After one subpar 3Y auction, and one average 10Y auction, we closed out the week's coupon issuance with a 30Y auction that, like this morning's CPI, was mixed, with a solid bid to cover, offset by a modest tail, a big drop in indirect demand, and the highest yield in over 12 years.

The auction stopped at a high yield of 4.345%, up from 4.189% in August, and the highest yield since May 2011; it also tailed the When Issued 4.335% by 1 basis point, the third consecutive tail.

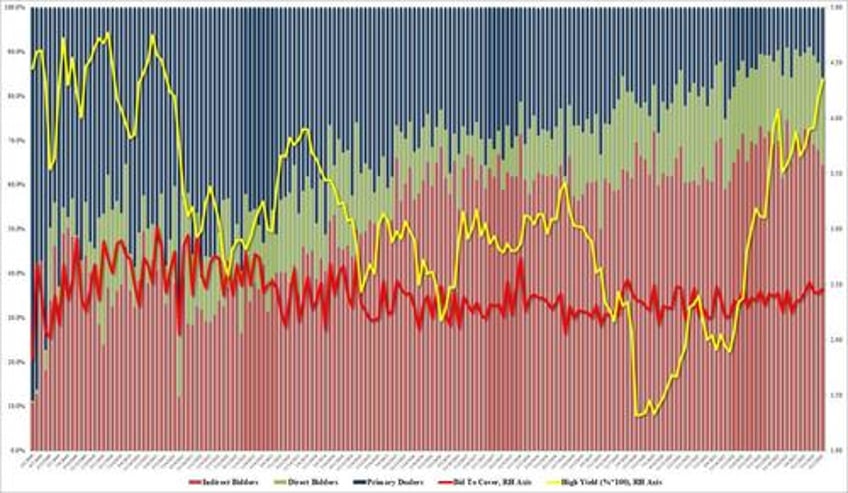

The bid to cover was 2.461, above last month's 2.418 and the highest since June; it was also above the six auction average of 2.418%.

The internals were weaker, with foreign buyers awarded just 64.5%, the lowest since December 2021. And with Directs taking down 19.7%, or roughly in line with the recent average of 19.1%, Dealers were left holding 15.6%, the highest since February to cover the shortfall of foreign buyers who pulled back.

Overall, this was a mixed auction, which could have been better but was certainly good enough, and has helped pushed 10Y yields near session lows.