Oil and oil stocks are overbought, but underlying supports could see them rise further before profit taking drives prices lower.

In June I laid out the case for why oil’s extended slump was likely over. Since then WTI is up over 30%, with prices near a one-year high.

Getting into a trade is comparatively the easy part, it’s knowing when to get out that’s the hard part. Unfortunately that’s the case with oil today, with it being overbought in the short term, but with still strong underlying supports which could mean it rises further.

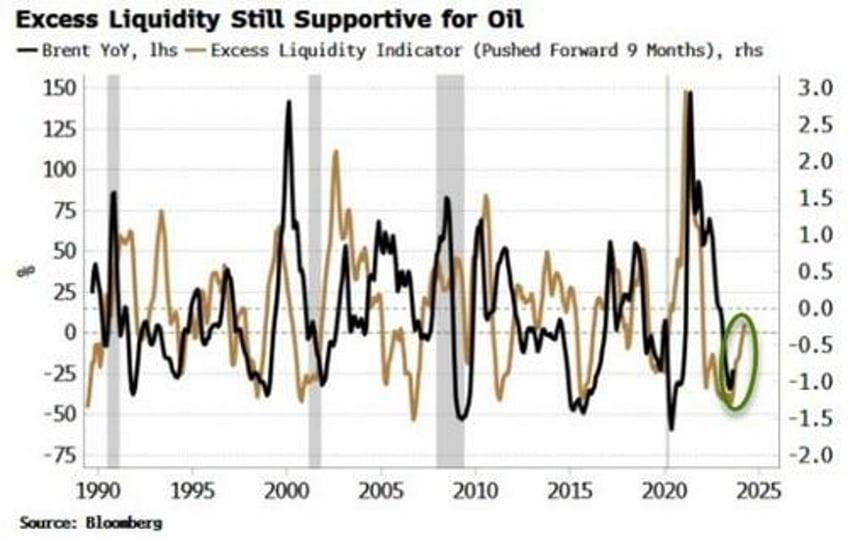

Rising excess liquidity was one of the main factors pointing to higher oil in June.

Over the longer-term, supply and demand are the ultimate arbiter of commodity prices, but over the medium term (~3-6 months) excess liquidity - the difference between real money growth and economic growth in dollar terms - is a key driver.

Excess liquidity has yet to turn lower, as inflation remains low and tailwinds from previous dollar weakness persist, which should keep oil supported for now.

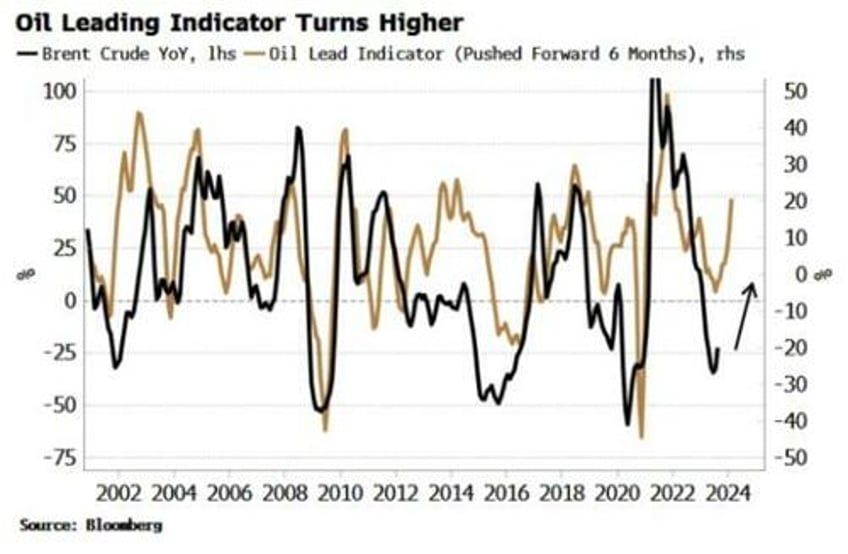

My indicator for oil, which leads oil prices by six months, had started to turn up in June, and has continued to rise, in another positive for oil in the medium term.

The US has been drawing down on its strategic reserves, while China has been scooping up barrels to add to its stockpiles, at the same time as OPEC+ and Saudi Arabia have cut production.

All of which dovetail with the excess liquidity picture to create a continued positive backdrop for crude.

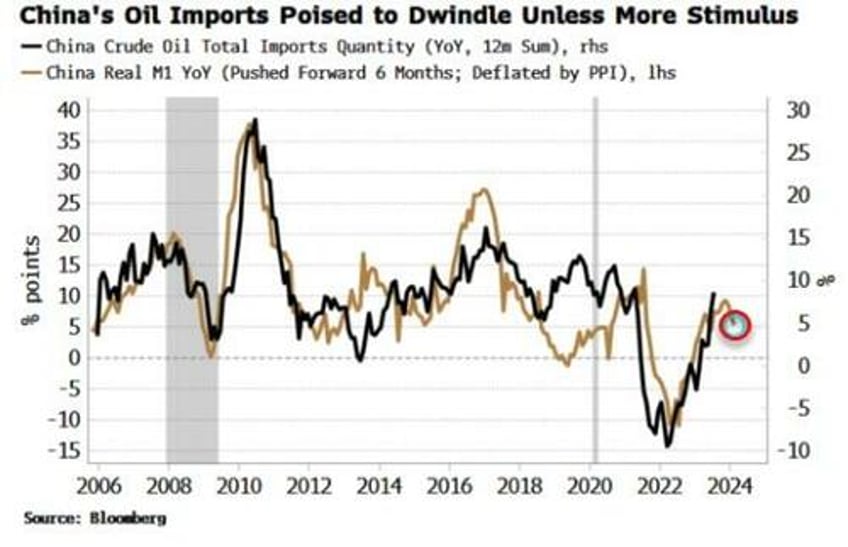

One caveat is that China’s demand may wane unless stimulus soon begins to pick up. Real money growth, which leads China’s oil imports, has turned lower.

Nonetheless, on shorter-term time scales oil and oil stocks are overbought. Whether we look at RSIs, MACDs, Bollingers, etc, oil is stretched to the upside, and is vulnerable to correcting lower.

Moreover sentiment has moved from extremely negative back in June, to considerably more positive.

But markets have a habit of overshooting, and given the still-friendly supports it’s conceivable oil becomes more overbought - especially as the net long in speculative positioning is not yet at extremes.