Higher yields threaten to make already-fraying breadth in US stocks even worse. This points to heightened short-term risks for the market, although the medium-term positive trend remains intact.

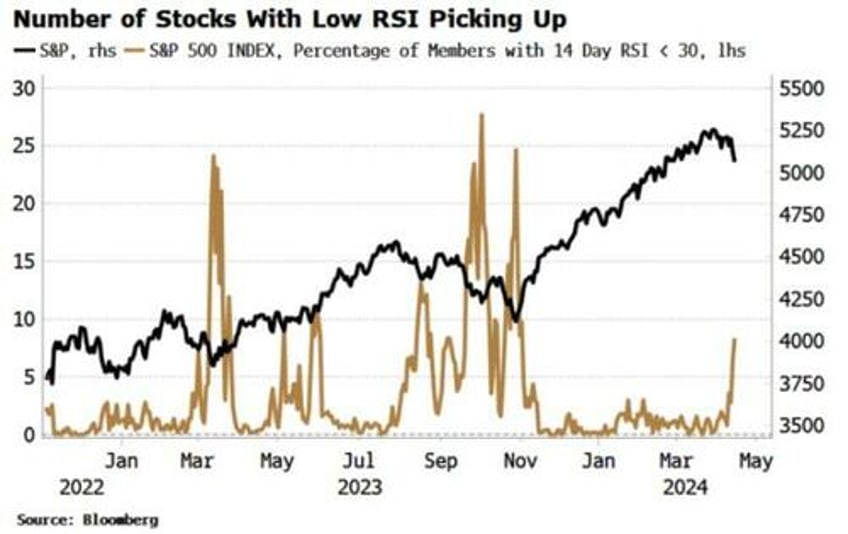

Breadth measures for the US market have in many cases deteriorated to levels last seen in November. The net number of stocks on the NYSE making new highs has fallen to its November lows, and the same for the S&P 500 advance-decline line. The percentage of S&P stocks with their RSI below 30 has hit six-month highs.

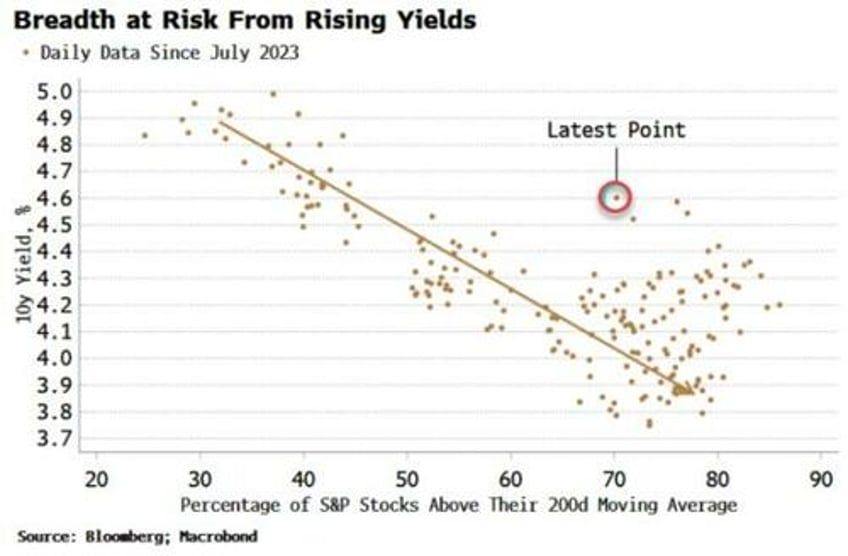

Higher yields are poised to worsen the outlook. Since last summer, there has been a good inverse relationship with the 10-year yield and the percentage of S&P stocks trading above their 200-day moving average. Breadth on this measure is currently higher than the straight-line relationship would imply, and further rises in yields potentially mean more S&P stocks will weaken.

Mark Cudmore has previously pointed out that higher yields in the next few weeks might be less of a problem for stocks, as they are more spurred by growth than inflation. Perhaps that will be the case, but we have not seen any capitulation yet in breadth measures, which would bring more comfort that the current downwards spasm is over.

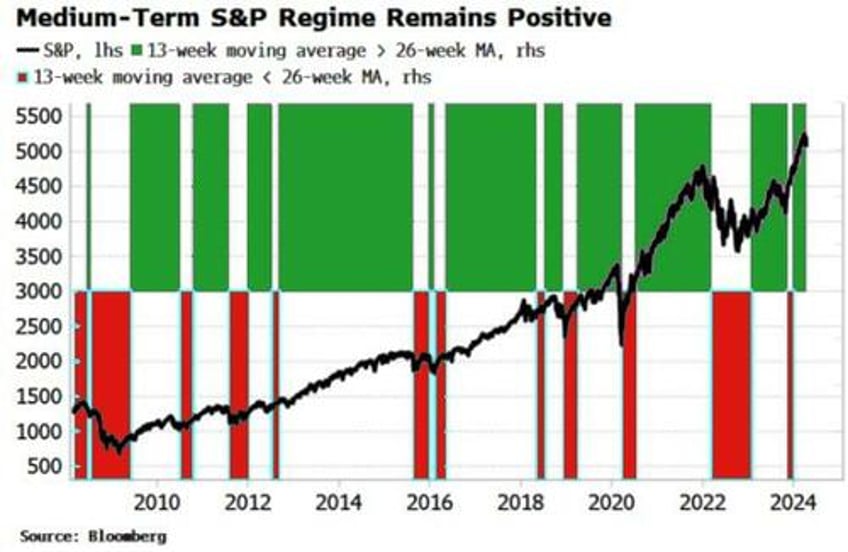

Nonetheless, the medium-term upwards trend in the market remains intact. One of the simplest and most reliable timers to tell you when to be in and out of the market is the 13 and 26-week moving average crossover for the S&P. The 13-week MA remains above the 26-week, suggesting the market remains in a positive regime over the medium term, despite shorter-term risks.

Resurgent inflation will dominate the medium and longer-term outlook for markets. While the deteriorating risk-reward of shorting Treasuries or buying gold or Bitcoin is more established, there are several other trades that are historically way offside compared to where they have been in previous inflation regimes, and therefore have the most catch-up potential.