Target's shares slumped in premarket trading in New York after the retailer's comparable sales missed Wall Street's consensus estimates for the quarter that ended May 4. This comes as Goldman analysts have warned about faltering low-income consumers in the era of failed Bidenomics.

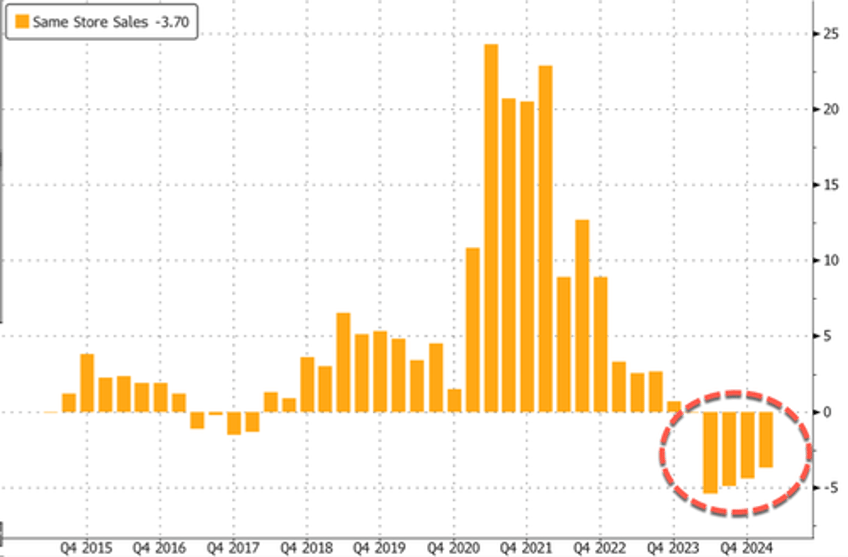

Comparable sales—those from stores or digital channels operating for at least 12 months—declined 3.7% in the quarter and were mostly in line with what analysts tracked by Bloomberg estimated. This was the fourth consecutive quarter of declines. However, digital sales offset brick-and-mortar comparable-store declines and lower foot traffic.

Here's a snapshot of the quarter (courtesy of Bloomberg):

Comparable sales -3.7%, estimate -3.68%

Comp digital sales +1.4% vs. -3.4% y/y, estimate -0.73%

Sales $24.14 billion, -3.2% y/y, estimate $24.13 billion

Gross margin 27.7% vs. 26.3% y/y, estimate 27.4%

Ebit $1.33 billion, -1.9% y/y

Ebitda $2.04 billion, +1.2% y/y, estimate $1.97 billion

Customer transactions -1.9% vs. +0.9% y/y

Average transaction amount -1.9% vs. -0.9% y/y, estimate -1.9%

Total stores 1,963, +0.5% y/y, estimate 1,966

Operating margin 5.3% vs. 5.2% y/y, estimate 5.34%

SG&A expense $5.17 billion, +2.8% y/y, estimate $5.07 billion

Store comparable sales -4.8% vs. +0.7% y/y, estimate -4.65%

Stores originated sales 81.7% vs. 82.5% y/y, estimate 81%

Adjusted EPS $2.03 vs. $2.05 y/y, estimate $2.05

Operating income $1.30 billion, -2.4% y/y, estimate $1.3 billion

Here's Goldman trading desk take on the earnings report:

Surprising operating margin miss: We think expectations were for comp sales to be -3.5% and they did a -3.7%. That is not the end of the world but everyone we heard from unanimously expected an operating margin beat, both bulls and bears. Instead, it was a miss. While small in magnitude to EPS, it will have shares down, as the bull case was built on operating margin upside with a sales inflection. It is not a total thesis changer, but certainly a step back in a tougher macro.

Details: 1Q EPS of $2.03 vs Consensus $2.06 on in-line sales and in-line comp sales. Gross margins did beat pretty handily, with SG&A a miss and driving the modest operating margin downside. Guides 2Q EPS largely in-line with a $2.15 (mid) vs Consensus $2.20 on comps of 0 to +2% vs Consensus +1.5%. Reaffirming the FY guide.

The retailer reaffirmed guidance for the full year:

Still sees adjusted EPS of $8.60 to $9.60, estimated at $9.44

Still sees comparable sales flat to up 2%, estimate +0.9%

Target Chief Executive Brian Cornell told reporters that high prices are hurting the wallets of customers.

"We remain cautious in our near-term growth outlook," Christina Hennington, the company's chief growth officer, said.

Hennington said discretionary spending would be under pressure in the coming months, adding demand for appliances and home products languishes. However, she noted apparel demand is improving.

To mitigate further sales declines, Target is following Walmart's lead by lowering prices for cash-strapped consumers. The company said earlier this week that it would reduce prices on thousands of products this summer.

It's not just Target and Walmart slashing prices. McDonald's recently entertained the idea of returning $5 meal deals again because low-income people are broke.

Covering the faltering consumer theme have been Goldman analysts:

- The Largest US Trading Desk Is "Getting Bearish On The US Consumer"

- Goldman Warns Consumers Are Cracking As Stagflation Threats Emerge

- Goldman's Commentary On Consumer Health Is An Ominous One

Target is also facing a boycott over its LGBTQ-themed products. Execs have decided to remove some of these controversial products from some stores next month.

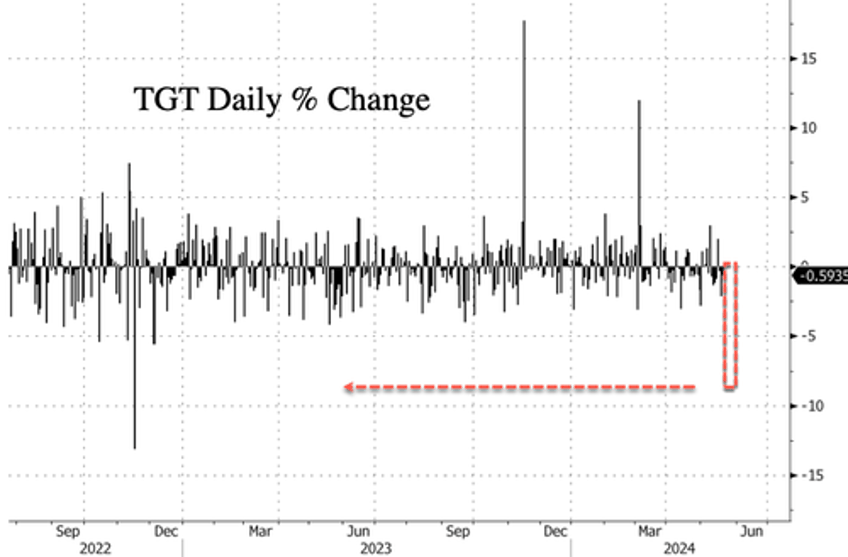

Target's shares slid nearly 8% in premarket trading.

If premarket losses hold into the cash session and settle later today, then this would be the largest daily decline in two years.

Wall Street was "underwhelmed"...

Vital Knowledge

“This isn’t a ‘bad’ report, and it really shouldn’t be called anything other than ‘in-line,’ but vs. Walmart last week, Target clearly lagged behind expectations,” analyst Adam Crisafulli writes

Walmart’s results demonstrate how it is using its “enormous scale and huge grocery franchise to drive traffic and capture [market] share at a time when consumers are feeling increased stress,” he says

RBC (outperform, PT $191)

“1Q results were generally in-line with consensus, but as feared, fell short of heightened investor expectations,” analyst Steven Shemesh writes

Thinks buyside was looking for 1Q comp. decline of around 3.5% vs Target’s reported comp. decline of 3.7%, and EPS of $2.03 was “well below” buyside expectations of $2.15+ due to sales deleveraging, continued investments in pay/benefits and higher marketing spend

“We’ll look for additional detail on the call, but at first glance - consensus is likely to remain unchanged, though buyside expectations will likely drift lower, putting pressure on shares,” according to Shemesh

“Shorter-term investor positioning could start to fade given ongoing pressure on comp. sales and Target being “seemingly in the latter innings of the margin recapture story”

Bloomberg Intelligence

“Reiteration of full-year same-store sales and adjusted EPS guidance suggests it will need to see growth accelerate as the year progresses, which may be tough given low discretionary spending,” analyst Jennifer Bartashus writes

Bartashus is encouraged by improving margins, but recently announced price cuts could add pressure, while “persistently weak in-store visits are a concern”

Morgan Stanley (overweight)

“One could argue the EPS bull case for 2024 of 6%+ EBIT margins and significant EPS upside may be less likely,” which may explain the premarket stock decline, analyst Simeon Gutman writes

1Q comparable sales expectations were appropriately “subdued” but investors still expected “meaningful EPS upside” in the quarter driven by gross margin, but higher SG&A offset the gross margin upside and resulted in below-consensus EBIT dollars

The reason for the SG&A miss is unclear, and more details on that, as well as management’s tone around the 2Q sales trajectory will be helpful in “framing the overall story”

Gutman would have thought the flat to +2% 2Q comp. growth forecast would have been good enough to push shares higher today, given Target’s recent pullback in response to slowing consumer spending

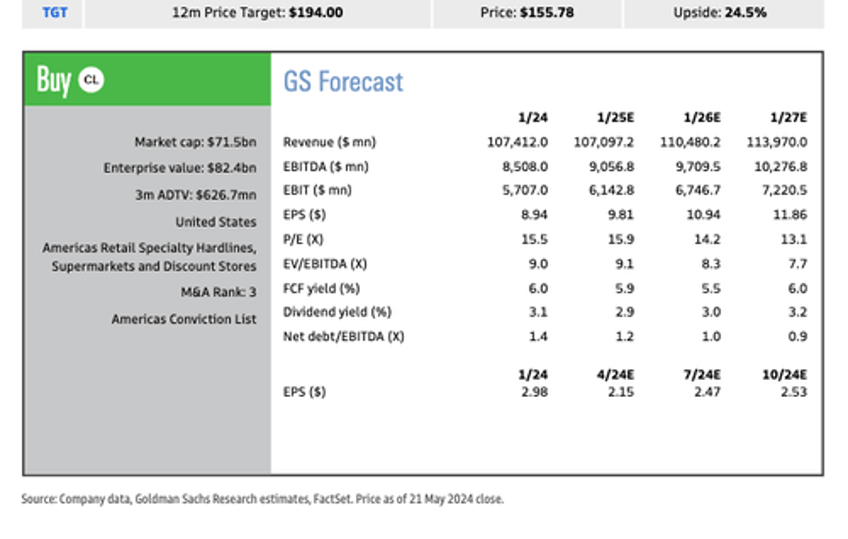

And finally, Goldman's Kate McShane commented on earnings and price action in premarket trading:

The stock is currently down ~7% in the pre-market. On the call, we are interested in the cadence of SSS throughout 1Q; QTD trends by category; the relative impact of the gross margin drivers, including markdowns, mix, and shrink; the view of inflation; details on its inventory position; and the company's promotional outlook. target of $194, based on our risk-reward framework with downside/base/upside relative P/E multiples of 80%/85%/90%.

McShane's team laid out their valuation for the retail following the report:

- We are Buy rated on TGT with a 12-month price target of $194, based on our risk-reward framework with downside/base/upside relative P/E multiples of 80%/85%/90%.

Also, they outlined four downside risks:

- Traffic and sales trends decelerate due to weakness in consumer spending;

- Inflationary pressures related to product costs, freight/transportation, and/or wages;

- The competitive environment forces TGT to compete more aggressively on price;

- Margins come under pressure from omni-channel, supply chain investments, and mix shift.

Consumers pulling back on discretionary spending is an ominous sign.