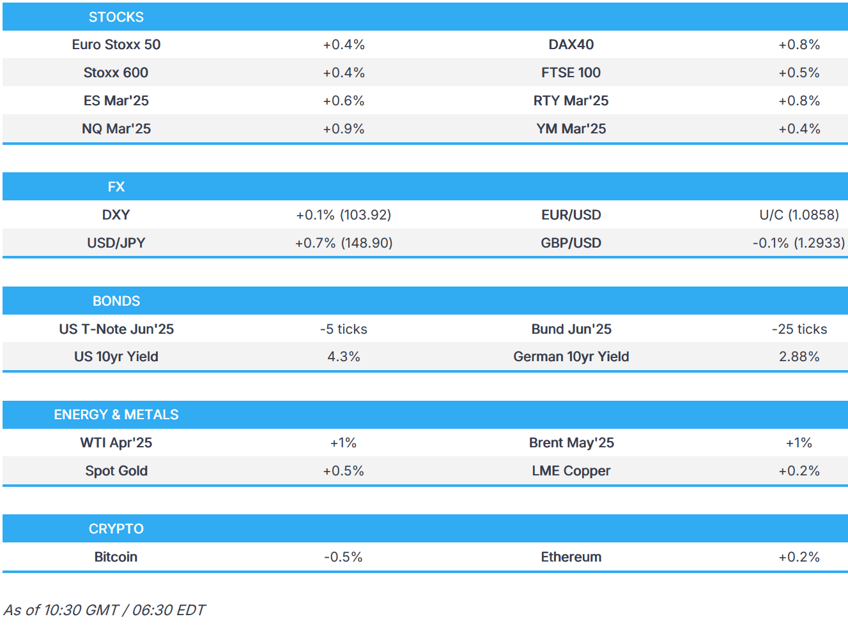

- Stocks gain with sentiment lifted after a strong Chinese session overnight and after the recent market turmoil.

- USD mixed vs. peers, GBP soft post-GDP, JPY weighed on by Rengo data, which showed average wage hike less than demands.

- Gilts gap higher on soft growth data while JGBs lift on Rengo.

- Spot gold makes a fresh record high above USD 3,000/oz; crude oil and base metals benefit from the risk tone.

- Looking ahead, US UoM Survey, Trump executive orders, Fitch to review France; US Government Funding Expires.

Newsquawk in 3 steps:

Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- Canada's Finance Minister LeBlanc said they agreed to continue discussions in the meeting with US Commerce Secretary Lutnick, while they have been clear that they will not reopen USMCA provisions on dairy and didn't discuss that with Lutnick.

- Canada's Industry Minister Champagne said there was a mutual understanding that there is an impact on both sides of the border from tariffs and they talked about issues around economic security and national security with US Commerce Secretary Lutnick. Furthermore, they talked about Canadian aluminium steel and how they can help the US

- Ontario's Premier Ford said they had a productive meeting with US Commerce Secretary Lutnick and will have another meeting next week, while he feels temperatures are decreasing and said it was the best meeting they had since tariff talks began.

- ECB President Lagarde said US President Trump's policy decisions cause concern and warned trade conflict will damage the worldwide economy, according to an interview with BBC.

EUROPEAN TRADE

EQUITIES

- European bourses are mostly firmer, in what has been a choppy session thus far; initial weakness at the cash open has been entirely pared with indices generally towards the top end of the day's ranges.

- European sectors hold a slight positive bias; Basis Resources tops the pile, buoyed by strength in the metals complex, amid the risk sentiment and strong Chinese price action overnight. Media is found at the foot of the pile. Consumer Products is also higher today, benefiting from the strength in Chinese trade overnight; though Kering (-13%) slips after appointing Demna as Gucci's artistic director, a move JP Morgan brands as "controversial".

- US equity futures (ES +0.7%, NQ +1%, RTY +1%) are entirely in the green, after the S&P 500 slipped into a technical correction; sentiment overnight benefited from remarks by China's financial regulator who said financial institutions should boost financial support for consumption and will provide loan renewal support to eligible personal consumption loan borrowers.

- Foxconn (2317 TT) says it continues to see strong demand for AI servers.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is flat after trading firmer for most of the European morning; now currently towards the lower end of a 103.79-104.09 range. Trade updates on Thursday included President Trump noting he will not change his mind on the April 2nd tariffs. As for US Government shutdown developments, things seem to be improving with US Senate Minority Leader Schumer suggesting he will vote to keep the government open and not shut it down. Focus ahead will be on the US UoM survey and then Trump executive orders thereafter.

- EUR is firmer and trading towards the upper end of a 1.0831-1.0875 range. There has been little by way of trade updates, after Trump threatened the EU with 200% tariffs on alcoholic products on Thursday, if the EU do not remove their countermeasures on the US. Focus today will be on any potential updates on German spending plans, after the debate in the prior session - Reuters reported that Germany's CDU/CSU is to hold a special parliamentary faction meeting this afternoon - a report which may be attributed to the modest upside in the Single-Currency; elsewhere, focus will be on a Fitch credit review on France.

- JPY is the clear underperformer today, with early morning losses facilitated by the risk-on mood; have peer CHF is also a touch softer. Further pressure was seen after Japan's largest labour union, Rengo, said the first-round data shows an average wage hike of 5.46% in FY25 (demand of 6.09%). There spurred some further pressure in the JPY, with USD/JPY lifting from 148.65 to briefly top 149.00.

- GBP is subdued in reaction to the regions softer than expected GDP figures, which saw the UK unexpectedly contract in January; the downside was primarily driven by a slowdown in manufacturing. However, such an outturn was not entirely unexpected given the jump seen in December's release. Money market pricing incrementally moved dovishly, and is ultimately unlikely to have too much of an impact for the BoE as it remains focussed on inflation and other price points. Cable saw some modest downside on the release, and currently trades towards the lower end of a 1.2918-59 range.

- Antipodeans are the best performing G10 currencies today, benefiting from the positive risk tone, which was lifted by remarks by a China's financial regulator who said financial institutions should boost financial support for consumption and will provide loan renewal support to eligible personal consumption loan borrowers.

- PBoC set USD/CNY mid-point at 7.1738 vs exp. 7.2463 (Prev. 7.1728).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs hold a slight downward bias, in-fitting peers; currently sitting in a 110-24 to 110-31 range. Some of the bearish action stems from the positive risk tone, as well as a weaker-than-average 30yr auction on Thursday. Trade updates on Thursday included President Trump noting he will not change his mind on the April 2nd tariffs. As for US Government shutdown developments, things seem to be improving with US Senate Minority Leader Schumer suggesting he will vote to keep the government open and not shut it down. Focus ahead will be on the US UoM survey and then Trump executive orders thereafter.

- Bunds are on the backfoot by around 12 ticks, and currently just off the day's trough at 127.15. As above, pressure stems from the risk tone and as markets digest the latest Trump threats on the EU (200% tariffs on alcohol, should the EU not remove their countermeasures). For Germany, Wholesale Prices jumped Y/Y whilst German inflation figures were revised a touch lower. And on German spending, updates have been light thus far CDU/CSU is to hold special parliamentary faction meeting this afternoon, according to Reuters sources, Scheduled EU-specific events are light for the remainder of the day, but focus will be on Fitch's credit review on France.

- Gilts are flat but still outperforming today, with gains facilitated by the softer-than-expected UK GDP figures, which saw the UK surprisingly contract in January. A softer print than the market had been looking for, driven primarily by a slowdown in manufacturing. However, such an outturn was not entirely unexpected given the jump seen in December's release. Gilts are flat, but have held a downward bias in-fitting with peers; currently in a 91.67-92.03 range.

- JGBs are modestly higher as Japanese paper reacted to the latest Rengo update, with initial data pointing towards 5.46% avg. wage hike vs demands of 6.09%. Initial hawkish reaction as it highlights the continued wage pressures in the region, but this proved short-lived as it was less than initial demands.

- Click for a detailed summary

COMMODITIES

- Crude is on a firmer footing with WTI and Brent currently higher by around USD 0.74/bbl and USD 0.70/bbl respectively. Upside today stems from a paring of the prior day's losses and in tandem with the pick up in sentiment. On Russia/Ukraine, Russian President Putin supported the idea of a ceasefire but stressed that the ceasefire must lead to a final settlement of the conflict and solve the root causes of the conflict. More recently, Russia's Kremlin said it held late night talks with US Envoy Witkoff; Russia and the US will determine a timing of Russian President Putin/Trump call once Witkoff has briefed Trump. Brent'May currently in a USD 70.00-70.75/bbl range.

- Spot gold is on a firmer footing, and has made a fresh ATH just above the USD 3k mark. ANZ sets its short-term price target of USD 3,050/oz.

- Base metals are entirely in the green, with the complex boosted by the risk tone and support measure commentary from China overnight.

- Russian Deputy Prime Minister Novak says global oil demand will rise during driving season and OPEC+ takes this into account; resumption of gas exports to Europe via Nord Stream pipelines is irrelevant for now. No talks about possible resumption of Russian oil exports to Germany via the Druzhba pipeline.

- Qatar lowered the May term price for Al-Shaheen crude oil to USD 1.29/bbl above Dubai quotes.

- Russian President Putin and Saudi Arabia's Crown Prince MBS discussed cooperation in OPEC+, as well as US-Russia ties and the Ukraine conflict.

- US President Trump’s administration unlocked a USD 4.7bln loan for TotalEnergies (TTE FP)

- Click for a detailed summary

NOTABLE DATA RECAP

- UK GDP Estimate MM (Jan) -0.1% vs. Exp. 0.1% (Prev. 0.4%); 3M/3M (Jan) 0.2% vs. Exp. 0.3% (Prev. 0.1%); YY (Jan) 1.0% vs. Exp. 1.2% (Prev. 1.5%)

- French CPI (EU Norm) Final MM (Feb) 0.1% vs. Exp. 0.0% (Prev. -0.2%); YY (Feb) 0.9% vs. Exp. 0.9% (Prev. 0.9%)

NOTABLE EUROPEAN HEADLINES

- Germany's CDU/CSU to hold special parliamentary faction meeting this afternoon, according to Reuters sources

- Goldman Sachs cuts its UK 2025 GDP growth forecast to 0.9%, down from 1.0% previously.

- DIW institute says the German economy is expected to stagnate in 2025, down from the previously expected growth of 0.2%; economy expected to grow by 1.1% in 2026, down from the previously expected 1.2%

- BoE/Ipsos Inflation Attitudes Survey - February 2025. Median expectations of the rate of inflation over the coming year were 3.4%, up from 3% in November 2024.

- UK PM Starmer reportedly suffered a cabinet uprising over planned welfare and public spending cuts, but insisted tough choices are needed and said he will not bend fiscal rules to allow more borrowing, according to FT.

- EU Diplomatic Service proposes that member nations deliver military aid to Ukraine in 2025 worth at least EUR 20bln and potentially up to EUR 40bln, via Reuters citing a paper; aid to be provided in line with nations economic "weight".

- ECB's Villeroy says will be inflation to 2% this year in Europe; EU has the resources to retaliate against the US admin tariffs on wine and liquor.

- EU Envoys agree to remove three individuals from the sanctions list, agree to renew sanctions on more than 2400 individuals and entities.

NOTABLE US HEADLINES

- US President Trump is to sign executive orders on Friday at 12:00EDT/16:00GMT.

- US Vice President Vance said can never predict the future but thinks the economy is strong when asked if he could rule out a recession, according to a Fox News interview,

- US Treasury Secretary Bessent said they hopefully won't get a recursive 'Biden-flation' and said they are very vigilant and it could happen again. Bessent added that before they can bring down inflation, they also want to help affordability and as they bring down inflation, they want to bring the absolute price level down through deregulation and bringing down interest rates for house payments and car payments.

- US Senate Minority Leader Schumer said he will vote to keep the government open and not shut it down. It was separately reported that multiple US Democratic Senators and aides indicated sufficient Democratic support for cloture on the House-passed continuing resolution in Friday morning’s vote, according to Punchbowl.

GEOPOLITICS

MIDDLE EAST

- Israel's Channel 12 quoted an Israeli source stating if there is no progress in negotiations within the next two days, the team will return to Israel, according to Al Jazeera.

- US and Israel look to Africa for resettling Palestinians uprooted from Gaza, according to AP.

- UN Security Council agreed to the Russia and US-drafted statement condemning widespread violence in Syria's Latakia and Tartus, while the statement called for Syria's interim authorities to protect all Syrians, regardless of ethnicity or religion and to hold the perpetrators of the mass killings accountable.

RUSSIA-UKRAINE

- Russia's Kremlin says it held late night talks with US Envoy Witkoff, conveyed signals to US President Trump via Witkoff, Russia and the US will determine a timing of Russian President Putin/Trump call once Witkoff has briefed Trump. There are grounds for cautious optimism. Both sides understand there is a need for such a call. Putin got information from US Envoy on US thinking on Ukraine. Putin is in solidarity with Trump's position but there is a lot of work to do

- Ukraine Foreign Minister says the nation has begun forming a team to develop ways to control a possible ceasefire.

- EU Foreign Policy chief Kallas said she is quite optimistic G7 can reach accord on a joint communique and if they cannot agree on G7 communique, it shows division between member countries. Kallas also said it is most likely that Russia will say yes to the US proposal for a ceasefire with Ukraine but with conditions and the US is telling G7 members they understand the Russians may want to extend the process by blurring the picture. Furthermore, she said the red line is Ukraine giving away territory and that territorial integrity is an important element, as well as noted that without the EU, any deal cannot be implemented because there are elements for which Europe has the card.

- Saudi Crown Prince MBS and Russian President Putin spoke on the phone and the Saudi Crown Prince affirmed the kingdom's commitment to exerting all efforts to facilitate dialogue and achieve a political solution to the Ukraine crisis.

OTHER

- Senior officials from China, Iran and Russia hold talks in Beijing over Iran's nuclear issues, according to CCTV.

- US Pentagon has been tasked with providing military options to ensure US access to the Panama Canal, according to CNN.

- US President Trump said they are going to have to make a deal on Greenland and thinks the annexation will happen, while he added the US is going to order 48 icebreakers.

CRYPTO

- Bitcoin is a little lower today, unable to benefit from the risk tone; currently around USD 82.7k.

APAC TRADE

- APAC stocks were mostly positive as risk sentiment gradually improved following the negative lead from Wall St where the S&P 500 slipped into a technical correction amid tariff concerns after President Trump threatened 200% tariffs on EU wine and champagne.

- ASX 200 gained as strength in mining, materials, resources and utilities atoned for the losses seen in the energy, financials and tech industries.

- Nikkei 225 staggered at the open with pressure from recent currency strength but then recovered soon after as the yen steadily pared its recent gains.

- Hang Seng and Shanghai Comp advanced with the Hang Seng resuming the outperformance which has helped the index notch gains of around 22% so far this year, while the PBoC reiterated support pledges and stated that it will lower rates and the RRR at a 'proper time', keep liquidity ample and guide social financing costs lower.

NOTABLE ASIA-PAC HEADLINES

- China's financial regulator said financial institutions should boost financial support for consumption and will provide loan renewal support to eligible personal consumption loan borrowers.

- DeepSeek is focusing on research over revenue and customers from sectors such as healthcare and finance bought API access to DeepSeek’s R1 and V3 models. Furthermore, DeepSeek's founder declined to entertain interest from China’s tech giants and venture and state-backed funds to invest in the group for the time being, while it may find limited access to NVIDIA's (NVDA) new generation of more advanced chips a potential bottleneck in the long run and could consider future partnerships that can help solve this issue, according to FT citing sources.

- Rengo, Japan's largest labour union, says first-round data shows average wage hike of 5.46% in FY25 (demand of 6.09%); initial wage hike exceeds 5% for the second straight year.

- Chinese regulators have issued a requirement for the labelling of AI generated content.

- China Feb YTD Aggregate Financing (CNY) 9.29tln (exp. 9.757tln); M2 Money Supply 7% (exp. 7%); New Yuan Loans 6.14tln (exp. 6.38tln)