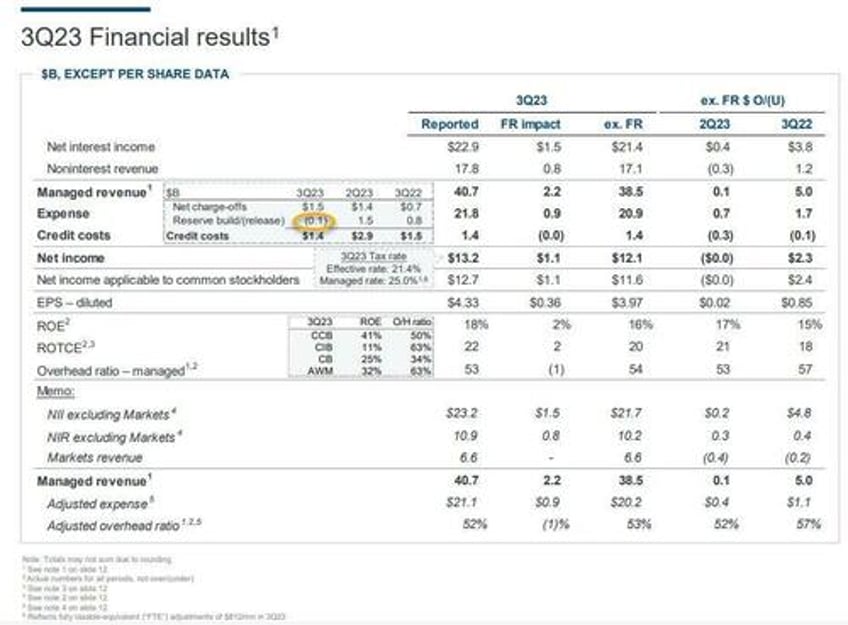

There was a big surprise this morning in JPM's earnings report: as we noted earlier in our post-mortem, JPM reported $1.497 billion in net charge-offs, citing primarily the adverse impact of credit-card loans, and yet the total provision for credit losses was lower, at $1.38 billion.

This is strange since normally this number is higher than the total amount of charge-offs, and is only lower when the bank releases from loan loss reserves to boost earnings (the opposite of what it does when it build reserves in anticipation of a credit crunch).