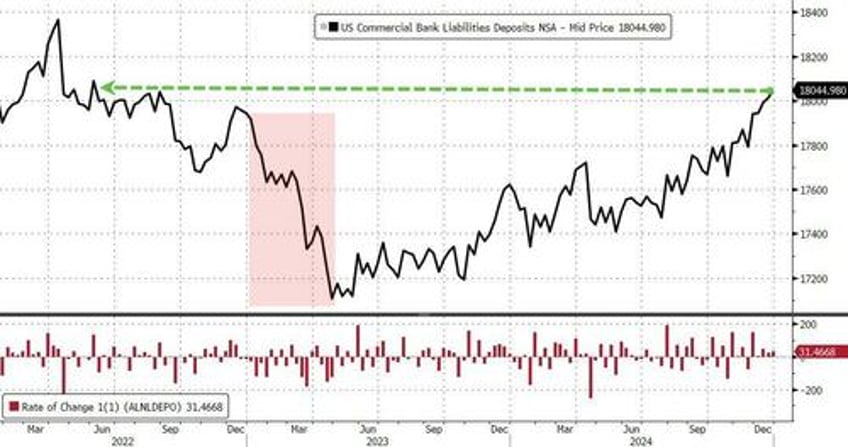

Money market assets surged again in the last week of 2024 to a new record high of $6.848 trillion and at the same time money flowed into bank deposits for the fifth straight week, recovering all the outflows from the SVB crisis...

Source: Bloomberg

On a seasonally-adjusted basis, banks saw $58.5BN of deposit inflows (after 3 weeks of outflows)...

Source: Bloomberg

On a non-seasonally-adjusted basis, banks benefited from a 5th straight week of deposit inflows (+$31.5BN in the last week of 2024), heading back up near record highs...

Source: Bloomberg

However, under the hood, excluding foreign deposits, Small Domestic Banks saw sizable outflows into Christmas (as Large Domestic Banks saw inflows)...

Source: Bloomberg

On the other side of the ledger, both small and large bank loan volumes shrank in the last week of the year...

Source: Bloomberg

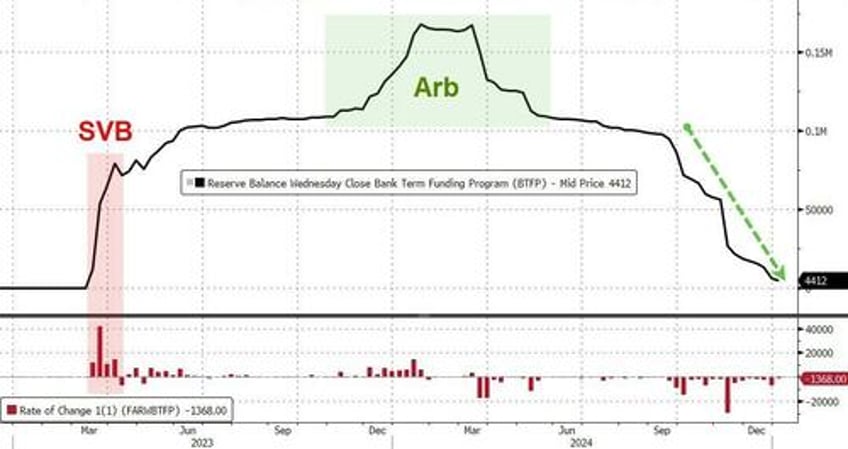

Additionally, The Fed's bank bailout facility is almost (for all intent and purpose) fully reversed after this week's decline with only $4.4BN outstanding (down from the peak $168BN)...

Source: Bloomberg

Perfect timing for another banking crisis bailout right as Trump takes office.