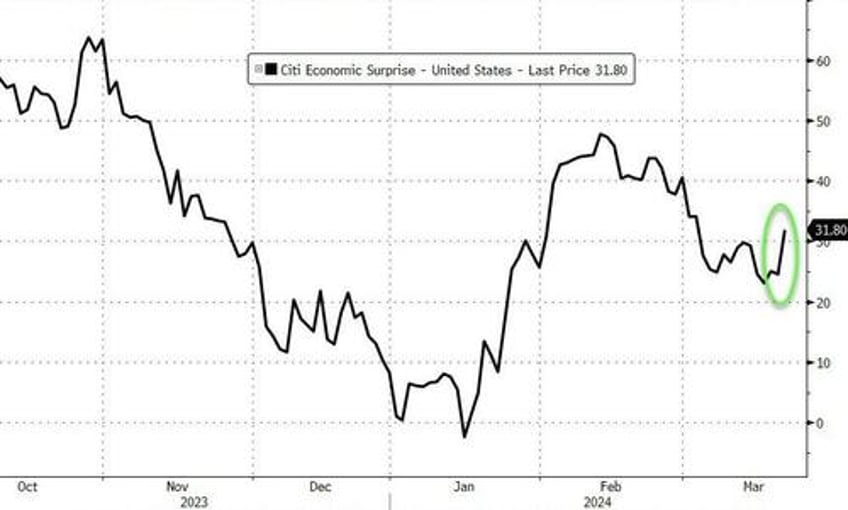

Philly Fed beat, jobless claims beat, PMIs beat... but with soaring prices, Leading Indicators beat, and existing home sales beat... all good news...

Source: Bloomberg

That good news reduced expectations for rate-cuts in 2024...

Source: Bloomberg

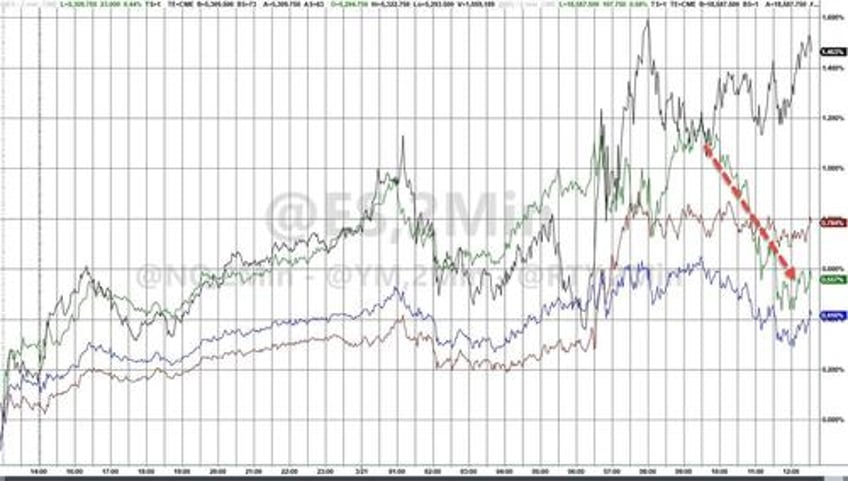

Stocks extended yesterday's gains on the good news... but Nasdaq was hit during the day on the heels of the AAPL news...

AAPL was clubbed like a baby seal on the regulatory crackdown...

Treasuries were mixed with the short-end lagging after yesterday's outperformance, (2Y +4bps, 30Y -1bps) with only the long-end still higher in yield on the week...

Source: Bloomberg

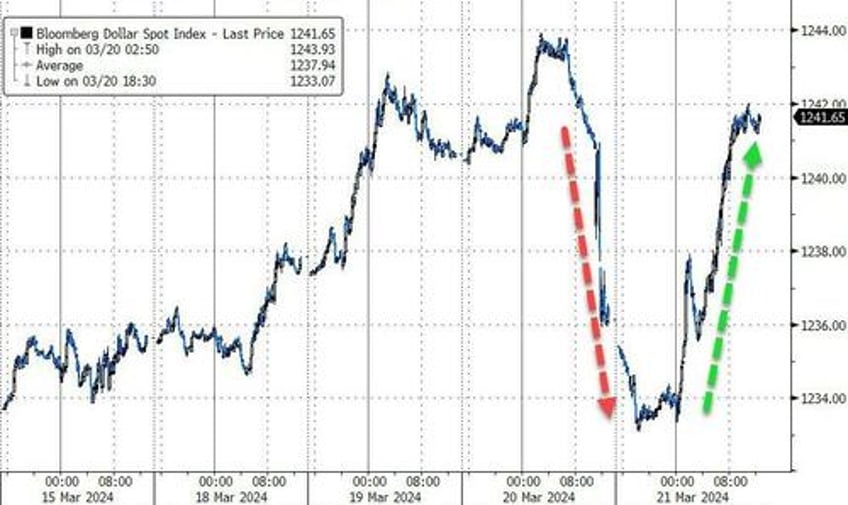

The dollar rebounded, retracing almost all of yesterday's losses...

Source: Bloomberg

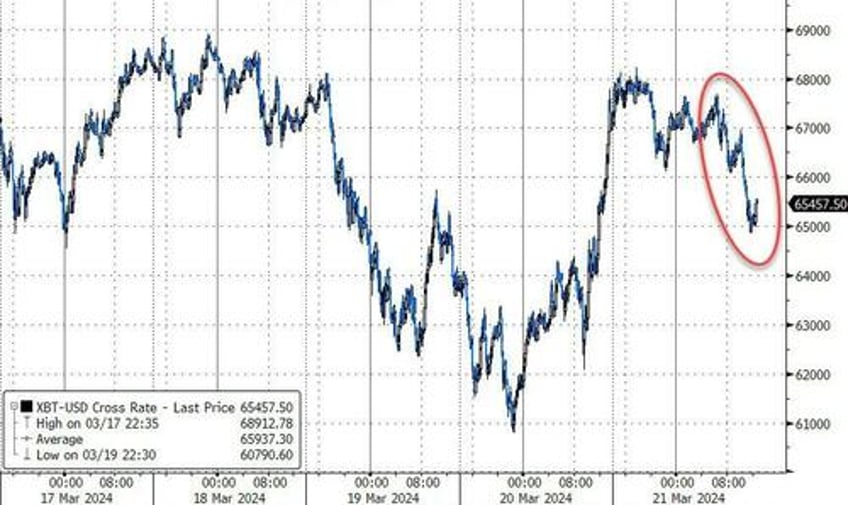

Another net outflow (3rd in a row) from BTC ETFs yesterday...

Source: Bloomberg

...and the crypto-currency was sold today...

Source: Bloomberg

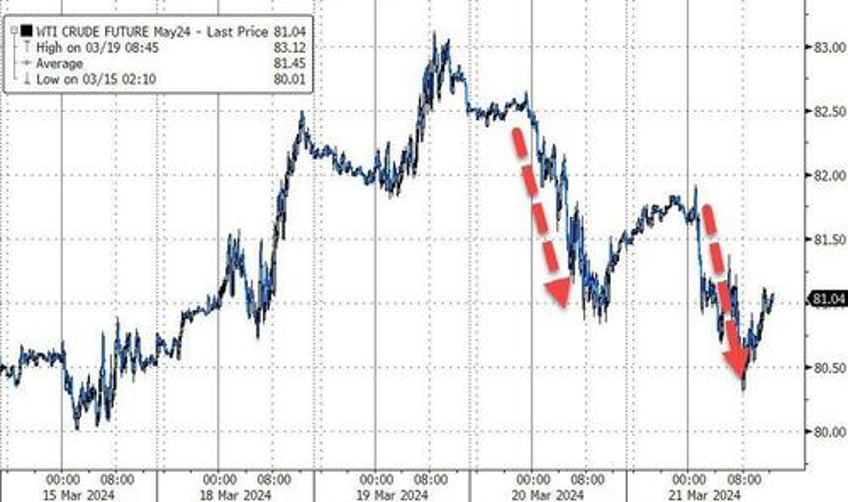

Oil prices dipped for a second day - despite bond yields higher and growth being positive...

Source: Bloomberg

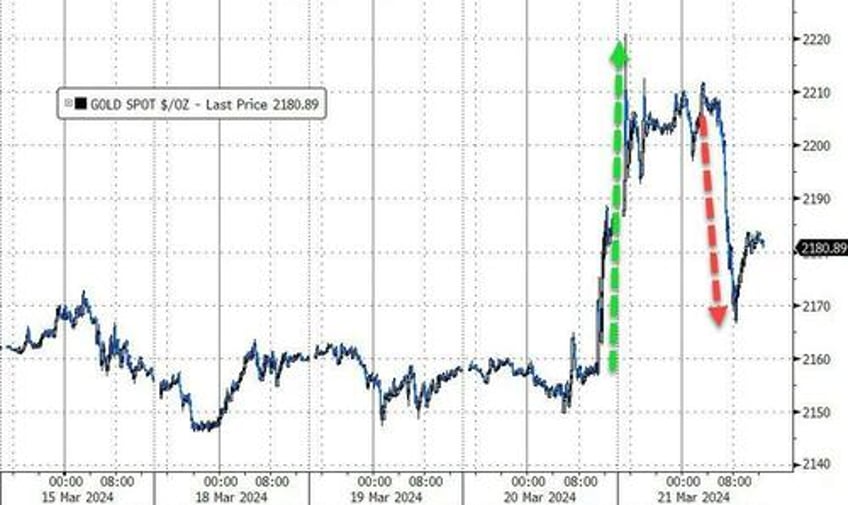

Gold retraced much of yesterday's spike gains...

Source: Bloomberg

Finally, which comes first: Nasdaq 17,000 or 10Y 4.0%...

Source: Bloomberg

...before or after the election?