Moments ago, the Treasury conducted the week's final coupon auction when it sold $35BN in 7 Year paper in what was another mediocre auction following this week's just as medicore sales of 3Y and 5Y paper.

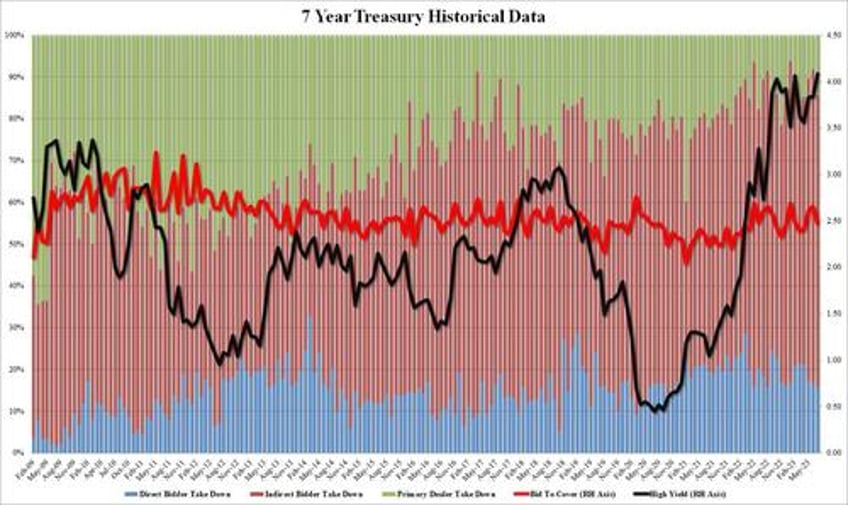

The auction stopped at a high yield of 4.087% which was the highest yield in the history of the 7Y auction; it also tailed the When Issued 4.074% by 1.3bps, the 7th tail in the past 10 auctions.

The bid to cover of 2.479 was below last month's 2.653 and also below the six-auction average of 2.542, if smack in the middle of the long-term range over the past decade which has been between 2.25 and 2.75.

The internals were also on the soft side, with Indirects awarded 69.75%, below last month's 75.31%, but just above the recent auction average of 69.6%. And with Directs awarded 15.9%, Dealers were left holding 14.3% of the auction, well above last month's 8.1%.

Overall, this was a mediocre, forgettable auction in line with this week's average offerings. As for the spike in 10Y yields just after the auction priced, it had nothing to do with the auction results and everything to do with a Nikkei report that a report from the Nikkei that the Bank of Japan will discuss tweaking its yield curve control policy at a policy board meeting (spoiler alert: it will discuss it and do nothing about it, since it still remembers vividly just how catastrophically the market reacted to its latest YCC tweak at the end of 2022 when the BOJ had to spend hundreds of billions to avoid a collapse in the JGB market.