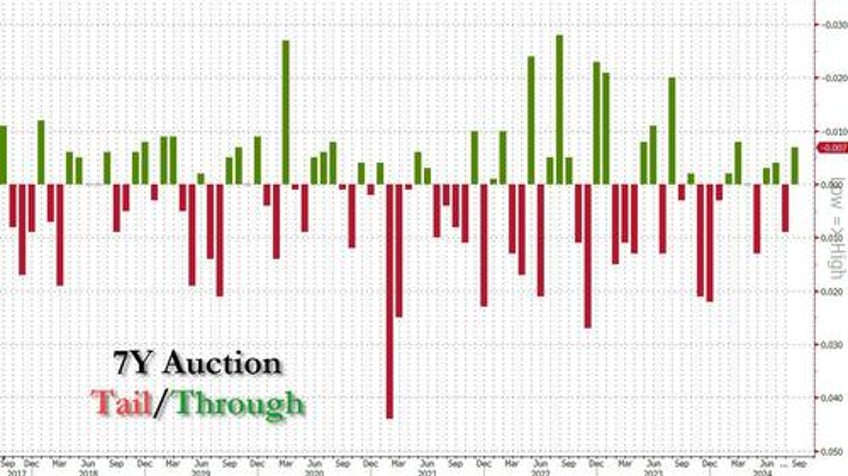

After two coupon auctions which stopped on the screws, moments ago we had a belly-busting 7Y auction which was also the strongest auction of the week. The Treasury sold $44 billion in 7Y paper in a solid auction, pricing at a high yield of 3.668%, down from 3.770% last month, and stopping through the When Issued 3.67% by 0.7bps, a reversal to the 0.9bps tail last month.

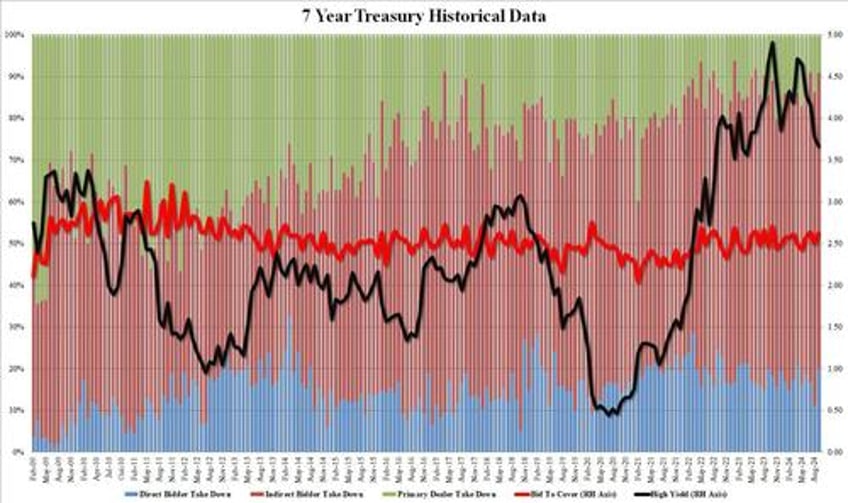

The bid to cover was 2.628, up from 2.50 in August, and above the six auction average of 2.54, otherwise it was almost smack in the middle of the very narrow range centered around 2.50 over the past decade.

The internals were average, with Indirects taking down 70.8%, the lowest since June if just above the six-auction average of 70.1%. And with the Directs take downjumping to 20.3%, from 11.2%, Dealers were left holding just 8.9%, a drop from 13.7% last month, and one of the lowest on record.

Overall, this was a solid, if not stellar, 7Y auction and one which clearly took advantage of the concession in today's modest selloff which pushed yields near session highs ahead of the auction deadline.