In the week's only coupon auction, moments ago the Treasury sold $16bn in 20Y paper in a solid auction.

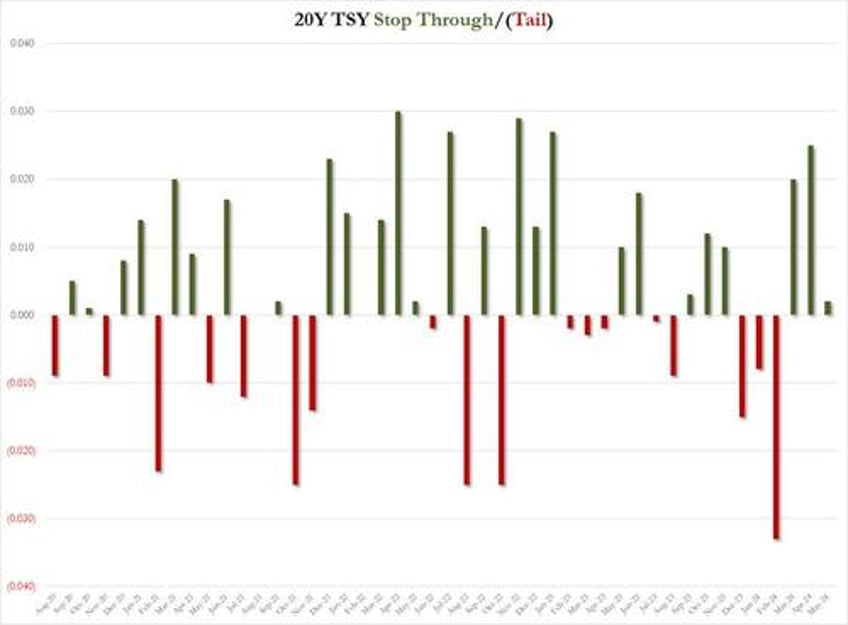

The high yield of 4.635% was down from last month's 4.818% and also stopped through the When Issued 4.637% by 0.2bps, the third consecutive non-tailing auction in a row.

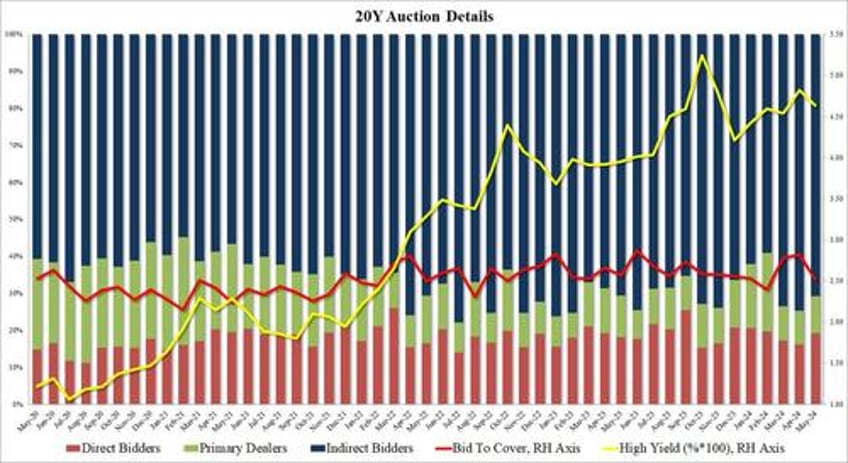

The bid to cover was on the light side, dropping to 2.51 from 2.82 in April and below the six-auction average of 2.61.

The internals were solid with Indirects awarded 70.8%, above the recent average of 68.3% but the lowest since February (April was 74.7%). And with Directs taking down 19.2%, the most since February, Dealers were left holding 10.1%, also the most since February.

Overall this was a solid if hardly spectacular auction, and predictably there was virtually no market reaction, with the 10Y trading unchanged at 4.42% on the results.