Another day, another 0-DTE dominated melt-up...

Source: SpotGamma

NVDA and TSLA dominating the options trading... and all 0-DTE!

Source: Bloomberg

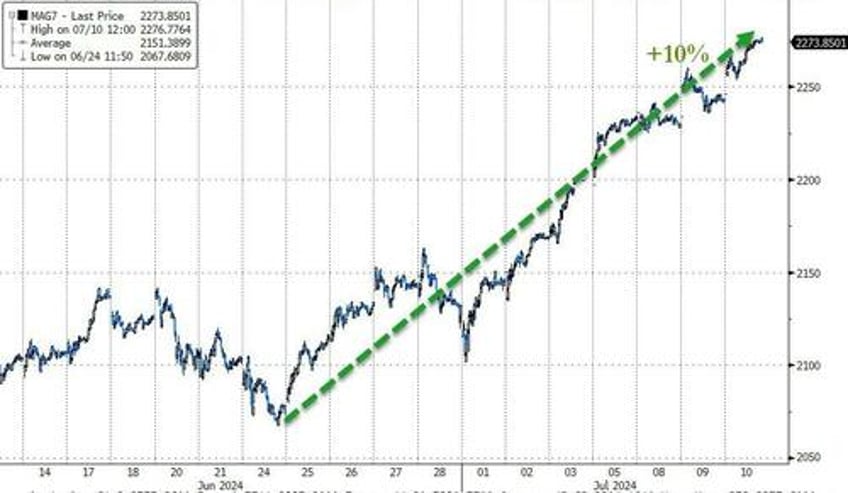

Which levitated MAG7 stocks for the 7th straight day (10 of last 11 days)...

Source: Bloomberg

And that is all that is needed to lift the Nasdaq and S&P (and everything else by association). Late in the day, everything just went vertical... because!!

The S&P 500 is now almost 15% above its 200DMA - quite a stretch...

Source: Bloomberg

...ahead of tomorrow's CPI print event risk, realized vol is near record lows (10d with a 5 handle) and very short-dated vol (across the CPI print) is near 16...

Source: Bloomberg

Rate-cut expectations continue to rise as Powell said nothing hawkish... which is therefore dovish?

Source: Bloomberg

Treasury yields are down very modestly on the day 1-2bps with a very modest long-end outperformance...

Source: Bloomberg

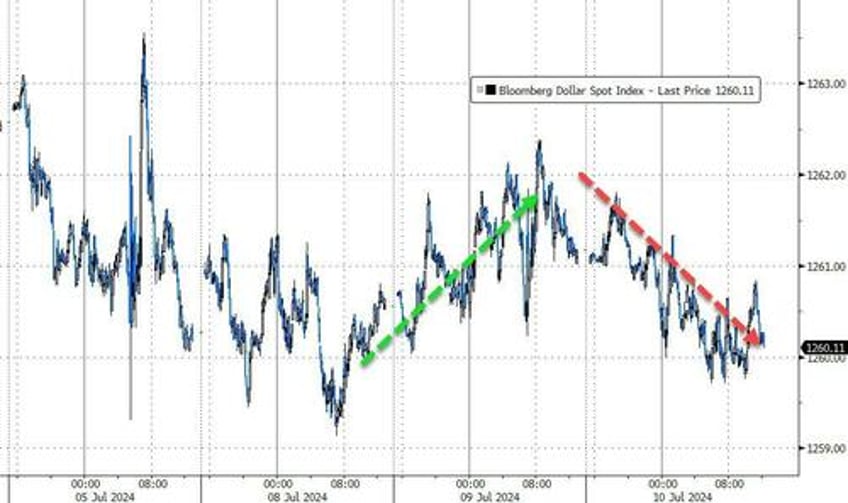

The dollar index slipped back to Monday's lows...

Source: Bloomberg

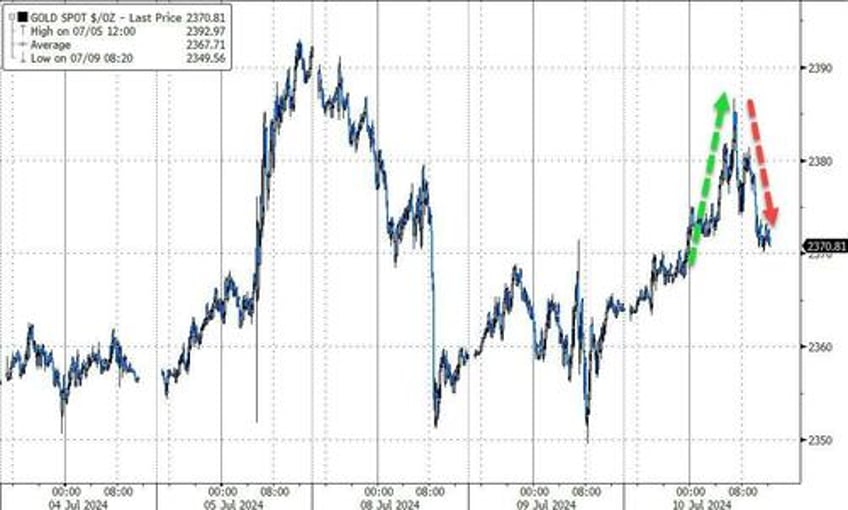

Gold rallied early on but gave some back in the US session...

Source: Bloomberg

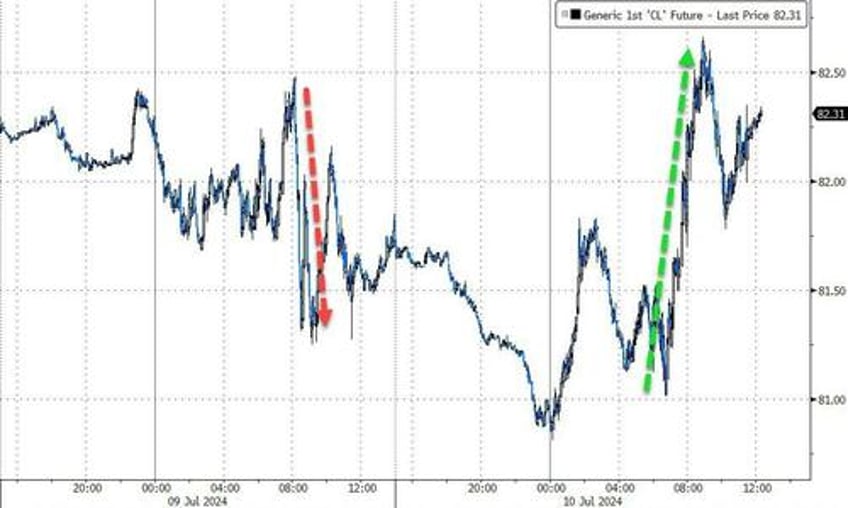

Oil prices surged back above $82.50 (WTI) after the official inventory data...

Source: Bloomberg

Bitcoin rallied back above its 200DMA 58,818 but was slammed back down again...

Source: Bloomberg

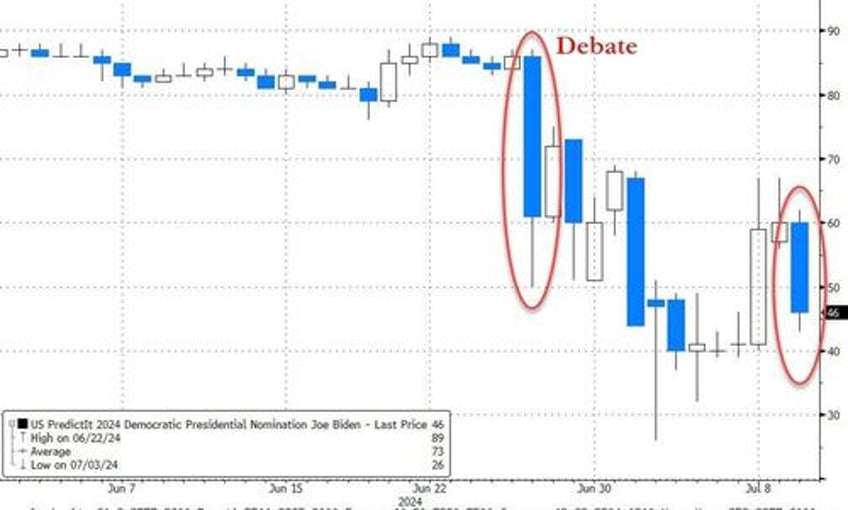

Finally, President Biden's odds of being the Democratic Party nominee plunged again today...

Source: Bloomberg

...do traders know something about tomorrow's solo press conference gauntlet?

Come On England!!!! See you Tuesday, BD.