After several mediocre auctions to close out the month of February, the first coupon auction of March just concluded when the Treasury sold $56BN in 3Y paper (while this was higher than the $54BN in February, it has another $2BN to go to surpass the covid record high of $56BN in 3Y paper sold in one auction) in what was a stellar auction.

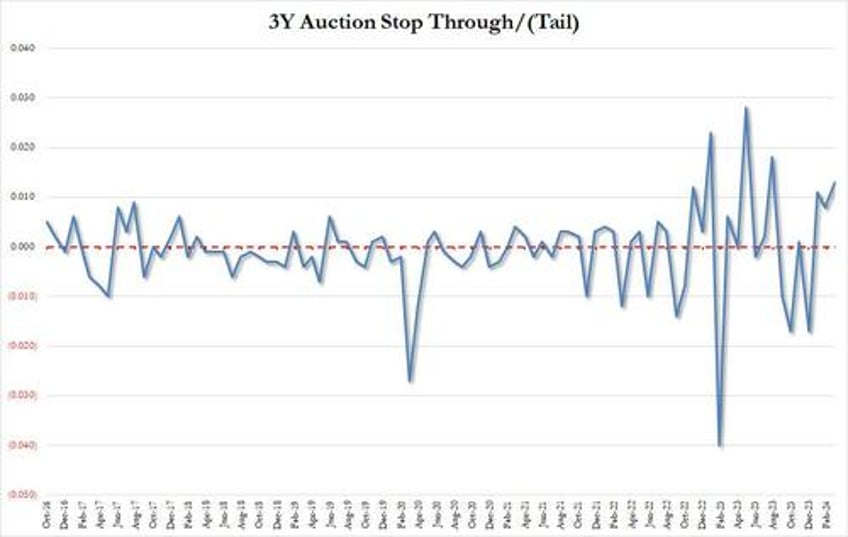

The high yield of 4.256% was above last month's 4.169%, but stopped through the 4.269% When Issued by 1.3bps, the biggest stop through since August 2023, and the 4th in the last 5 auctions.

The bid to cover was 2.604, above last month's 2.581 but just below the six-auction average of 2.608.

The internals were more solid, with Indirects awarded 70.0% of the auction allocation (up from 66.0% last month and well above the recent average of 60.3%, and with Directs taking down 15.6%, the lowest since May 2023, Dealers were left holding just 14.40%, which was the lowest since August 2023.

Overall, this was a very strong auction yet despite the impressive showing by foreign buyers, yields barely budged on the result and if anything we have seen a modest grind higher all day, with the 10Y trading at 4.09% last, about 1bps cheaper on the day vs the Friday close.