed.

NOTABLE ASIA-PAC HEADLINES

- BoJ Deputy Governor Uchida said their interest rate path will obviously change if as a result of market volatility, economic forecasts, view on risks, and likelihood of achieving the projection change, while he added that they won't hike rates when markets are unstable and they must maintain the current degree of monetary easing for the time being. Uchida said Japan is not in an environment where they would be behind the curve unless they hike rates at a set pace, as well as noted that a weak yen and subsequent rise in import costs pose upside risks to inflation. Furthermore, Uchida said if the economy and prices move in line with projections, it is appropriate to adjust the degree of monetary easing but also commented that Japan's real interest rate is very low, monetary conditions are very accommodative and that the scheduled tapering of bond buying likely won't cause major changes in the degree of monetary easing.

- BoJ's Uchida says market volatility is very large, will be keeping a close eye on moves and the impact on the economy and prices. Real rates remain low, will underpin the economy. There is no gap in views between Ueda and Uchida, recent Uchida remarks reflect changes in the latest market developments following the last meeting.

- Honda (7267 JT) Q1 (JPY): Net 394bln (exp. 343bln), Operating 484bln (exp. 472bln), PBT 559bln (exp. 508bln). FY Guidance: Downgraded group sales guidance; sees GY global retail sales at 3.9mln vehicles (prev. guided 4.1mln). N. American sales 1.675mln vehicles (prev. guided 1.675mln)

DATA RECAP

- Chinese Trade Balance (USD)(Jul) 84.65B vs. Exp. 99.0B (Prev. 99.05B)

- Chinese Exports YY (USD)(Jul) 7.0% vs. Exp. 9.7% (Prev. 8.6%); Imports YY (USD)(Jul) 7.2% vs. Exp. 3.5% (Prev. -2.3%)

- Chinese Trade Balance (CNY)(Jul) 601.9B (Prev. 703.7B)

- Chinese Exports (CNY)(Jul) 6.5% (Prev. 10.7%)

- Chinese Imports (CNY)(Jul) 6.6% (Prev. -0.6%)

- New Zealand HLFS Job Growth QQ (Q2) 0.4% vs. Exp. -0.2% (Prev. -0.2%)

- New Zealand HLFS Unemployment Rate (Q2) 4.6% vs. Exp. 4.7% (Prev. 4.3%)

- New Zealand HLFS Participation Rate (Q2) 71.7% vs. Exp. 71.3% (Prev. 71.5%)

- New Zealand Labour Cost Index QQ (Q2) 0.9% vs. Exp. 0.8% (Prev. 0.8%)

- New Zealand Labour Cost Index YY (Q2) 3.6% vs. Exp. 3.5% (Prev. 3.8%)