If this week's 3Y auction was subpar, yesterday's 10Y was mediocre, then today's 30Y auction was an absolute stunner. In fact, one could saw it was the strongest 30Y auction on record.

Starting at the top, the high yield was 4.389%, up sharply from last month's 4.015% and the highest since July's 4.405%. But that was not a surprise to the market, where the When Issued had already been trading around 4.404%, meaning the auction stopped through by 1.5bps, the first non-tailing 30Y auction since June.

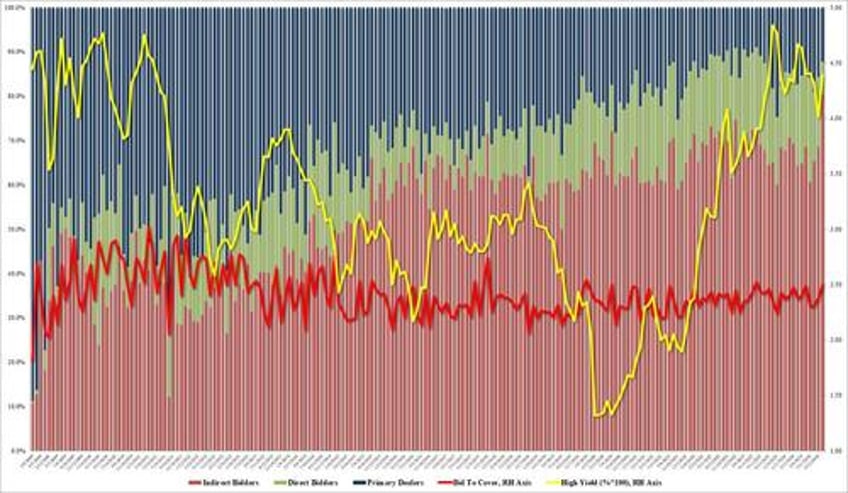

The bid to cover was 2.50, up sharply from 2.38 in September and the highest since June 2023. Needless to say, it was well above the recent average.

But the internals were where the auction truly shocked, because Indirects soared from 68.7% to a whopping 80.5%, the highest on record, as foreign central banks and various other entities just couldn't get enough paper.

And with less than 20% left for other participants, Directs took down just 7.6%, the lowest since 2018, leaving Dealers holding 12.2% of the final allocation, the lowest since July 2023.

And that's what the strongest 30Y auction - certainly in recent history, perhaps on record - looks like. Not surprisingly, with yields rising to session highs just ahead of the auction result, we have seen yields slide by about 3bps since as the market was clearly surprised with just how much demand there is for long-dated paper, suggesting that while the Fed may indeed slow down its easing cadence for a few months, it will eventually have to be much more aggressive in monetizing US debt at a time when both Kamala and Trump promise to pump tens of trillions more debt in the coming years.