While 'soft' data has been in free-fall recently, 'hard' data has been uncomfortably (for the hard-landing/recession/seven-rate-cut crowd) outperforming recently (retail sales, housing starts/permits, jobless claims all beat recently as Philly Fed survey disappointed)...

Source: Bloomberg

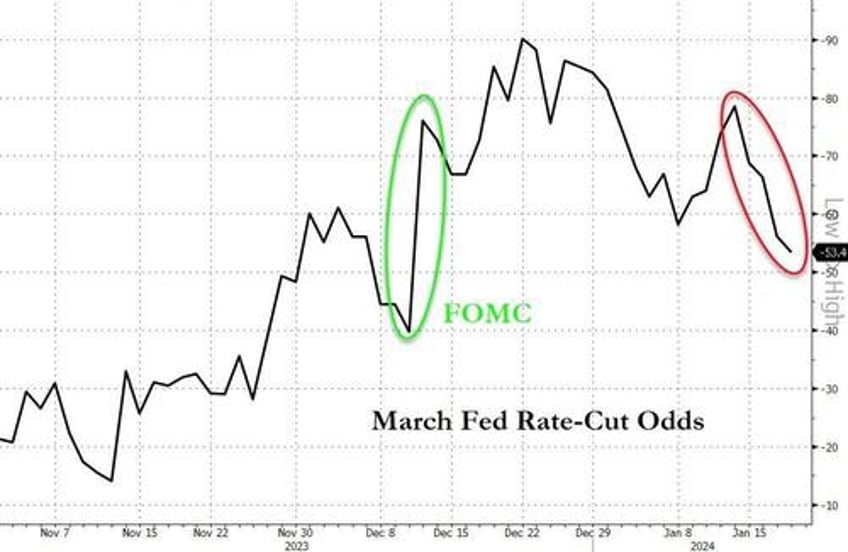

That hawkish tilt was helped along by more FedSpeak today - singing from the same 'more hawkish than the market expects' hymn-sheet - as Bostic reiterated his expectation that rate-cuts won't begin until the third quarter.

“In such an unpredictable environment, it would be unwise to lock in an emphatic approach to monetary policy,” Bostic said in prepared remarks Thursday at an event hosted by the Atlanta Business Chronicle.

“That is why I believe we should allow events to continue to unfold before beginning the process of normalizing policy.”

“My outlook right now is for our first cut to be sometime in the third quarter this year, and we’ll just have to see how the data progress,” Bostic concluded.

This sent the odds of a March rate-cut lower still...

Source: Bloomberg

The Senate passed a stopgap funding bill to keep the government open, which prompted an immediate buying spree in stocks, lifting all the majors into the green (with Nasdaq notably outperforming and Dow and Small Caps the worst gainers)...

MAG7 stocks soared to a new record high

Source: Bloomberg

'Most Shorted' stocks ended lower again, despite the afternoon ramp...

Source: Bloomberg

That is the 8th straight day lower for 'most shorted' stocks to make it the worst start to a year for those stocks since 2016...

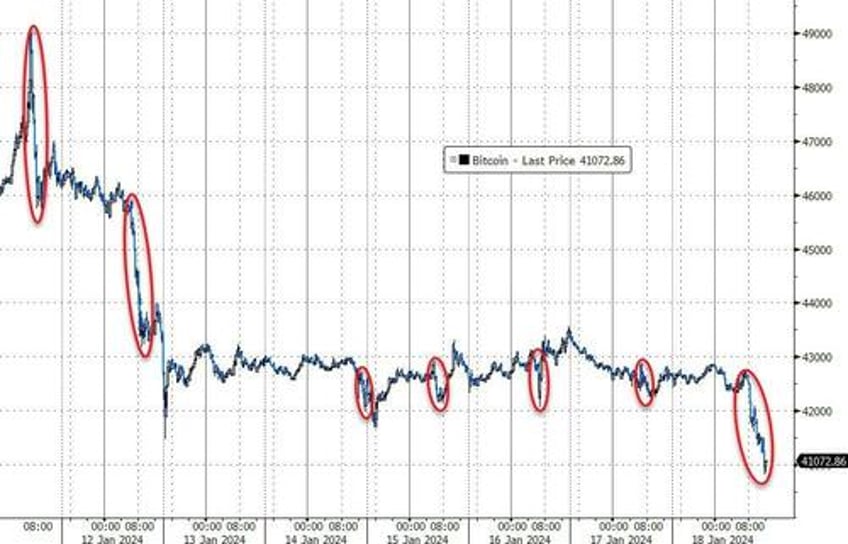

But, while stocks swung around wildly, Bitcoin was a one-way street lower after the ETFs opened... again...

Source: Bloomberg

...now back at its lowest since the start of December...

Source: Bloomberg

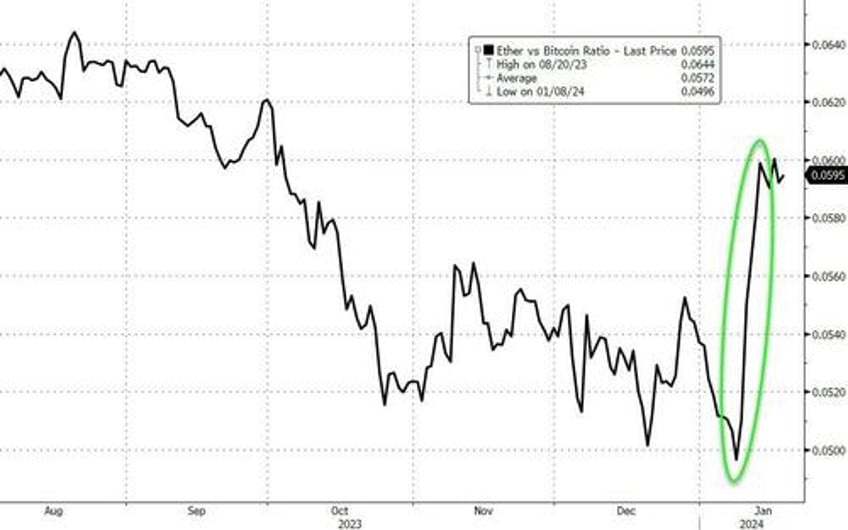

Ethereum has held its gains relative to Bitcoin since the ETFs launched...

Source: Bloomberg

Notably, Bitcoin ETFs have seen $1.25BN of net inflows since inception... and the price is down...

Source: Bloomberg

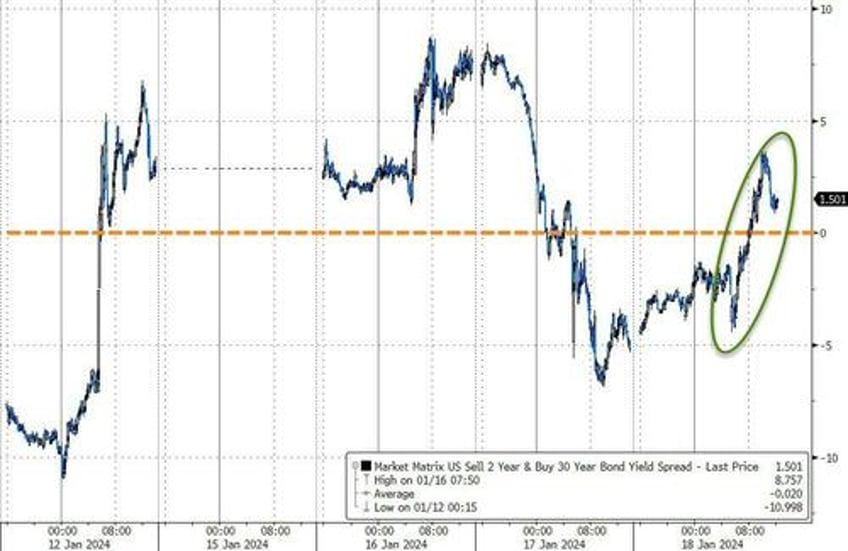

Yields continued to rise today, now all dramatically higher year-to-date with the long-end underperforming. On the day the long-end notably lagged (30Y +6bps, 2Y unch)...

Source: Bloomberg

The yield curve (2s30s) steepened back into dis-inversion...

Source: Bloomberg

In case you wondered, Stocks are at one-month highs... and so are bond yields...So bonds are unchanged since the FOMC but stocks are soaring...

Source: Bloomberg

The dollar ended the day unchanged, recovering overnight losses during the early US session...

Source: Bloomberg

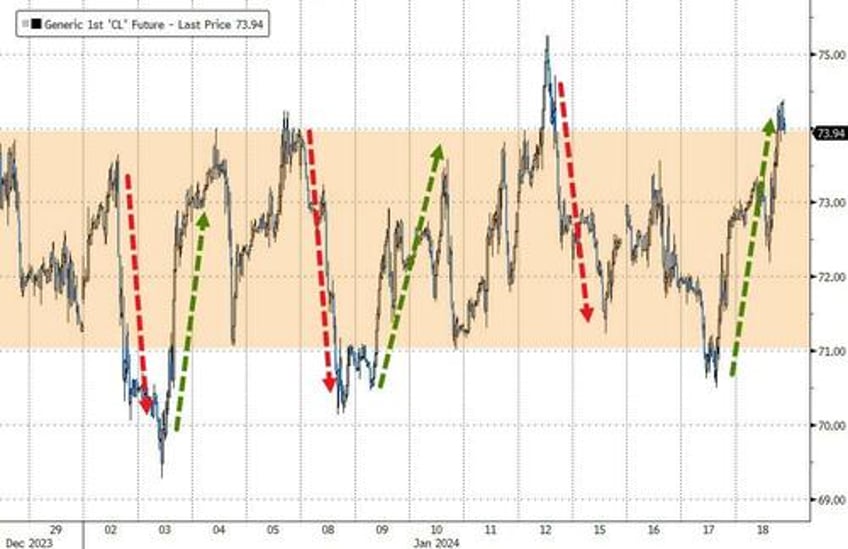

Oil prices extended gains after today's inventory data with WTI pushing above $74, breaking out of its YTD range (next stop $71?)...

Source: Bloomberg

Spot Gold prices tested down towards $2000 today, before bouncing back above $2020...

Source: Bloomberg

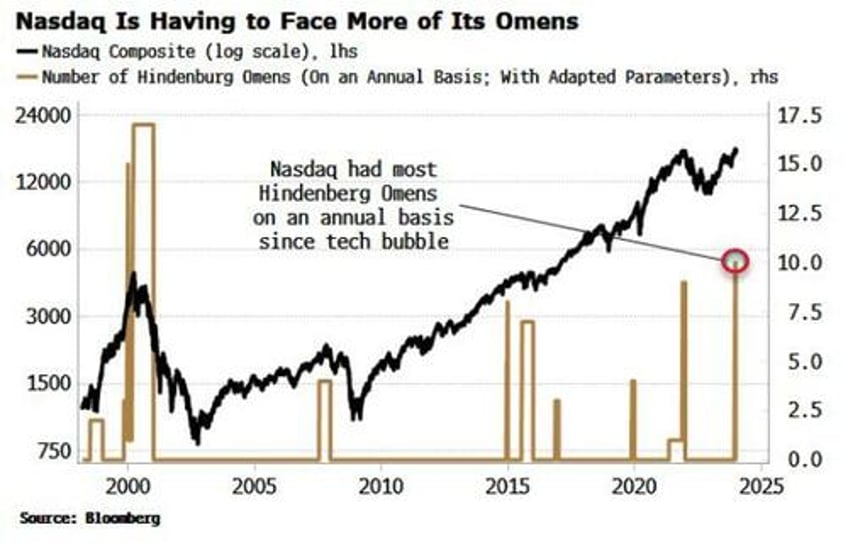

Finally, we note that the frequency of Hindenberg Omens is increasing significantly...

Source: Bloomberg

"Probably nothing!"