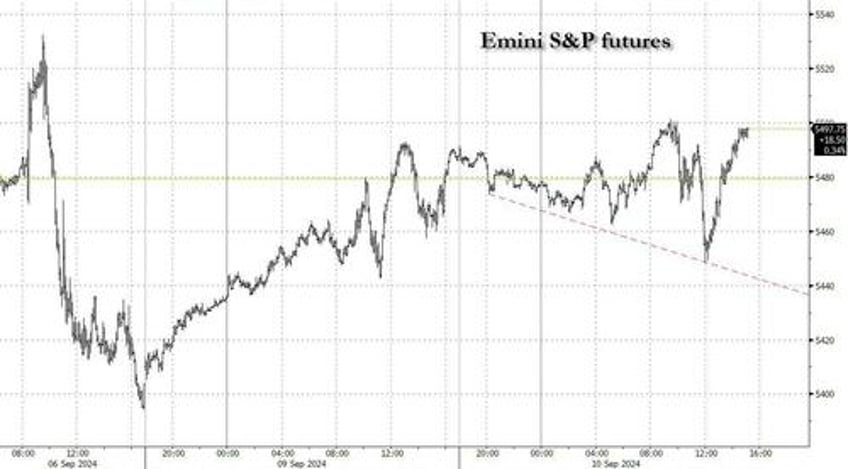

With both the presidential debate and CPI prints on deck, traders were not in an adventurous mood today, and after a rocky last few days of trading, where stocks first dropped 1.7% Friday only to rebound 1.2% on Monday, Tuesday saw a mini rollercoaster, as emini futures first dropped, then gained, only to slide to session lows after Europe closed, before recovering all losses and closing near session highs, and just around 5,500, a key psychological resistance level.

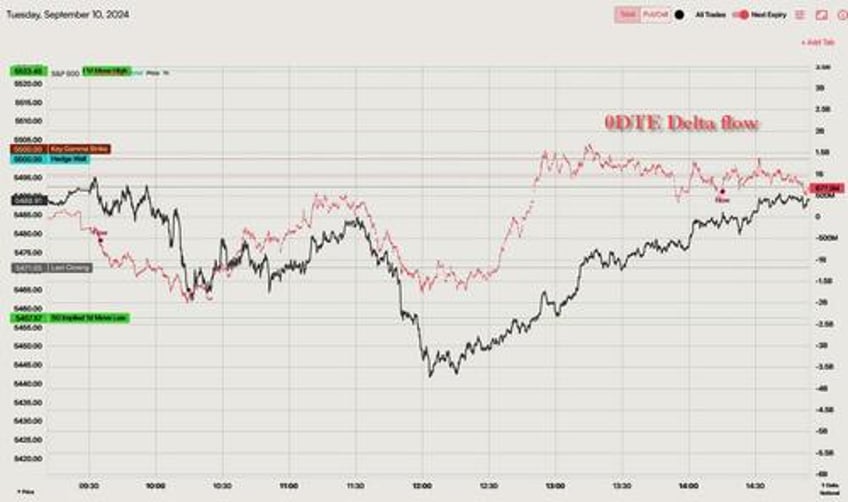

Today's moves were so phlegmatic that not even the 0DTE crew tried to move stocks much either way.

And speaking of phlegmatic, this is how Goldman's trading floor described today's market "uninspiring tape and eerily quiet intraday trading (again) which is concerning…... no smoking gun on this sharp move lower but feels like risk is to the downside in an illiquid and low volume tape. Tonight’s must watch debate between Kamala Harris and Donald Trump has unnerved investors more than before the June event with Joe Biden."

The market got some much needed tailwind thanks to Oracle, which surged to an all time high after reporting solid results...

... and supported the AI trade just as it was about to crack the most important long-term support levels.

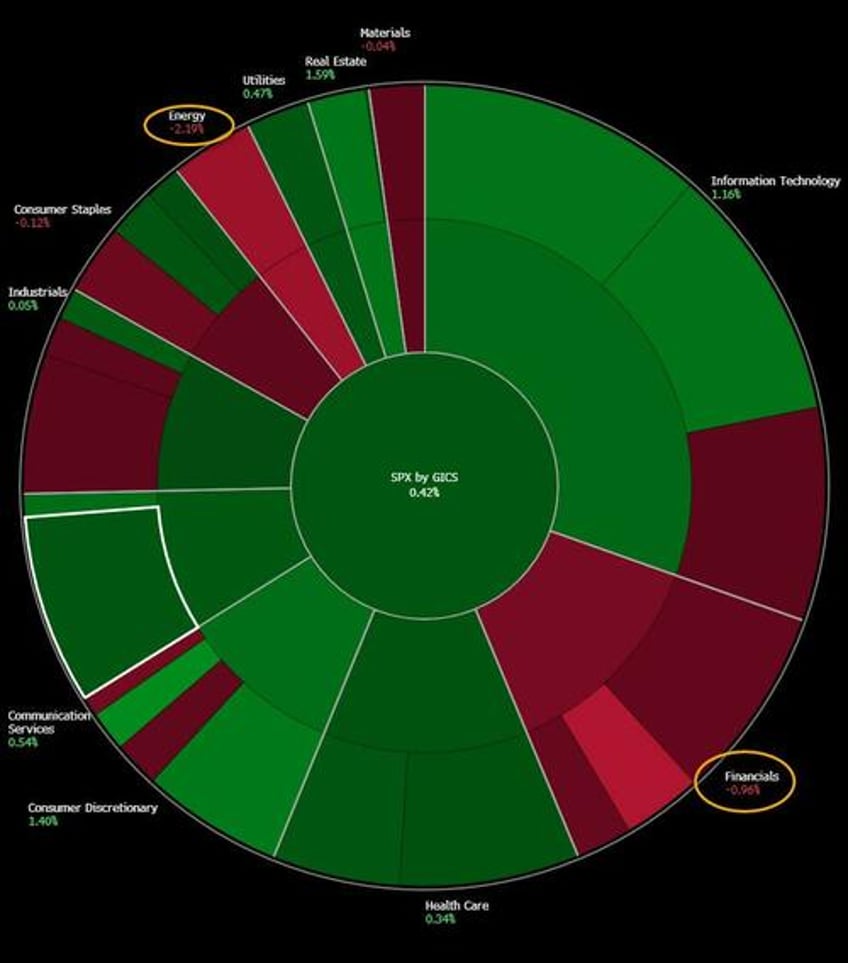

Strength in Mega Cap Tech, up 1.3%, helped offset the cyclical weakness: AI Winners were up 70bp, while Defensives rose 35bp, with the bid led by Wireless, Utilities and Real Estate.

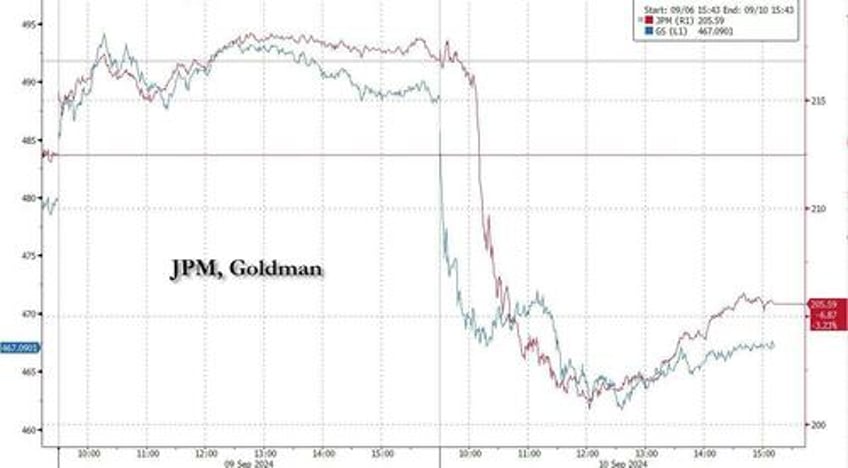

Which is not to say there were no casualties: banks got crushed after first Goldman and then JPMorgan warned that Q3 revenues and the full year Net Interest Income outlook would likely disappoint, sending their stocks sharply lower...

... with the largest US bank at one point tumbling the most since the covid crash. A far more ominous plunge, however, took place at Ally Financial: one of the largest US auto loan lenders finally admitted what everyone else knew already: both delinquencies and charge offs are surging, and results in one of the biggest drop in ALLY stock on record.

The rest of the market was generally solid and closed in the green, with the exception of energy...

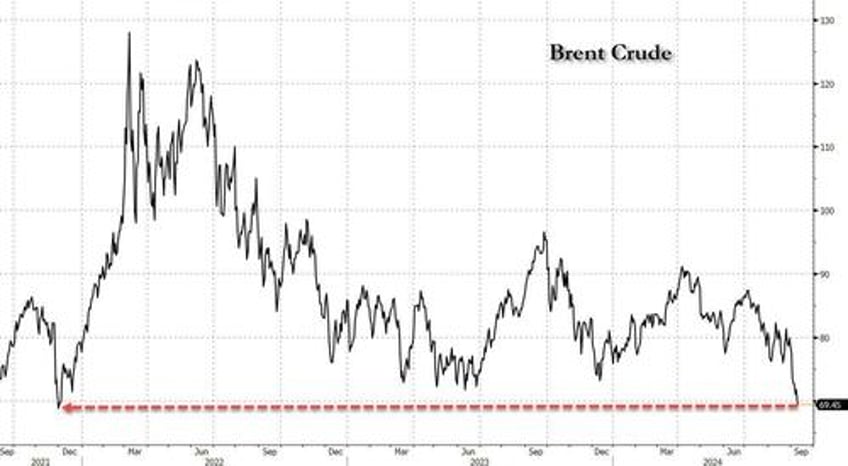

... and with good reason: ahead of today's presidential debate where inflation and the price of various goods will be a key topic, it was imperative that oil be hammered, and sure enough, Brent plunged 3.3%, one of its biggest one-day drops of 2024, sending the price to 2021 levels.

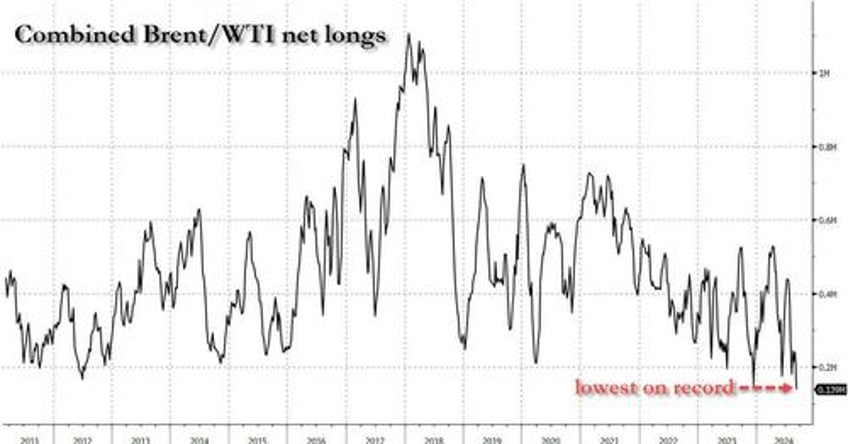

Of course, the last time oil was here, it then promptly doubled int he next 3 months, and while another war doesn't appear imminent, the fact that hedge funds are the most bearish on oil they have ever been...

... suggests that a historic short squeeze may be looming, especially since Goldman warned that while financial demand may be low (boosted by historic shorting), physical demand remains quite resilient.

As such, it wouldn't take much work by Saudi Arabia and OPEC+ to spark a massive squeeze, an April 2020 in reverse if you will, as all those who are short oil are unable to find deliverables to cover. And so we wait.

Oil and banks aside, however, the action remained choppy at the index level with no change to the broader narrative even as micro headlines pick up. As UBS notes, "the market remains surprisingly resilient despite the increased activity in equity capital markets and high yield issuance, Election uncertainty and growth concerns with crude oil down 4%. Brent dropped below $70 for the first time since December 2021 after China’s weak import data adds to oversupply concerns ."

UBS warns that "a lack of liquidity is contributing to the choppiness. Lots of investors remain on the road attending various conferences and the uncertainty around the Fed cut pace and the election is keeping investors on the sideline and will not go away near term." And the punchline: "investors are already set up very defensively (look at recent action in defensives like Staples and Wireless names ) and/or there is plenty of cash on the sidelines as last week’s healthy equity capital markets activity and performance showed."

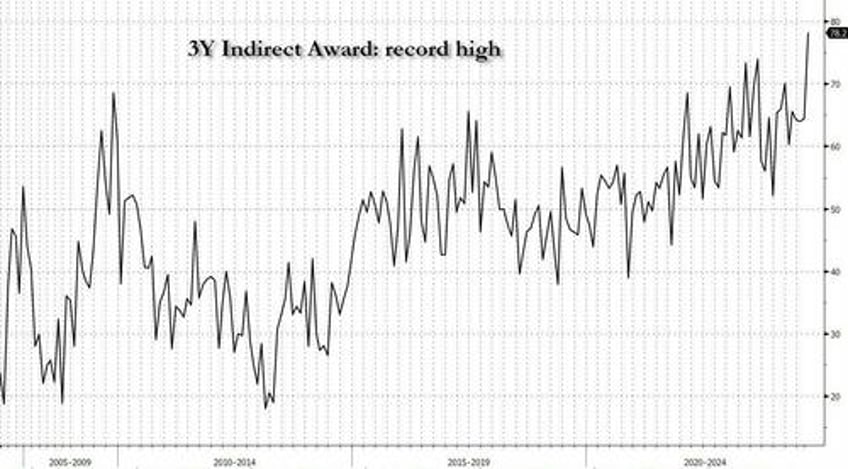

Defensive is correct, and one need look no further than the record takedown by foreign (Indirect) buyers in today's 3Y auction...

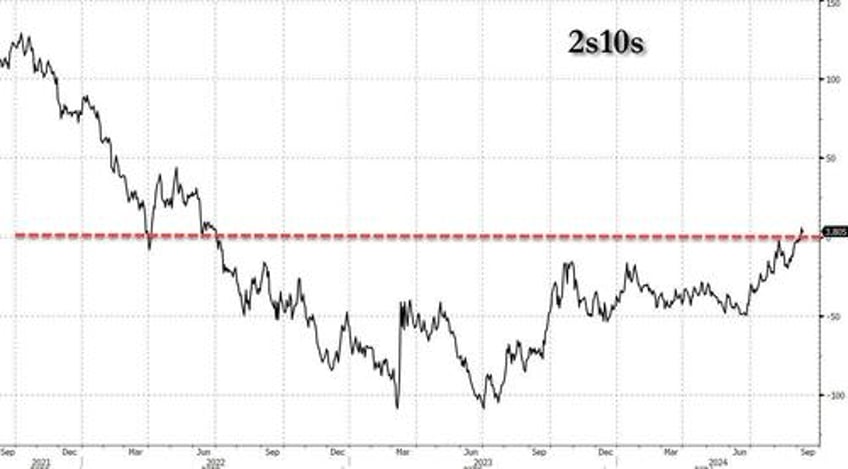

... which led to continued buying on the short-end, and pushed the 2s10s curve - which until last week had just emerged from the longest stretch of inversion on record - to the most steep it has been since the summer of 2022.

Bonds were not the only "flight to safety": so was bullion, which extended its rebound from Friday's swoon to trade just shy of its record high...

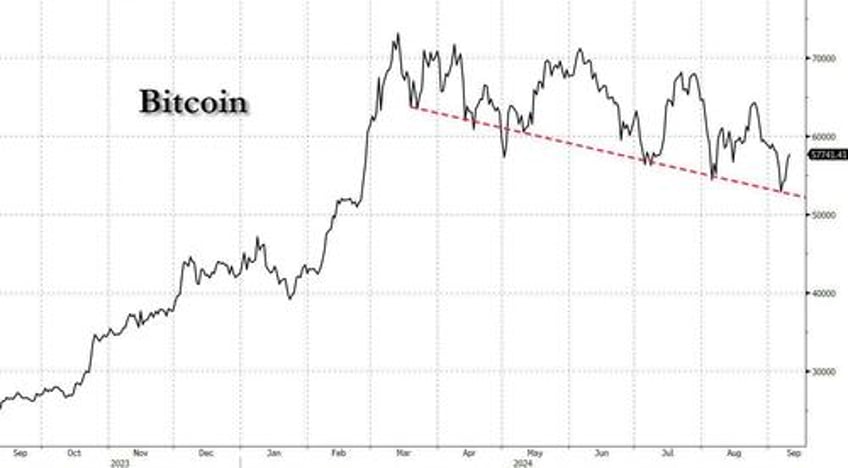

... and even bitcoin appears to once again be catching a more solid bid.

And now, all attention turns to the bloodbath that will be the Kamala-Trump debate in a few hours.