The Dow Jones Industrial Average surged above the historic 40,000 mark in late morning and early afternoon trading. Euphoria was high as bulls celebrated Dow 40,000. This week's gains across broad equity indexes were primarily driven by a cooler April CPI print and dismal retail data on Wednesday, along with cooling Philly Fed data, surprisingly weak home-building activity, and a flat industrial production report on Thursday. The macro-intensive week puts the economy potentially on a soft-landing approach, with the Federal Reserve likely to start cutting interest rates in the second half of the year. However, around 1300 ET, broad selling pressure hit US equity indexes, pushing them flat to red for the session. The Dow has since lost the 40,000 mark.

The S&P 500 flirted with the 5,300 level for most of the session. Walmart surged to a record as earnings guided higher as wealthy consumers traded down to the big box retailer, driving sales higher.

Matt Maley at Miller Tabak + Co told Bloomberg that the stock market experienced a breakout to all-time highs this week, though it might be time for a short-term "breather" before further gains are seen.

The GameStop and AMC Entertainment Holdings short squeezes by Roaring Kitty faded into the end of the week.

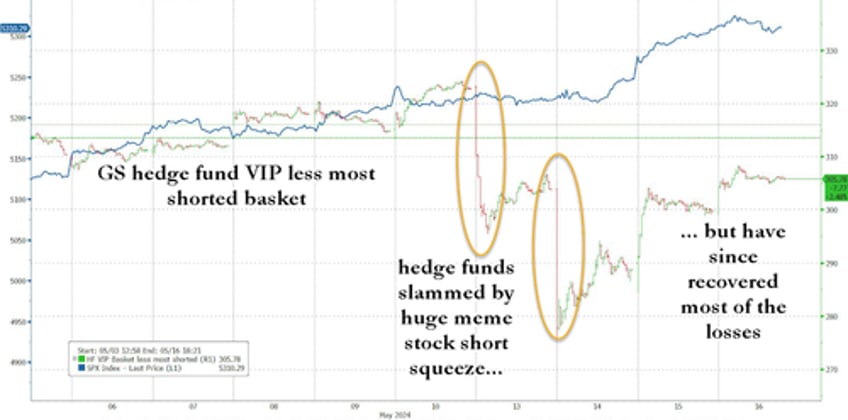

Long-short hedge funds were hit hard on Monday and Tuesday as the most shorted stocks, including meme stocks like GME and AMC, surged higher. However, as the rally in these heavily shorted stocks reversed, hedge funds have managed to recover most of their recent losses.

"Our HF VIP vs. Most short (GSPRHVMS Index) is +215bps today, now down only -2.5% in the last five days. As of Tuesday, this was down as much as -12%. This feels much more orderly (Unwinds of macro hedges)," Goldman's Chloe Garber wrote in a midday note.

Here are some of Garber's key observations in markets today via the bank's trading desk:

All micro today: WMT +6% on EBIT upside and sales at the high end of the range; DE -3% on a Q2 beat but full year cut; UAA (+66bps) went from -15% to green on the day… shorted name/ one of the worst guides of the EPS season so far. Goldman thinks the stock went green because ppl aware of the consumer pressures at this point.

45% of the total market volume so far today is in <$1 stocks (CRKN, GWAV, FFIE, SINT stick out specifically. This compares to YTD average of ~12% for <$1 stocks. Clearly a knock-on effect associated w/ meme stock activity.

Volumes elevated today +30% vs the rest of the week, with S&P top of book tracking higher as well. The floor is skewed +8% better to buy today led largely by LO buying.

LOs most active in tech and macro products on the buy side, vs selling cons discretionary. HFs also much better buyers with demand concentrated in macro products, HC, Industrials, and Tech. HFs are selling Fins, staples, and Energy.

The macro-intensive week has sent the Citigroup Economic Surprise Index to its lowest level since September 2022, as economic data increasingly prints to the downside as the economy slows.

After all this data, yields on 10-year US Treasuries are marginally higher on the session, trading around 4.37%.

Chris Zaccarelli at Independent Advisor Alliance said, "Breaking the 40,000 barrier is a big psychological boost for the bulls as round numbers hold special significance in people's hearts and minds."

Goldman's Chris Hussey writes in a midday note, "As for markets, the equity market continues to like what it's seeing in the data -- data that is pointing to a decidedly 'soft' landing and not the 'strong' landing that many had started to worry about through March."

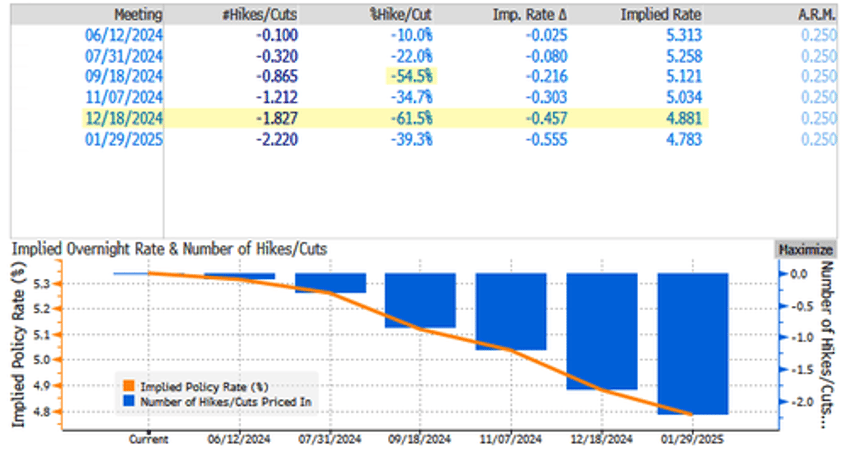

Interest-rate swaps showed traders have priced in just two Fed rate cuts by the end of the year. Probabilities at the moment have the first cut at 86.5% in September.

The gap between 2-10 year yields inverted further, approaching the 200-day moving average of around 41bps.

"The re-establishment of a disinflation trend in the coming months should allow the Fed to start easing policy in September," Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, wrote in a note.

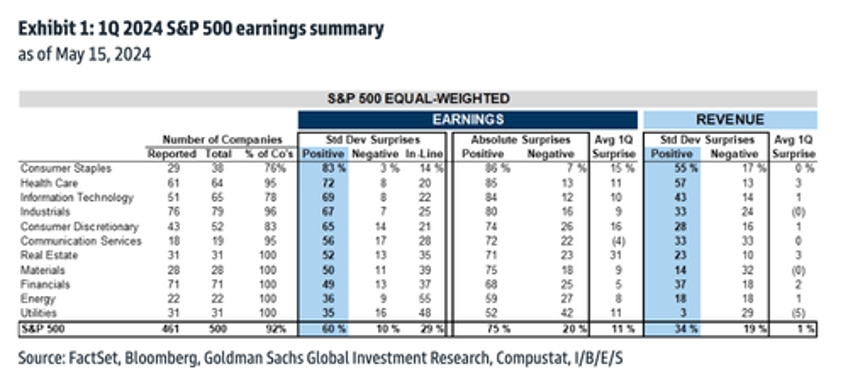

Taking a look at GS' latest earning results as 88% of total S&P 500 market cap has reported:

60% beat earnings by at least 1 standard deviation of analyst estimates (vs. 15 year average of 48%) and 10% of companies missed earnings by at least 1 standard deviation of analyst estimates (vs. 15 year average of 13%). Consensus expected EPS to grow by 3% at the start of 1Q reporting season. With reporting season almost complete, EPS growth year/year is tracking at +6%.

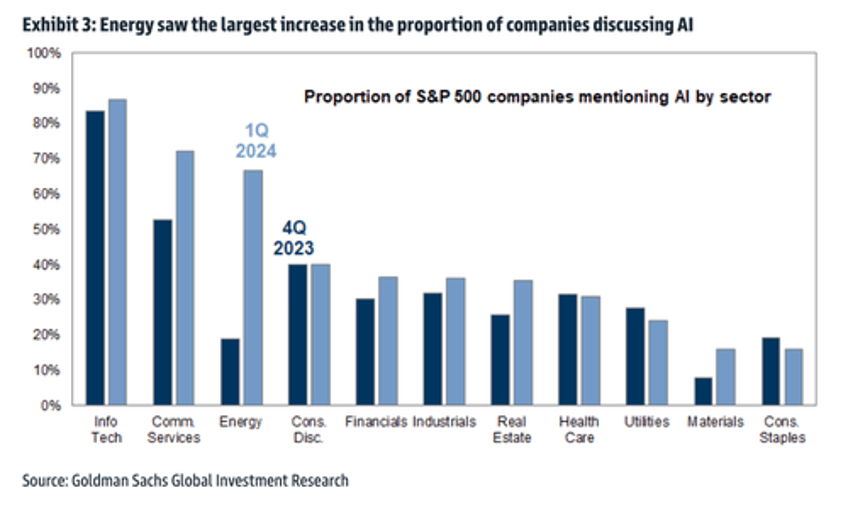

Chart of the day via GS are energy companies saw the largest increase in AI mentions on earnings call vs the prior quarter.

Let's not forget while this is happening...

Dow hits 40,000 on the day the Citi economic surprise index dumps to the lowest level since Sept 2022 pic.twitter.com/QJQj2Fmbws

— zerohedge (@zerohedge) May 16, 2024

The Vix has tumbled to its lowest intraday level since December.

Bloomberg outlines one of the most notable Vix option trades today:

- A VIX trader seemingly bought a 22/47.50 call spread expiring Aug. 21 in a 1x2 ratio 20,000 times

- Paid $0.36 per position

- VIX approached 12 midday

Earlier, JPMorgan CEO Jamie Dimon warned that persistent inflation will surprise markets, which is an ominous sign for corporate bond markets.

Ending with S&P500's daily RSI approach 'overbought' levels...

It's all or nothing for Dow 40,000. Will the level be sustained, or is this a 'kiss of death'?