Despite mortgage rates having tumbled (relatively-speaking), and homebuilder sentiment picking back up post-Fed-pivot, expectations were for a plunge back to reality for Housing Starts in December after November's unexpected surge. Permits were expected to rise only very modestly.

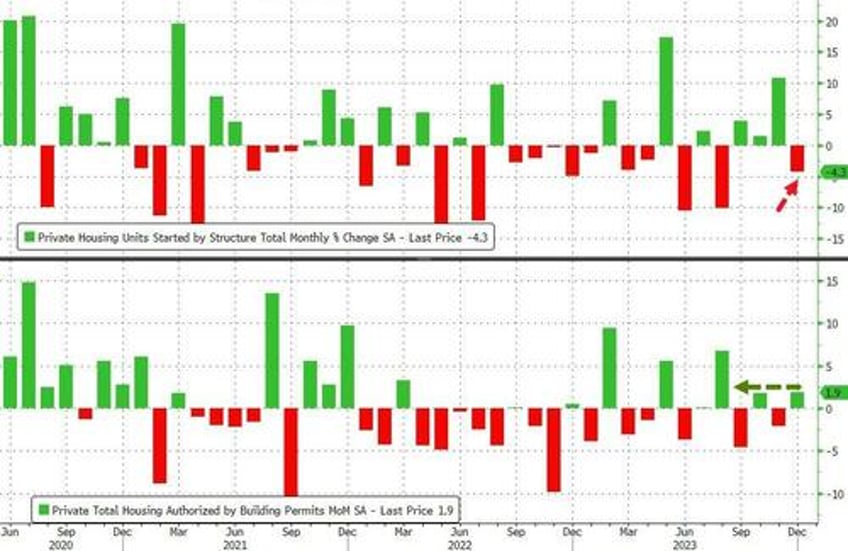

Analysts were right in direction but wrong in magnitude - too bearish. Housing starts declined 4.3% MoM (vs -8.7% MoM exp and +10.8% MoM in November, a big downward revision from the initial +14.8% MoM). Building permits also rose more than expected (+1.9% MoM vs +0.6% exp but saw November's 2.5% MoM decline upwardly revised to -2.1% MoM...

Source: Bloomberg

On a SAAR basis, Housing Starts and Building Permits are higher YoY

Source: Bloomberg

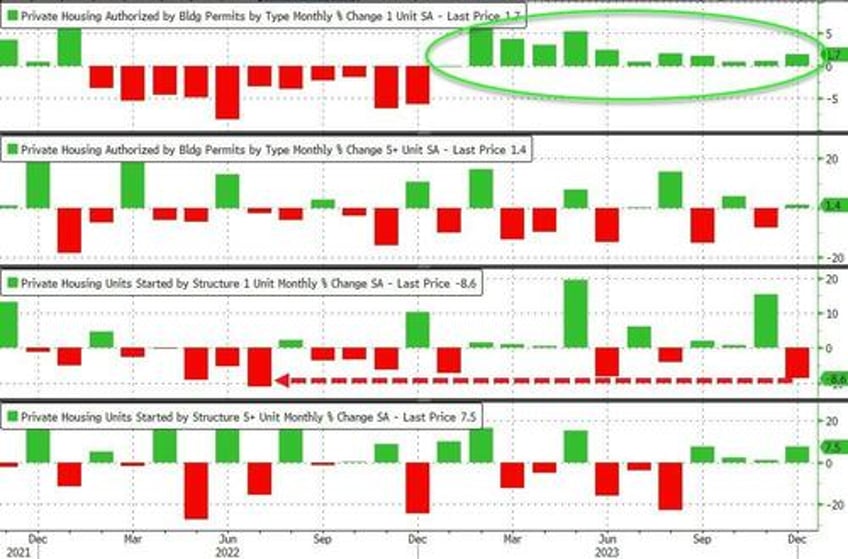

Under the hood, single-family permits rose for the 12th month in a row (i.e. every month in 2023) but single-family home starts plunged 8.6% MoM after surging 15.4% MoM in November... that is the biggest monthly decline since July 2022...

Source: Bloomberg

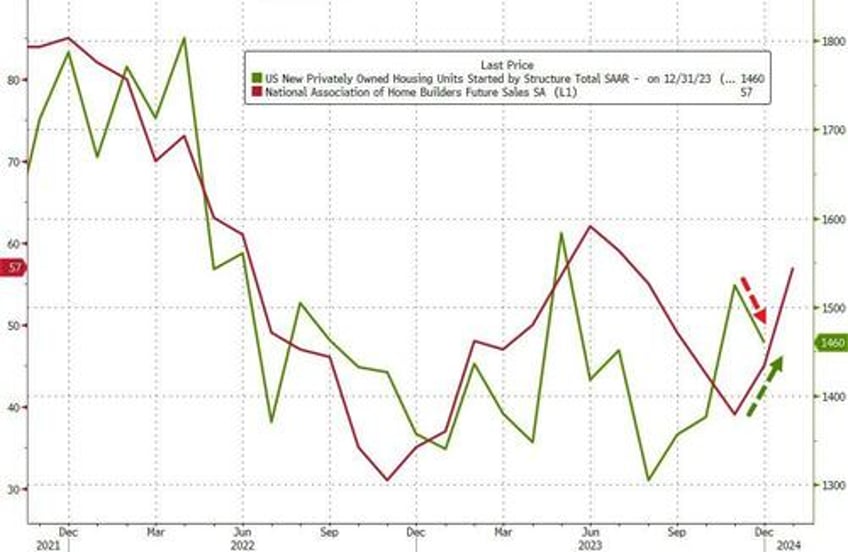

Perhaps the optimism among homebuilders about future sales is a little overdone given their actions?

Source: Bloomberg

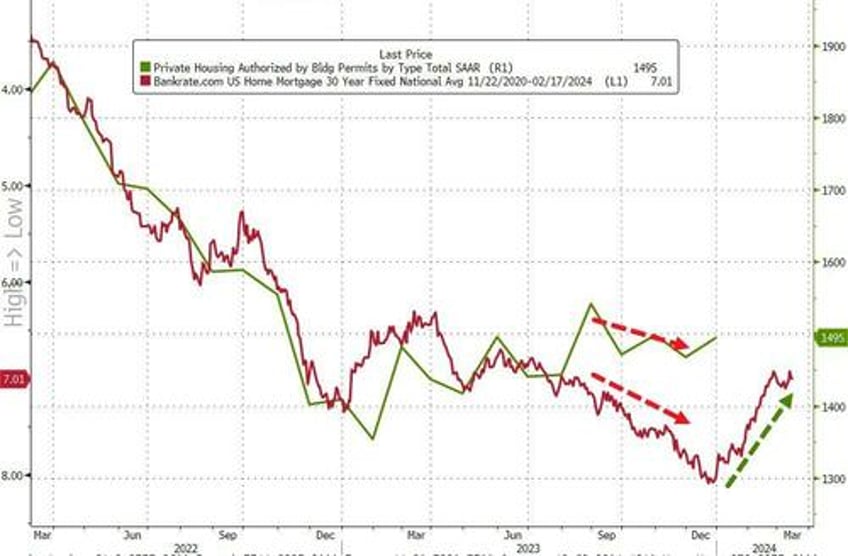

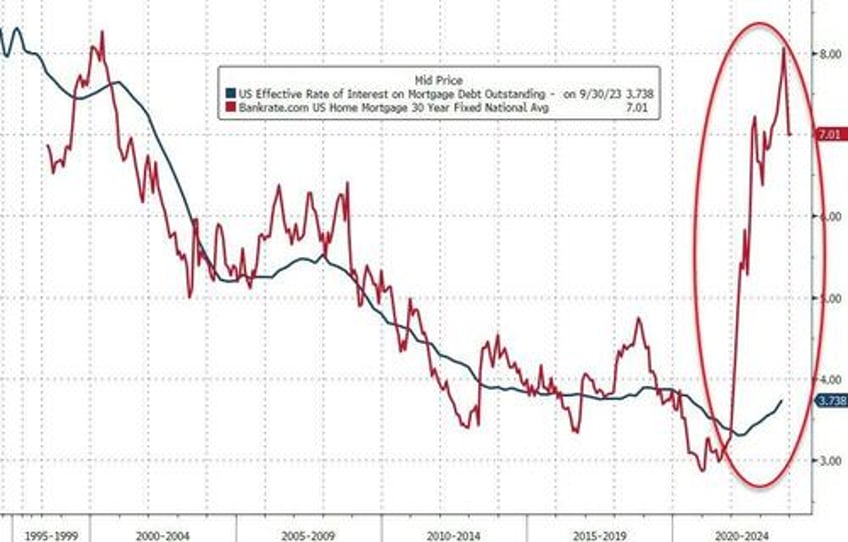

And why would starts be down so much if rates are tumbling?

Source: Bloomberg

Still along way to go for mortgages to be affordable...

Source: Bloomberg

Will less supply of new homes do anything to help the Shelter component of CPI (hint - no!).