The last coupon auction of the week is now in the history books, and for long-suffering bond traders it couldn't come a minute sooner.

After two solid bond sales earlier this week, moments ago the Treasury offloaded another $37BN in 7Y paper, in what was at best a mediocre affair.

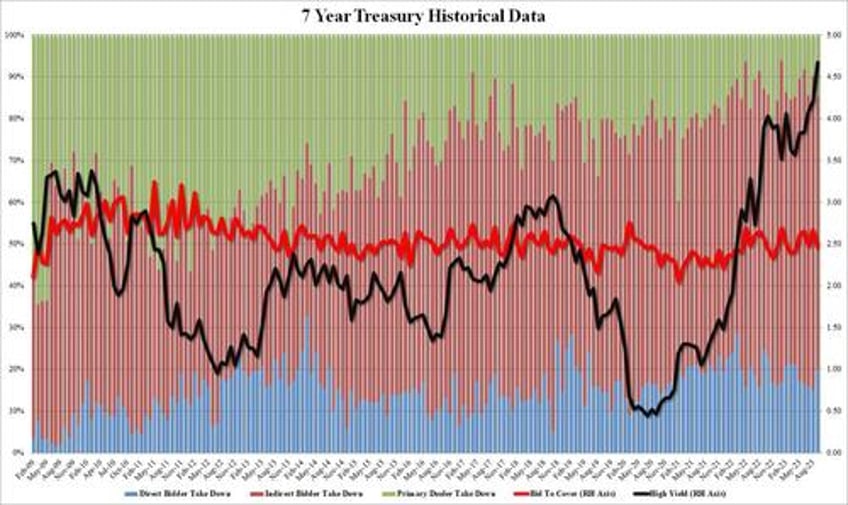

Pricing at a high yield of 4.673%, this was the highest stop on record...

... up a whopping 46bps from the 4.212 in August, and also tailed the When Issued 4.670% by 0.3bps.

The bid to cover of 2.465 was below last month's 2.663 and was also the lowest since April, thus well below the six-auction average of 2.535.

The internals were a mixed bag at best, with Indirects taking down 65.5%, down a big 10bps from last month's 75.3%, and with Directs awarded 19.9%, the highest since April above the recent average of 17.9%, Dealers were left holding 14.6%, also the highest since April.

Overall, today's subpar auction was a fitting farewell for what has been a catastrophic week for duration, and the only good news is that we now have almost two weeks until the next batch of duration in the form of 3Y, 10Y and 30Y in early October, only don't expect these to be accompanies by macro data: after all the government is about to be shut down for a long time.