By Michael Msika, Bloomberg Markets Live reporter and strateigst

Simmering geopolitical risks and seemingly unstoppable bond yields are making things tough for equity markets. And they aren’t getting much help from the earnings season either.

The absence of an escalation in the Israel-Hamas war in the past few days has provided a pause in the ascent of oil and gold. But pressure from US 10-year Treasury yields exceeding 5% and slowing corporate profits have pushed the Stoxx 600 to the verge of erasing its 2023 gains. The European benchmark is testing major support as well as oversold technical levels and, while this leaves scope for a short-term bounce, the week remains packed with risk events including Tuesday’s PMIs and an ECB rate decision on Thursday.

“Investors will likely remain in wait-and-see mode, as low conviction and geopolitical uncertainty leave money on the sidelines,” says Citi strategist Beata Manthey. “Market volatility may continue in the near term, especially as geopolitics have complicated the outlook.”

With equity positioning now looking one-sidedly short, a rally could be in the cards. Systematic investors have continued to sell stocks, according to Deutsche Bank strategists. Volatility-control funds have trimmed their equity exposure sharply to 62.3%, the 25th percentile, and their lowest since March this year. CTAs cut their aggregate equity allocation further last week after going short equities for the first time since November 2022 in the week before that. In particular, they’ve increased their recent short positions in the Euro Stoxx 50, they say.

Still, the broader picture remains fairly clouded, especially with bond yields this elevated and interest rates likely to stay higher for longer, increasing the risk that something will break soon on the credit side, while keeping the strain on valuations more broadly.

“Much of the recent yield rise has been in term premia, the risk of owning longer duration bonds,” say UBS strategists Gerry Fowler and Sutanya Chedda. They recommend investors focus on quality stocks in this environment. “This is not a factor likely to reverse quickly and therefore equity valuations will remain under pressure until we have clearly lower growth and inflation leading to a policy response. We currently forecast this only from the middle of next year.”

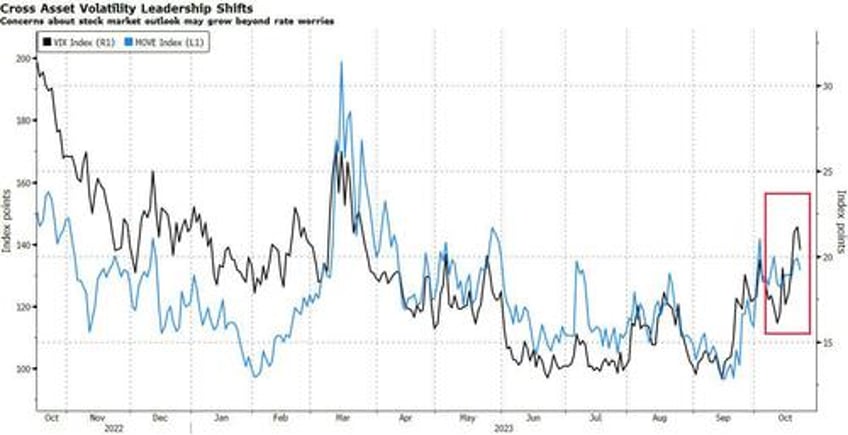

What’s even more eye-catching is the change in leadership when it comes to the market’s fear triggers. While bond volatility was often the catalyst for cross-asset concerns spilling into equities for most of the past year, it seems that swings in the stock market are now taking the lead. That suggests that some intrinsic concerns over the outlook for equities may be brewing.

For example, the earnings season has proved pretty underwhelming so far, both in Europe and the US. While EPS is doing alright, investors are showing a sharp negative reaction to companies falling short of their relatively low expectations. The coming days are particularly busy for corporate updates, so things could get shaky.

“EPS beats are running above average, but stock price reaction has been tilted to the downside, with misses punished,” says Barclays strategist Emmanuel Cau. “Europe looks softer than the US — top line in particular.” He adds that a more mixed economy during the quarter has meant the same for earnings quality, failing to lift the mood in equities.

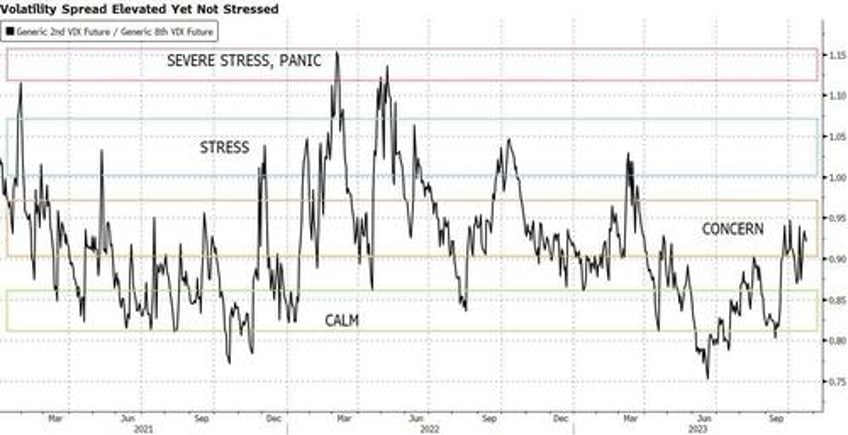

A look under the hood of the rising VIX Index shows that the curve of volatility is also shifting, suggesting that investors are worrying more about short-term risks right now. The 2/8 months VIX future spread is now the highest since March’s banking industry wobbles. And while that signals that people are concerned, the market is still a fair bit away from stress or all-out panic.