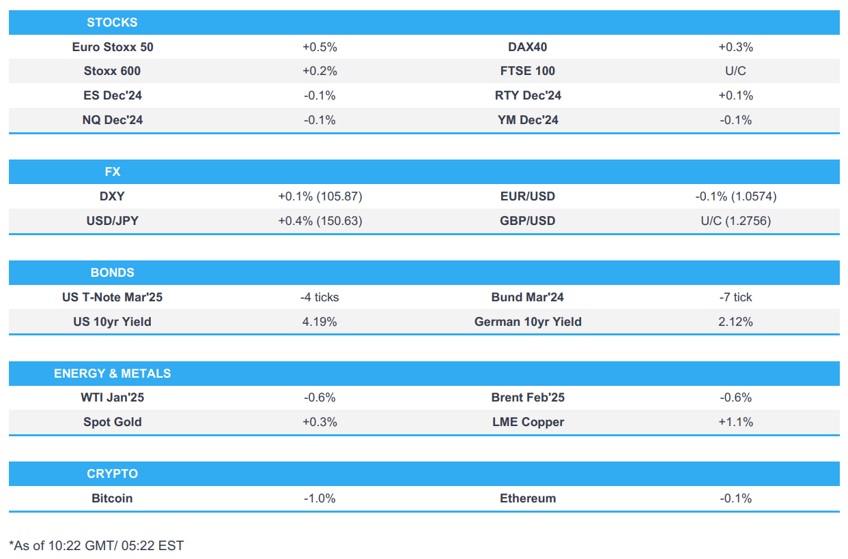

- European stocks are mixed and US futures trade sideways amidst a lack of fresh pertinent catalysts in the run-up to the US jobs report.

- USD is a touch firmer vs. most peers in the run-up to today's NFP print, EUR's rally vs. the USD has paused for breath, JPY and Antipodeans are softer.

- USTs are a touch lower following yesterday's flattening of the curve. Fresh macro drivers for the US are on the light side in the run-up to today's NFP print.

- Bitcoin gradually edged higher and briefly reclaimed the USD 98,000 level after yesterday's pullback from a record high north of USD 103,000.

- Looking ahead, highlights s include Canadian jobs data, US jobs report & Univ. of Michigan, Fed’s Bowman, Goolsbee, Hammack & Daly.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- Mixed performance thus far from Europe following a flat open amidst a lack of fresh pertinent catalysts and in the run-up to the US jobs report later today which will help shape expectations for near-term Fed policy.

- European Sectors are mixed with no clear bias or theme, with the breadth of the market narrow at the open before gradually widening.

- In terms of majors, CAC 40 narrowly outperforms in the aftermath of the French political developments as President Macron looks to name a new PM within days, with French Banks once again seeing a strong performance. Furthermore, luxury stocks see upside amid a possible China play in the run-up to the Chinese Central Economic Work Conference next week.

- US equity futures see flat trade across the board but with a mild downward bias in the RTY in a continuation of its recent underperformance, with traders awaiting the latest US jobs report.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is a touch firmer vs. most peers in the run-up to today's NFP print which is expected to pick up to 200k vs. October's weather/strike-impacted 12k.

- EUR's rally vs. the USD has paused for breath after vaulting from a 1.0508 low yesterday to a 1.0593 peak today. Support yesterday was derived from some relief around the French budget situation with Le Pen optimistic that a 2025 budget can be passed in the coming weeks.

- JPY is softer vs. the USD despite some fleeting support from comments by Japan's main Opposition party Chief who said the BoJ should normalise monetary policy, adding it is wrong to focus too much on keeping monetary policy loose when Japan is experiencing inflation. USD/JPY has made its way back onto a 150 handle with a current session peak @ 150.60 vs. yesterday's high @ 150.77. If breached, the 10DMA sits @ 150.99.

- GBP flat vs. the USD in quiet UK newsflow asides from comments by BoE's Greene who said UK services inflation has remained stubbornly high, underpinned by wage growth and the supply side of the UK economy is weak. Cable briefly rose above the top end of yesterday's 1.2693-1.2771 range before fading gains.

- Antipodeans are both softer vs. the USD and at the foot of the G10 leaderboard. AUD/USD briefly slipped below yesterday's 0.6421. If breached again, the next target is the 0.64 mark with Wednesday's low just below @ 0.6399. NZD/USD is just about holding above yesterday's 0.5848 low. If breached, Wednesday's low sits @ 0.5829.

- PBoC set USD/CNY mid-point at 7.1848 vs exp. 7.2396 (prev. 7.1879)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are a touch lower following yesterday's flattening of the curve. Fresh macro drivers for the US are on the light side in the run-up to today's NFP print. Mar'25 UTSs are currently towards the top end of yesterday's 110.28+ to 111.08+ range.

- Bunds a touch higher but off best levels as support from soft German Industrial Production metrics proved to be fleeting. There was no clear driver for the pullback. However, German paper has continued to fall behind its French equivalent. This move garnered traction following comments from far-right leader Le Pen who stated she sees a 2025 budget being passed in the coming weeks. Accordingly, the FR/GE spread has narrowed to its lowest level since November 21st.

- Gilts are just above the unchanged mark with fresh UK drivers lacking since the "dovish" Governor Bailey interview earlier in the week. Thus far the Mar'25 contract sits towards the bottom end of yesterday's 95.69-96.18 range, whilst the 10yr yield remains north of 4.25%.

- Click for a detailed summary

COMMODITIES

- Crude complex experiences a modest downward tilt with prices lacklustre after the prior day's choppy performance amid the deluge of OPEC+ updates, with traders keeping an eye on geopolitical updates ahead of the US jobs report.

- Spot gold holds a modest upward bias ahead of NFP. Spot gold resides in a USD 2,613-2,645.73/oz range after dipping under yesterday's USD 2,623.61/oz low. Prices remain sandwiched between the 50 DMA (USD 2.667.96/oz) and 100 DMA (2,583.44/oz).

- Copper grinds higher as traders look ahead to the US jobs report, and thereafter the Chinese Central Economic Work Conference next week whereby the focus will likely be on whether there’s a new emphasis on boosting domestic demand or supporting the property market.

- Morgan Stanley raised its H2 2025 Brent price forecast to USD 70/bbl (prev. USD 66-68/bbl); and lowered its estimate for OPEC-9 production by 400k BPD for 2025 and 700k BPD by Q4 2025. The desk said the OPEC+ updated production agreement tightens its supply/demand outlook for 2025, particularly for H2. MS still estimates a surplus for the oil market next year, but smaller than before.

- Qatar set January Marine crude and Land crude OSP at Oman/Dubai plus USD 0.15/bbl.

- Oil supplies to Czech Republic via Druzbha were resumed today, according to CTK citing Orlen CEO.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Employment Final YY (Q3) 1.0% vs. Exp. 1.0% (Prev. 1.0%)

- EU Employment Final QQ (Q3) 0.2% vs. Exp. 0.2% (Prev. 0.2%)

- EU GDP Revised YY (Q3) 0.9% vs. Exp. 0.9% (Prev. 0.9%)

- EU GDP Revised QQ (Q3) 0.4% vs. Exp. 0.4% (Prev. 0.4%)

- UK Halifax House Prices MM (Nov) 1.3% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.4%)

- German Industrial Output MM (Oct) -1.0% vs. Exp. 1.2% (Prev. -2.5%)

- French Trade Balance, EUR, SA (Oct) -7.666B (Prev. -8.266B, Rev. -8.418B)

- French Imports, EUR (Oct) 56.404B (Prev. 56.853B, Rev. 56.710B)

- French Exports, EUR (Oct) 48.738B (Prev. 48.587B, Rev. 48.292B)

- French Current Account (Oct) -2.6B (Prev. -2.1B, Rev. -2.4B)

- Italian Retail Sales NSA YY (Oct) 2.6% (Prev. 0.7%)

- Italian Retail Sales SA MM (Oct) -0.5% (Prev. 1.2%)

- Norwegian Manufacturing Output MM (Oct) -1.6% (Prev. -0.8%)

NOTABLE EUROPEAN HEADLINES

- French Socialists have expressed a willingness to work with a Macronist or Republican Prime Minister if “reciprocal concessions” are made, according to Politics Global.

- Riksbank's Seim said if economic and inflation outlook remains unchanged, policy rate can be cut again in December and again in H1 2025.

NOTABLE US HEADLINES

- BofA Weekly Flow Show: USD 136.4bln inflow to cash in week to Wednesday - largest weekly inflow since March 2023. Stocks: USD 8.2bln inflow, Bonds: USD 4.9bln inflow, Crypto: USD 3bln (largest every 4-week inflow of 11bln), YTD inflows: USD 53bln annualised, Bull/Bear Indicator: 3.7 (prev. 4.7)

CRYPTO

- Bitcoin gradually edged higher and briefly reclaimed the USD 98,000 level after yesterday's pullback from a record high north of USD 103,000.

GEOPOLITICS

MIDDLE EAST

- Senior Iranian official said Tehran has taken all necessary steps to increase number of military advisers in Syria and deploy troops; likely that Tehran will need to send military equipment, missiles, and drones to Syria.

- IDF announces interception of suspicious air target after warnings in Upper Galilee, according to Sky News Arabia.

- Russian Foreign Minister Lavrov said they are very worried after what happened in Syria, while he spoke with his Turkish and Iranian counterparts and they agreed to meet this week, according to Al Jazeera

RUSSIA-UKRAINE

- White House stated regarding National Security Advisor Sullivan's meeting with Ukrainian officials that Sullivan focused the discussion on the President’s theory of the case to improve Ukraine’s position in its war against Russia, while it was stated that Ukraine’s position in this war will improve relative to Russia's as we enter into 2025 and will allow Ukraine to enter any future negotiating process from a position of strength.

- Russia's Foreign Minister Lavrov said the use of hypersonic missiles in Ukraine means the West must understand that Russia is ready to use anything to stop notions of inflicting a strategic defeat on Moscow, while he added it is a mistake for anyone in the West to suggest that Russia has no red lines. It was separately reported that the Foreign Minister said Russia sees no reason why Moscow and Washington should not cooperate for the sake of the world.

OTHER

- Taiwan's President Lai said he hopes China does not take any unilateral actions and noted that more Chinese military drills won't win respect from any other countries in the region, while he added that authoritarian countries should not see Taiwan's engagement with other countries as a provocation and hopes China returns to rules-based international order. Furthermore, he said Taiwan's people cannot accept China's military operating around Taiwan, as well as noted that peace is priceless and there’s no winner in a war but also stated they cannot have any illusions about peace and must continue to strengthen defences.

- Armed forces from Japan, Philippines, and US conducted "multilateral maritime cooperative activity" within the Philippines’ exclusive economic zone.

APAC TRADE

- APAC stocks were mixed with some cautiousness in the region after the weak lead from Wall St and ahead of the key US jobs data.

- ASX 200 was dragged lower by early underperformance in tech and healthcare, while gold miners also suffered after initial declines in the precious metal.

- Nikkei 225 was the laggard and briefly fell beneath the 39,000 level despite encouraging Household Spending data.

- Hang Seng and Shanghai Comp were buoyed despite the lack of any major fresh catalysts heading into next week's trade and inflation data releases, as well as the Central Economic Work Conference where Chinese leaders are said to discuss economic growth and stimulus.

NOTABLE ASIA-PAC HEADLINES

- China may let provinces approve special bond projects, according to Caixin news.

- RBI kept the Repurchase Rate unchanged at 6.50%, as expected, while it maintained its neutral stance with the rate decision made by 4 out of 6 voting in favour of a hold and the policy stance vote was unanimous. However, RBI Governor Das later announced a surprise cut to the Cash Reserve Ratio by 50bps to 4.00% which will take effect in two tranches of 25bps each on December 14th and December 28th which will infuse liquidity of INR 1.16tln. Das said price stability is a mandate given to them and growth is also very important, while he noted the last mile of disinflation is prolonged and recent growth slowdown will lead to downward revision for full-year growth. Das acknowledged that inflation crossed the upper band and food inflation pressures will linger with food prices to start easing only in Q4, while headline inflation is likely to be elevated in Q3 and he noted a status quo in this policy is appropriate and essential. Das said the near-term inflation and growth outlook has turned somewhat adverse, while India's FY25 real GDP growth forecast was cut to 6.6% versus 7.2% previously and the FY25 CPI inflation forecast was raised to 4.8% versus 4.5% previously. Das also announced to introduce a new benchmark called the secured overnight rupee rate and said in order to attract more capital inflows, to increase interest rate ceilings on FCNR-B deposits.

- RBI Governor Das said expect tight liquidity in the next few months; there is a possibility of increase in currency in circulation.

- South Korean ruling party leader Han said President Yoon needs to be suspended from his office ASAP and that Yoon ordered to arrest prominent politicians on the grounds they are anti-state forces. It was also reported that South Korea's main opposition party said lawmakers were on high alert after many reports of another martial law declaration, although the South Korean Joint Chiefs of Staff later said there is no need to worry about a second martial law and the special warfare commander also said he would refuse should another martial law order come.

DATA RECAP

- Japanese All Household Spending MM (Oct) 2.9% vs. Exp. 0.4% (Prev. -1.3%)

- Japanese All Household Spending YY (Oct) -1.3% vs. Exp. -2.6% (Prev. -1.1%)

- Japanese Overall Labour Cash Earnings (Oct) 2.6% vs. Exp. 2.6% (Prev. 2.8%)