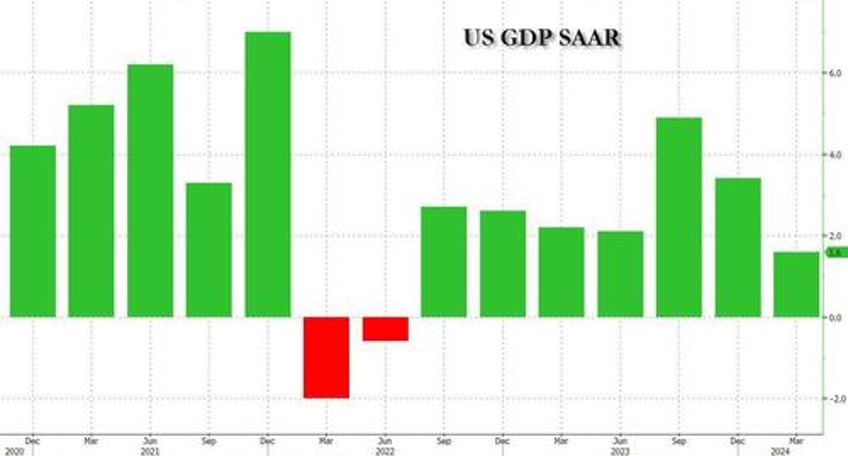

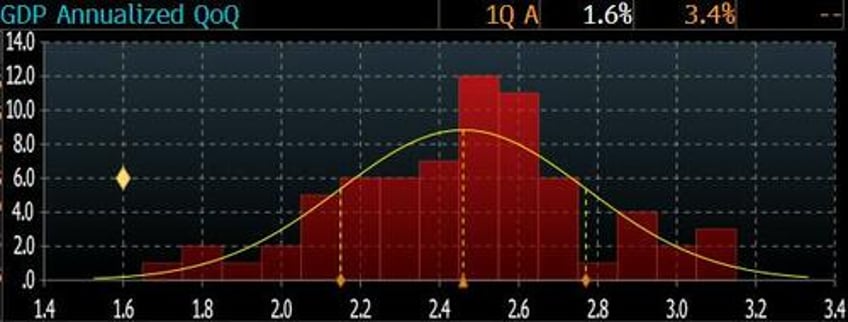

If the Biden admin was to have any hopes of the Fed cutting rates and monetary easing ahead of the election, the tires would need to start falling off the US economy right... about... now... Which is why we didn't find it at all surprising that moments ago the Biden Bureau of Economic Analysis reported that in Q1, US GDP unexpectedly collapsed to just 1.6%, down more than 50% from the Q4 print of 3.4% and a huge miss to the 1.6% estimate.

Almost as if on purpose, the GDP printed below the lowest estimate (that of SMBC Nikko) which was at 1.7% (the highest forecast was 3.1% from Goldman Sachs which was off by the usual 50%).

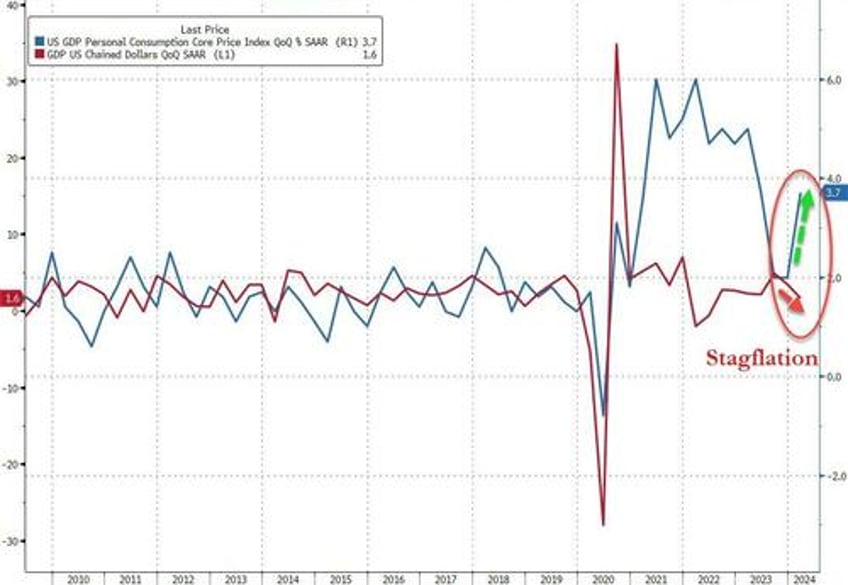

But while a collapse in the US economy is just what the "soft landers" wanted, the huge GDP miss was just half the story because at the same time, the BEA reported that the GDP Deflator (price index) came in at 3.1%, hotter than the 3.0% expected and almost double the 1.6% in Q4. Worse, the all important core PCE for Q1 soared from 2.0% to 3.7%, blowing away estimates of 3.4% (we will get a more accurate core PCE print tomorrow for the month of March) and suggesting that the US is about to not pass go, overshoot soft-landing island completely, and crash-land straight into a stagflationary recession...

... unless the Fed does something, although what it can do - with inflation rising and growth slowing - is anyone's guess.

Developing.