Top Stocks to Watch into July OPEX

See the Top 3 PLUS get the FULL LIST of 50 stocks to watch, identified by the SpotGamma algorithm

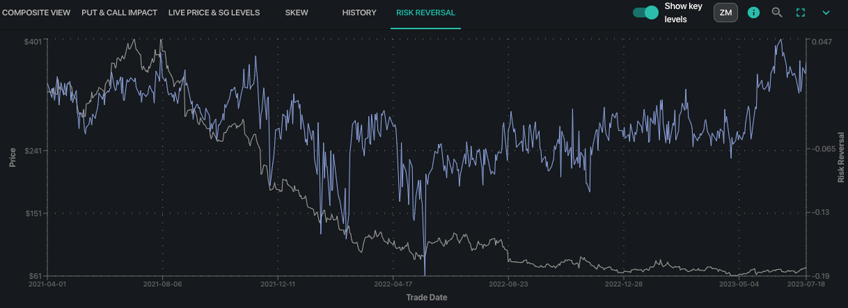

Bullish: Zoom (ZM)

ZM is up >8% for July, after struggling to break higher for the past several months. Recently, call buyers have been stepping in, which has shifted our key levels higher – but also elevated call skew. Further, +40% of gamma and +80% of delta is set to expire with Friday expiration. OPEX may therefore result in a short term pause, or reversion in the stock which may present a buying opportunity.

- Call Wall / Put Wall: The ZM Call Wall has been at $75 for several days, and the stock is now approaching this resistance level. $70 is major support.

- Skew/Risk Reversal: The elevated skew suggests that call prices are rich relative to recent history.

- Trade Structures: Calendar Spread: Selling the 7/28 exp, 78 Calls to buy 8/18 exp 85 strike calls, for even money.

This trade benefits from a short term correction/consolidation, but profits if equity bullishness continues into August.

Bearish: SPY

The market has been on fire for the month, which has resulted in the S&P gaining ~5% MTD & ~20% YTD. However, our data shows that the S&P500 tends to mean revert after options expirations. This implies that bullish moves may fade around expiration, as large call positions are removed.

- Call Wall / Put Wall: Our major levels have been clustering in the 4,500 range.

- Volatility Trigger: The Vol Trigger, our Gamma flip point, remains down near 4,400 which is our critical support line.

- Trade Structures: With implied volatility being very low, we look at buying short dated slightly out of the money put spreads. In this case we look at the July 31st, 450/440 Put Spread for $1.00, with an IV of 11%.

Should the market decline this trade should benefit from both increasing delta, and higher implied volatility.

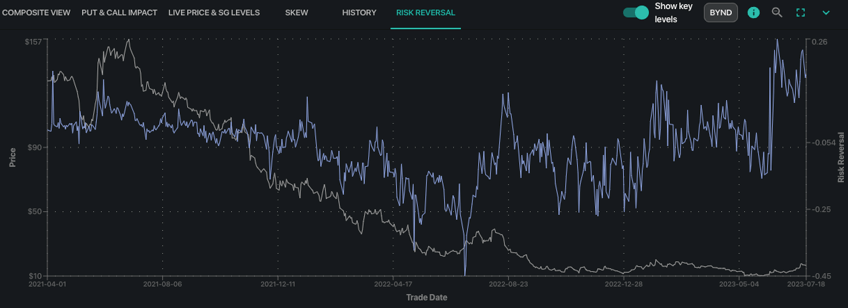

Neutral: BYND

“Fake meat” is +40% for the month to $17, but has been range bound between the $10-20 levels for the last several months. BYND posts earnings on 8/4 which should keep longer term IV’s elevated.

- Call Wall / Put Wall: The $15 strike has been significant for the stock, and is currently the strike with the largest Gamma.

- Hedge Wall: Our Hedge Wall, a key support level, is at $14.

- Trade Structures: We like the July 28th 18 x 15 x 5 broken wing put fly for ~$1.

This trade profits if the stock moves lower and IV comes down.

See the Top 3 PLUS get the FULL LIST of 50 stocks to watch, identified by the SpotGamma algorithm

Stocks into Expiration

Stocks often can have meaningful price action heading into monthly options expirations. At SpotGamma, we look for stocks where options have the largest amount of price impact, based on the removal of near term options positions.

Specifically, we often see the biggest moves and also gravitation toward a key SpotGamma level based on the amount of outstanding Gamma. Gamma is highest for options which are at-the-money, and increases as time approaches expiration, leading to changes in hedging activity.

Importantly, we believe that three of our proprietary levels (Call Wall, Put Wall, and Absolute Gamma Strike) are very interesting to watch relative to these names (see Legend, below).

By evaluating names with the largest options impact, and seeing where they are relative to SpotGamma key levels, you can get a trading edge.