Just as we warned earlier in the week, the macro playbook has shifted to "bad is bad and good is good" as 'growth scare' narratives now dominate the set-in-stone rate-cut scenarios.

This morning's payrolls data was 'bad news' and so we see rate-cut expectations explode higher with over four full cuts now priced in for 2024...

Source: Bloomberg

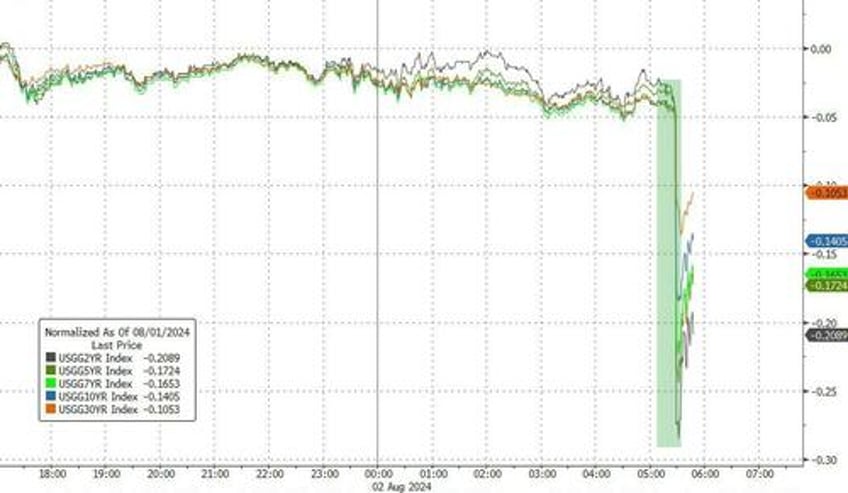

This prompted a massive plunge in Treasury bond yields...

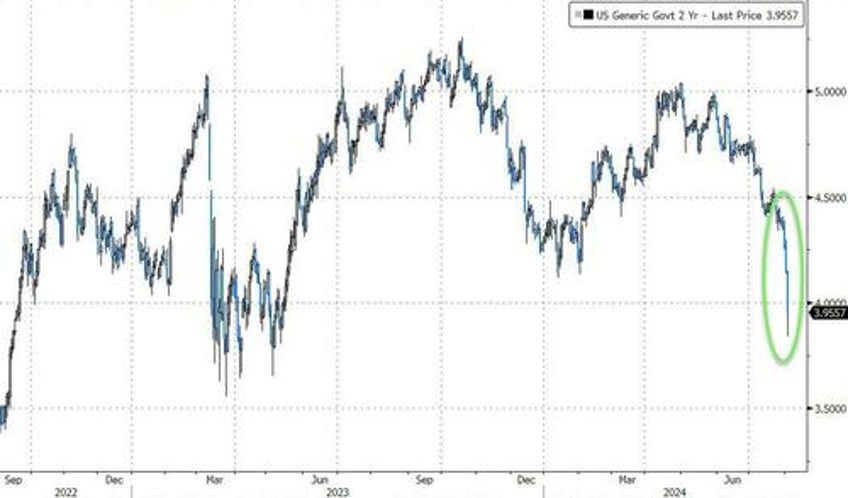

...especially at the short-end with 2Y yields dropping a stunning 29bps, back below 4.00%)...

...but stocks don't like the 'not-soft-landing' narrative...

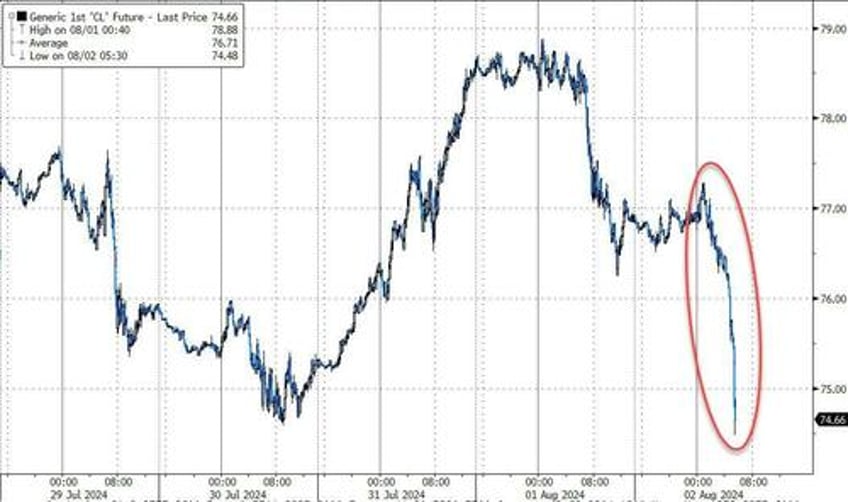

Crude oil prices also plunged...

But gold extended the week's gains (as the dollar dovishly limped lower)...

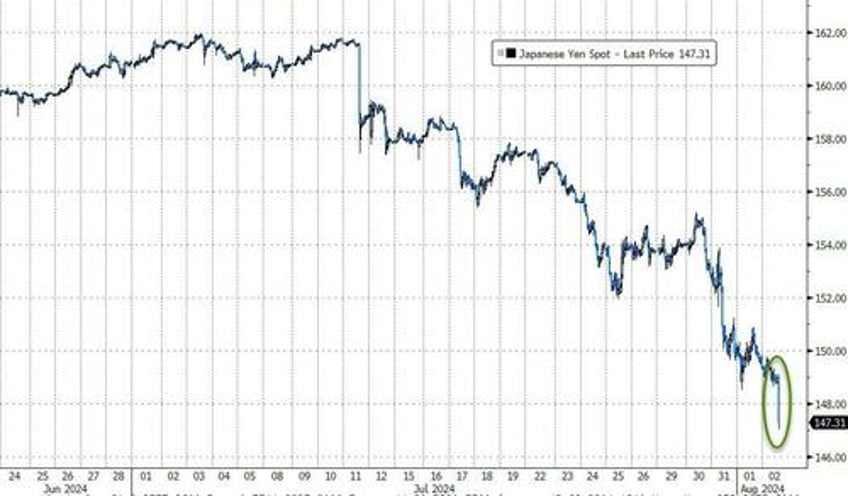

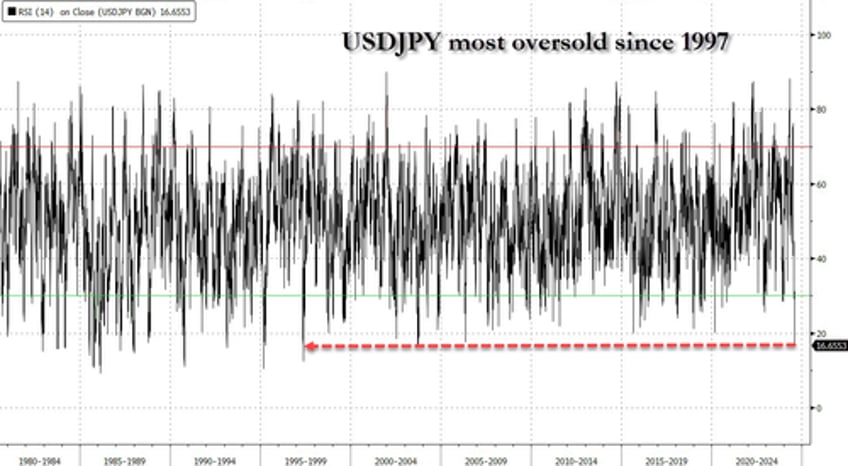

USDJPY extended its decline (yen strengthening versus the dollar)...

...now at its most oversold since 1997...

How long before FedSpeak will drift dovish and adjust to the market's new narrative (remember The Fed 'DOTS' are still at 2 cuts in 2024).