By Michael Msika and Jan-Patrick Barnert, Bloomberg Markets Live reporters and strategists

European stocks just notched their biggest gain of the year, bolstered by good news on the outlook for interest rates and yet another glimmer of hope that China will jolt its economy awake.

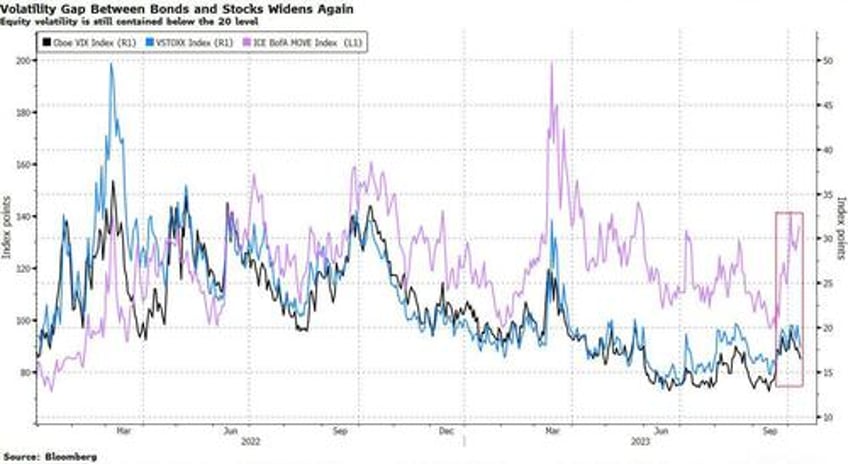

Yet Tuesday’s 2% rally in the Stoxx Europe 600 Index is by no means an all-clear signal. Even with the biggest drop in US Treasury yields since March, there’s no sign central banks will start easing monetary policy before the end of the year, the war between Israel and Hamas has put geopolitical risk front and center and a recession remains a real possibility.

For some investors, that makes it still a coin flip as to where the market goes in the short term. The newsflow over the next two days — minutes of the Federal Reserve’s September meeting, due Wednesday, and US consumer inflation data on Thursday — thus takes on heightened importance as money managers seek clues about the rate path from here.

“I would say (yesterday’s) rally is a more of technical rebound due to the latest readjustment of real rates but really there is nothing fundamental to justify it,” says Francois Rimeu, a strategist at La Francaise Asset Management in Paris.

The lurch lower in bond yields Tuesday came in reaction to hints from a couple of Fed officials that the central bank may be done tightening monetary policy. Stocks got squeezed higher on the news in part because investors had just spent months pricing in interest rates staying higher for longer.

But looking at the moving parts in Tuesday’s rally, it’s clear there’s no growing consensus for a sustained drop in yields. For one thing, stocks got a big helping hand from something else entirely: a Bloomberg News report that China plans further stimulus. Some of the biggest gains came in the consumer and industrial sectors that are most exposed to China, such as luxury, miners and autos.

“It’s too soon to tell if the shift in investor sentiment is sustainable,” says Richard Flax, chief investment officer at European digital wealth manager Moneyfarm. “The scenario we’re working with for the short-term is that yields may bounce around at current levels for a bit, but they won’t breach the highs we’ve seen in the last week or two. That’s underpinned by slowing inflation and signs of a slowdown in the US economy.”

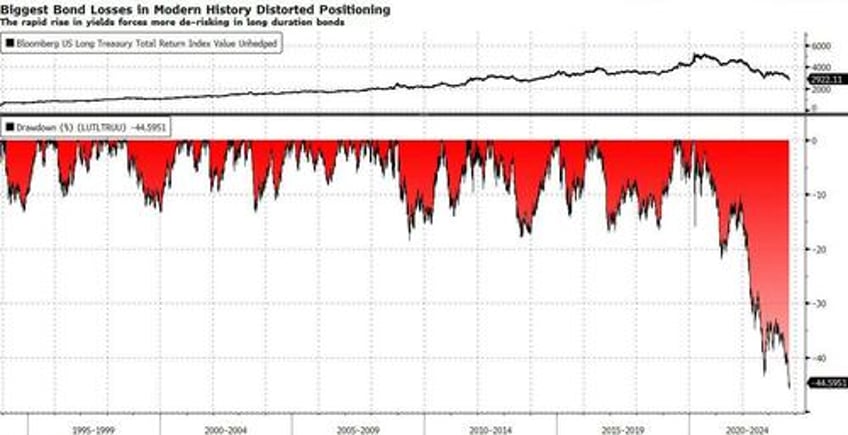

Some investors may be reluctant to take on more equity risk at this point because they’re gunshy about any long-duration assets after taking big losses on long bonds over the past two years. With the bond drawdown now exceeding 40%, the chart below looks more like a failing growth stock than a high-quality bond.

What’s more, in the latest Deutsche Bank survey, when investors were asked if the next 100-basis-point move in yields would be higher or lower, 75% voted for the latter. That means that, with 10-year US Treasury yields at about 4.65%, the consensus is absolutely not positioned for 6%, so should the market move that way it might get uglier for stocks.

The environment for a classic 60-40 stock and bond portfolio still looks rocky.

“While valuations have reset somewhat, this has been mostly due to higher bond yields: equity valuations remain elevated, helped by the US soft landing and US tech stocks,” say Goldman Sachs strategists led by Christian Mueller-Glissmann. “This, coupled with little cyclical upside and continued policy tightening, results in a continued poor risk/reward for 60/40 portfolios with less potential for a strong recovery and still above-average drawdown risk.”

The strategists remain overweight cash and neutral on other asset classes.

“As longer-dated yields are finding their new equilibrium and with our baseline macro view of no US recession, 60/40 portfolios should stabilize in the fourth quarter. However, if growth momentum turns much more negative the drawdown could deepen, led by equities,” they say.