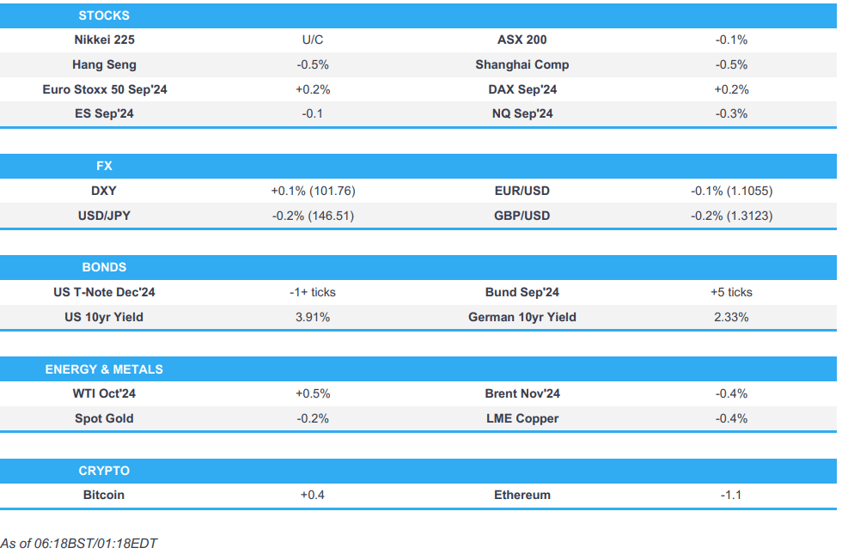

- APAC stocks eventually faltered and traded in the red across the board, albeit with losses somewhat limited amid cautious trade ahead of the US return.

- DXY remained in a tight range, JPY outperformed and Antipodeans lagged as risk tilted lower.

- China Commerce Ministry, in response to Canada's tariffs on Chinese products, said China to initiate an anti-dumping investigation into canola imports from Canada,

- European equity futures are indicative of a subdued open with Euro Stoxx 50 future -0.1% after cash closed +0.3% on Monday.

- Looking ahead, highlights include Swiss CPI, GDP (Q2), US PMI (F), ISM Manufacturing, BoE’s Breeden, Supply from Germany, and Earnings from Darktrace, DS Smith, and Ashtead.

- Click here for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES - Closed on Monday due to Labor Day

NOTABLE HEADLINES

- Intel (INTC) and Japan will establish a research and development hub for advanced semiconductor manufacturing equipment in Japan, according to Nikkei.

APAC TRADE

EQUITIES

- APAC stocks eventually faltered and traded in the red across the board, albeit with losses somewhat limited amid cautious trade ahead of the US return and accompanying risk events, such as ISM Manufacturing today and NFP on Friday.

- ASX 200 saw mild pressure from its Consumer Staples and Mining stocks, but losses are cushioned by Tech, Telecoms, and Energy.

- Nikkei 225 was initially firmer amid the weaker JPY with the upside is led by the Industrial sector, however, gains later trimmed as the JPY gained ground.

- Hang Seng and Shanghai Comp were subdued and in-fitting with a broader risk tone with pressure in Real Estate continuing to be a grey cloud over the nation, whilst PBoC liquidity injections get more and more tepid.

- US equity futures tilted lower after the Chinese cash open following initial sideways trade, with the contracts looking forward to the return of US participants ahead of ISM Manufacturing PMI.

- European equity futures are indicative of a subdued open with Euro Stoxx 50 future -0.1% after cash closed +0.3% on Monday.

FX

- DXY remained in a tight 101.64-73 parameter amid a lack of catalysts and within yesterday's narrow 101.56-79 range. Friday's range stands at 101.24-78, thus the 101.78-79 region could see some resistance.

- EUR/USD was uneventful and largely moving in tandem with the Dollar. The pair resided in a 1.1059-72 range and within yesterday's 1.1040-77 parameter.

- GBP/USD experienced a similar theme to what was seen in the EUR, with GBP moving at the whim of the buck without major catalysts. No move was seen on higher BRC total/retail Sales and an improvement in UK Barclaycard spending. Traders look ahead to BoE's Breeden. That being said, a tilt lower was seen as risk gradually deteriorated throughout the session.

- USD/JPY traded on either side of the 147.00 market after hovering just under the level of the European close yesterday. The pair tilted lower and hit session lows alongside risk sentiment.

- Antipodeans underperformed amid the glum mood in China coupled with a slide in iron ore prices overnight. CAD was also softer amid its high-beta properties alongside reports that China is to initiate an anti-dumping investigation into canola imports from Canada.

- PBoC set USD/CNY mid-point at 7.1112 vs exp. 7.1120 (prev. 7.1127)

FIXED INCOME

- 10-year UST futures gradually edged higher as risk in APAC tilted to the downside.

- Bund futures saw horizontal APAC trade thus far following the Monday European underperformance after German state elections on the weekend.

- 10-year JGB futures eventually fell after the results from the 10-year JGB auction, which although better than the prior 10-year last month, was nowhere near as strong as the 2-year action seen on August 29th. Expectations heading into the auction may have been for a similarly strong tap.

- Japan sold JPY 2.6tln 10-year JGB; b/c 3.17x (prev. 2.98x), average yield 0.915% (prev. 0.926%).

COMMODITIES

- Crude futures traded subdued but with a discrepancy in intraday changes amid a lack of WTI settlement yesterday on account of the US holiday. Aside from that, newsflow for the complex remained light as eyes remain on geopolitics and China's economic health for the time being.

- Spot gold traded softer amid broader losses in metals and as the DXY tilted higher, but the yellow metal also looked heavy following a more convincing downward breach of the USD 2,500/oz level. Spot gold found support near yesterday's low (USD 2,489.93/oz.)

- Copper futures traded lower amid the cautious but softer APAC mood in the run-up to risk events, with 3M LME copper eventually losing USD 9,200/t+ status before accelerating losses. Iron ore futures overnight fell over 3%.

- Libya's NOC declared force majeure on the El Feel oil field from 2nd September, according to Reuters.

- UN hosts talks in Tripoli aimed at resolving Libya's central bank crisis, key understandings reached, according to a statement cited by Reuters.

CRYPTO

- Bitcoin traded flat overnight but remained above USD 59k.

NOTABLE ASIA-PAC HEADLINES

- South Korean Vice Finance Minister said inflation is expected to stabilize in the lower 2% range going forward, according to Reuters.

- BoK sees inflation maintaining the current stable trend for the time being, according to Reuters.

- Japan says it will spend about JPY 989bln from the reserve fund to cover energy subsidies, according to Reuters

- PBoC injected CNY 1.2bln via 7-day Reverse Repo at a maintained rate of 1.70%

DATA RECAP

- New Zealand Terms of Trade QQ (Q2) 2.1% vs. Exp. 2.2% (Prev. 5.1%)

- New Zealand Import Prices SA (Q2) 3.1% vs. Exp. 0.5% (Prev. -5.1%)

- New Zealand Export Prices SA (Q2) 5.2% vs. Exp. 2.8% (Prev. -0.3%)

- New Zealand Export Volumes SA (Q2) -4.3% vs. Exp. -2.7% (Prev. 6.3%)

- Australian Current Account Balance SA (Q2) -10.7B AU vs. Exp. -5.9B AU (Prev. -4.9B AU)

- Australian Net Exports Contribution (Q2) 0.2% vs. Exp. 0.6% (Prev. -0.9%)

- South Korean CPI Growth YY (Aug) 2.0% vs. Exp. 2.0% (Prev. 2.6%)

- South Korean CPI Growth MM (Aug) 0.4% vs. Exp. 0.3% (Prev. 0.3%)

- Japanese Monetary Base YY (Aug) 0.6% (Prev. 1.0%)

GEOPOLITICS

MIDDLE EAST

- "Israel Today: The security establishment is considering declaring the West Bank a zone of military security operations", according to Sky News Arabia.

- On the Israel-Hamas talks, "Sources: The US administration is not particularly optimistic about the chances of success of the new outline, even in light of the declarations made by both sides", according to Kann News

- US President Biden said they are still in the middle of ceasefire and hostage-deal negotiations, according to Reuters.

- Two oil tankers, one Saudi-flagged and the other Panama-flagged, were attacked on Monday in the Red Sea off Yemen, according to Reuters sources.

OTHER

- China Commerce Ministry, in response to Canada's tariffs on Chinese products, said China to initiate an anti-dumping investigation into canola imports from Canada, according to Reuters.

EU/UK

NOTABLE HEADLINES

- ECB decisions look set to become more contentious once interest rates fall to about 3%, according to Bloomberg sources.

DATA RECAP

- UK Barclaycard Consumer Spending YY (Aug) +1.0% (Prev. -0.3%)

- UK BRC Total Sales YY (Aug) 1.0% (Prev. +0.5%); LFL Sales +0.8% (Prev. +0.3%)

- UK BRC Retail Sales YY (Aug) 0.8% (Prev. 0.3%)

LATAM

- Venezuelan Attorney General said arrest warrant issued for opposition leader Gonzalez, according to Reuters.

- US reportedly drafts sanctions against Venezuelans over the disputed elections, according to Bloomberg