Following US Manufacturing PMI's disappointing decline in December, US Services PMI was expected to rise in December and it did, with the final print of 51.4 (up from the flash 51.3 and 50.8 in November).

Source: Bloomberg

The 'soft' services sector survey is the strongest since July 2023 - as 'hard' data plumbs 2023 lows.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

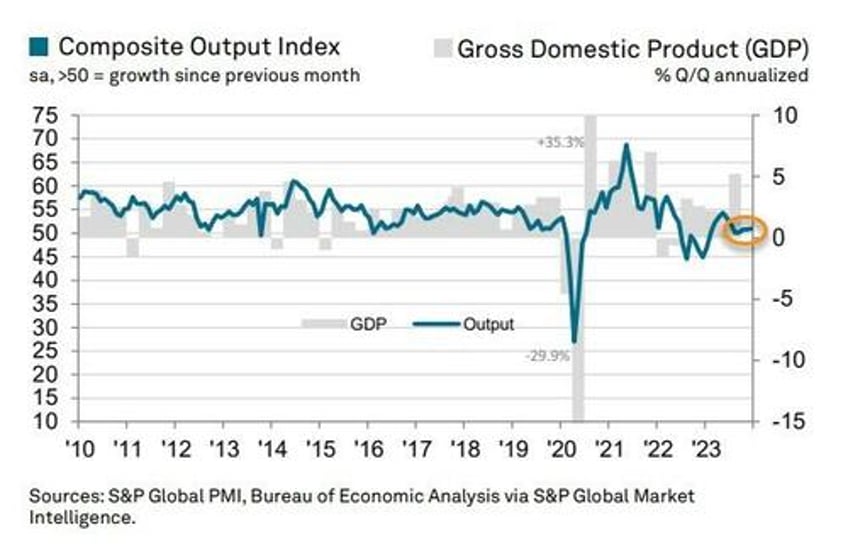

"Some New Year cheer is provided by the PMI signalling an acceleration of growth in the vast services economy, which reported its largest rise in output for five months in December. The improvement overshadows a downturn recorded in manufacturing to indicate that the overall pace of US economic growth likely accelerated slightly at the end of the year.

"Some support to financial services in particular is coming from the recent loosening of financial conditions amid growing hopes of interest rate cuts in 2024. Growth nevertheless remains subdued by standards seen over the spring and summer, with the struggling manufacturing sector dampening demand for business-to-business services and consumers remaining far less inclined to spend on luxuries such as travel and recreation than earlier in the year.

"The more challenging demand environment has dampened firms’ pricing power, squeezing service sector selling price inflation to the lowest for over three years on average during the fourth quarter. With sticky service sector inflation being a key area of concern among Fed policymakers, the slower rate of price increase in December is welcome news."

However, at the composite level, on the price front, total input costs rose at a sharper rate in December as operating expenses at manufacturers and service providers increased at faster paces.

So - take your pick - cut rates because manufacturing recession or cut rates to keep the Services sector soaring? Because it's an election year and we can't be hiking right?