After four consecutive poor, tailing 3Y auctions, moments ago the Treasury reported the results of today's sale of $58BN in 3 year paper, and it was nothing short of stellar.

The high yield of 4.300% was down 3.2bps from last month's 4.332% and stopped through the When Issued 4.313% by 1.3bps, the first non-tailing 3Y auction since September.

The bid to cover was 2.786, a jump from last month's 2.626 and the highest since August 2023.

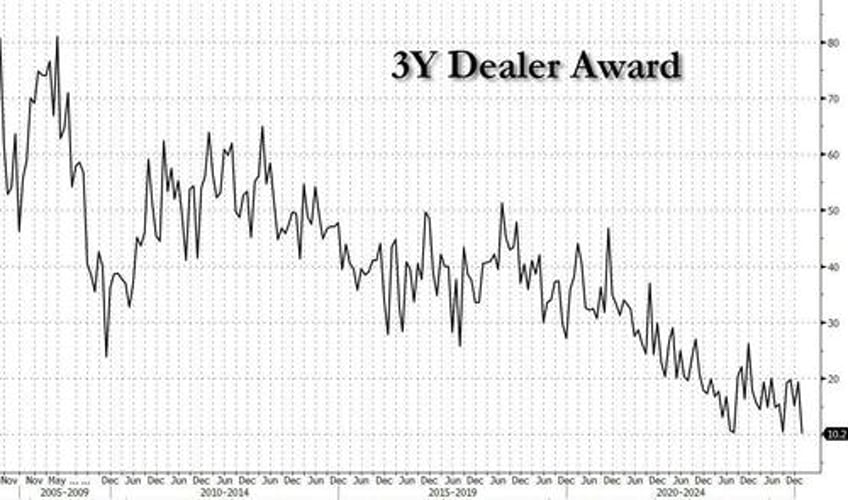

The internals were also stellar, with Indirects awarded 74.0%, the highest since last September. And with Directs taking 15.8%, Dealers were awarded just 10.2%, the lowest on record.

Overall, this was a stellar auction with impressive metrics up and down...

... even if the market barely budged in reaction with 10y yields trading just shy of the 4.54% session high.