After one of the strongest 2Y auction on record, the streak of strong coupon sales extended for a second day and despite the continued plunge in yields, which dipped well below 4.30% at one point in the day, today's sale of $70BN in 5Y paper was flawless, and almost as strong as yesterday's auction.

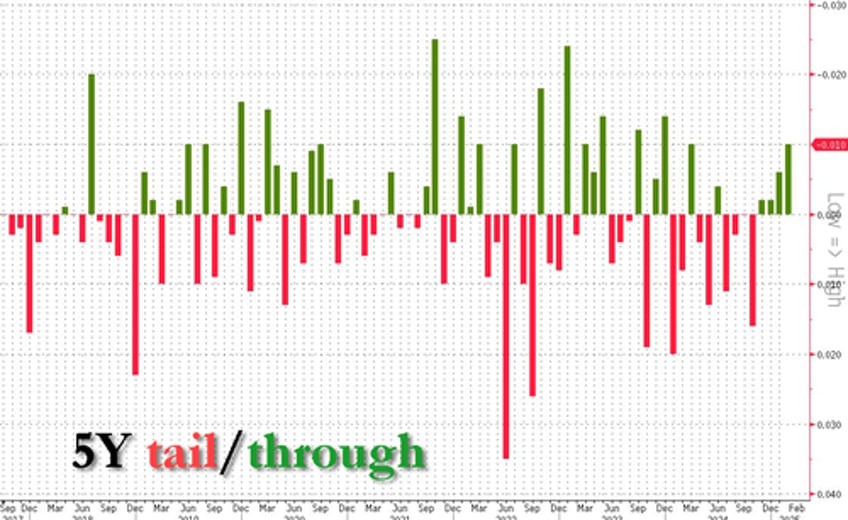

The auction stopped at a high yield of 4.123%, down 20bps from 4.330% last month and the lowest since Sept 24; it also stopped 1bps through the When Issued, the 4th consecutive stop through and the highest since December 2013.

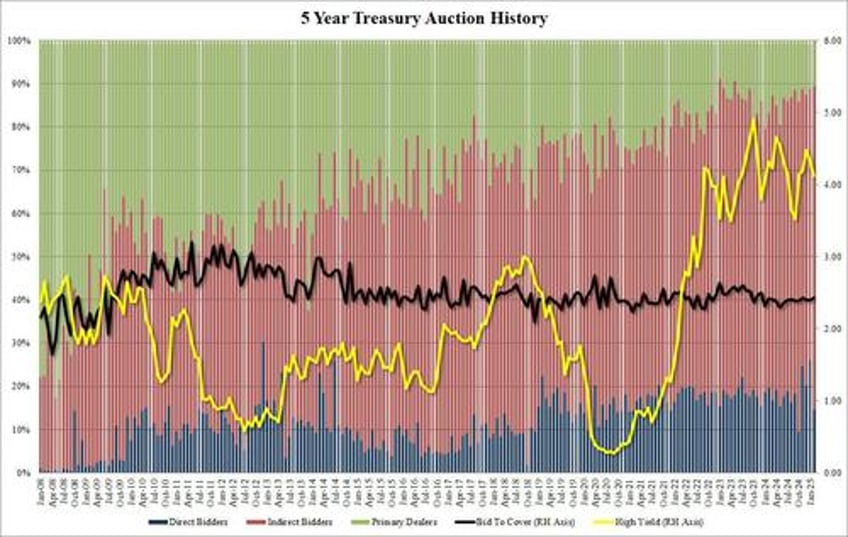

The bid to cover was fractionally better than last month, but for some bizarre reason this metric has completely frozen for the 5Y tenor as you can see here, with the final print barely moving month after month:

- July 24: 2.40

- Aug 24: 2.41

- Sept 24: 2.38

- Oct 24: 2.39

- Nov 24: 2.43

- Dec 24: 2.40

- Jan 24: 2.40

- Feb 24: 2.42

Finally, the internals were stellar, and while not quite as stellar as yesterday's 2Y which saw record foreign demand, Indirects still surged from 62.8% to 74.9%, the highest since October 2024. And with Directs taking 14.5%, Dealers were left with 10.6%, the lowest since May 2024.

And yet, another stellar coupon auction and... the market barely noticed for the second day in a row, with yields having already tumbled more than 10bps on the day as a result of the ongoing retail liquidation which has hammered stocks and pushed capital into the "safety" of bonds, which will remain safe at least until the Trump admin realizes - and admits - that it is facing an even bigger debt avalanche in the next 4 years. But we'll cross that bridge in due course...