Spot Gold prices spiked above $2185 this morning on the jobs data - a new record high for the precious metal - dipped back lower... then saw another wave of buying to lift it to another record high at $2195...

Source: Bloomberg

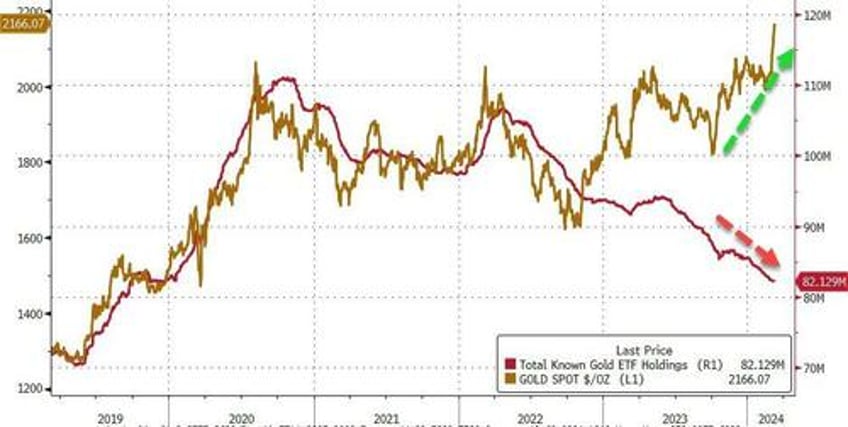

As we detailed previously, in recent years the swing buyers have been ETFs, which hold about 2,500 tonnes of gold. But ETF holdings have been falling even as the dollar price of gold has been rising...

Source: Bloomberg

...and, as Peter Schiff recently noted, the real driving force behind gold's price increase appears to be foreign central banks, which have been significant buyers of the metal.

This shift towards gold by central banks is seen as a strategic move away from holding U.S. dollars, signaling a broader trend of de-dollarization among global financial institutions.

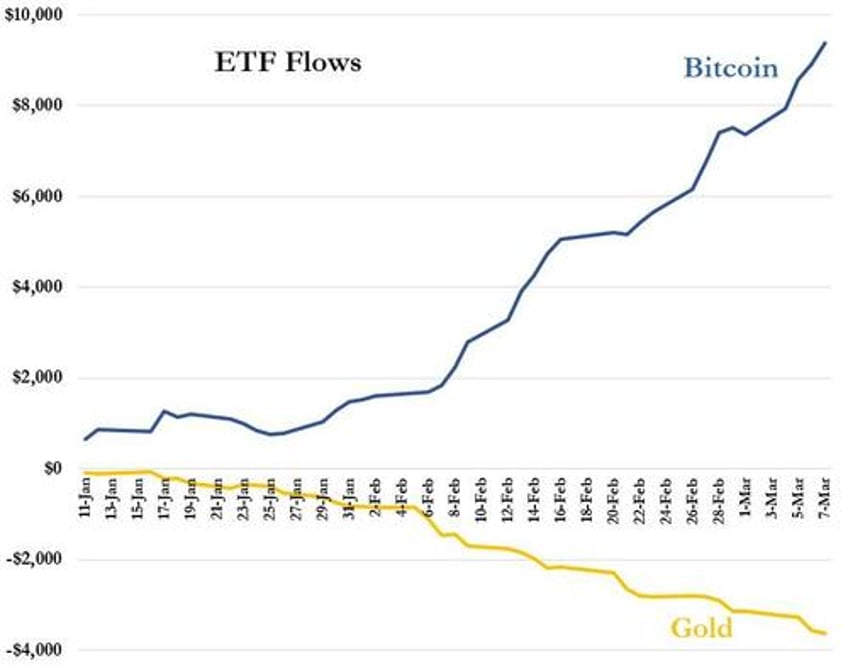

These developments come at a time when retail interest has been diverted towards more speculative investments like cryptocurrencies, overshadowing traditional safe havens like gold.

However, should retail investors start to show renewed interest, filling that gap would mean ETFs would have to source almost 40mm oz of gold?

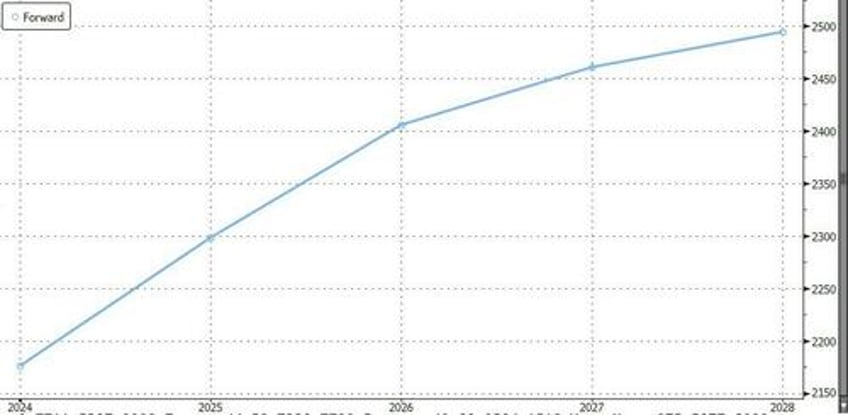

With the Fed still poised to cut interest rates as 2024 unfolds, the longer-term outlook is perhaps a more interesting topic, with the forward curve trending toward $2,500/oz...

As Bloomberg's Jake Lloyd-Smith remarked, there could be more life yet in the barbarous relic, as John Maynard Keynes once called gold.

What is gold pricing in about future Fed action? Real rates dramatically negative? As Luke Gromen noted on X:

"When gold rises in your currency DESPITE positive real rates, the gold market is saying 'Your government will have a debt spiral if real rates remain positive'."

With all-time highs for gold, incoming interest rate cuts, and more war on the horizon, 2024-2025 could be the time when the fiat chickens finally come home to roost for good.

Ron Paul recently offered a sliver of hope, imploring freedom lovers not to become too complacent or demoralized to continue the fight:

“We must continue our efforts to reach a critical mass of people with the message of liberty while making plans to ensure our families can take care of themselves when the next crash occurs.”

From the ashes of fiat money, we will have a unique chance to create a new society where sound money policies have a better chance than ever to take political hold - and, slowly but surely, repair the moral fiber of a society destroyed by endless war and overstretched welfare that are only possible with infinite debt to fund them.