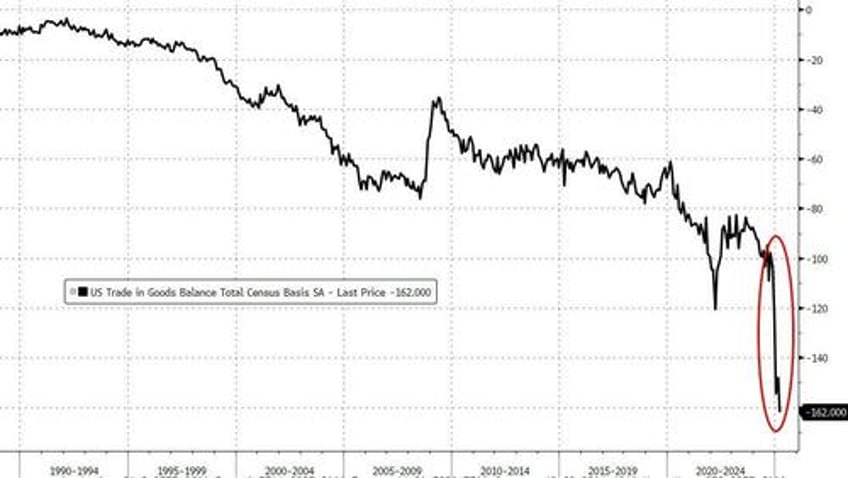

The US merchandise-trade deficit unexpectedly widened in March to a record as companies continued importing goods to get ahead of tariffs.

The shortfall in goods trade grew 9.6% from a month earlier to $162 billion, Commerce Department data showed Tuesday.

Imports rose 5% to $342.7 billion, led by consumer goods, while exports increased 1.2% as firms scrambled to get ahead of President Trump's 'Liberation Day' tariffs...

Imports of consumer goods surged 27.5%, while inbound shipments of motor vehicles and capital goods also increased.

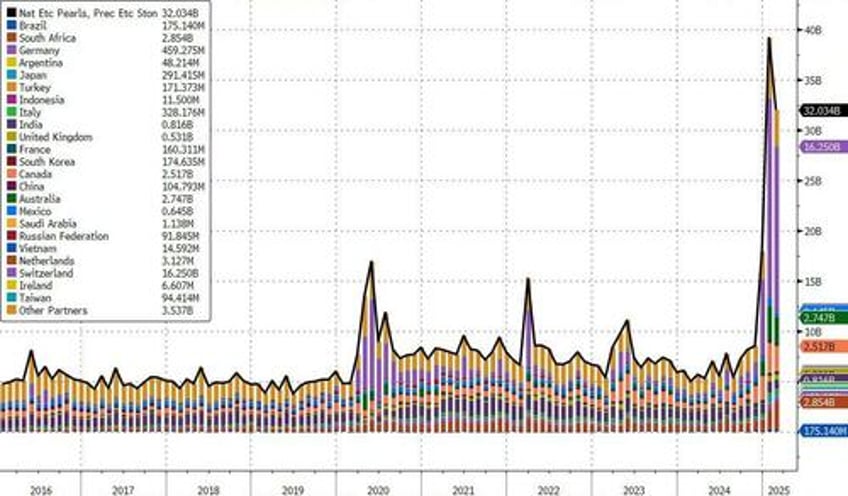

Because this is the 'advance' data release, there is no data for individual nation trade balances or how gold imports have shifted. Remember, gold imports had been soaring through February...

...and blowing up economists' models of GDP growth.

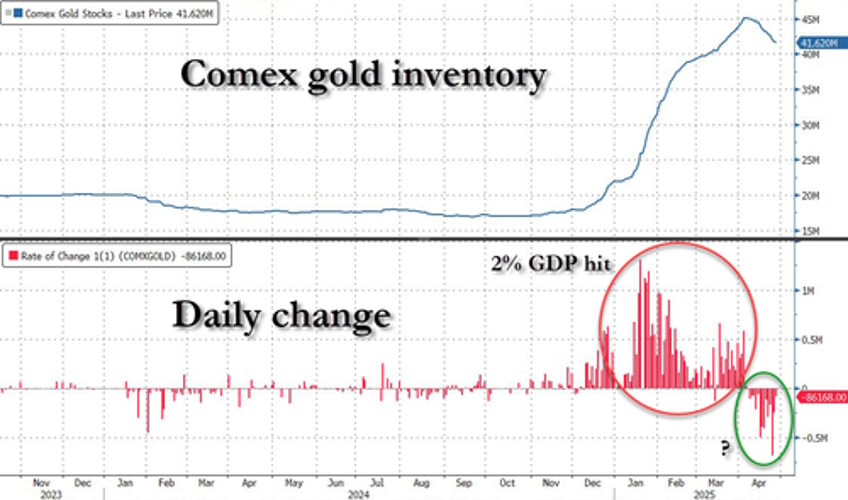

What we do know is that gold inventories at COMEX have been falling in March, suggesting a slowdown in imports... which will juice GDP forecasts (further confounding all the PhDs)

Finally, we note that Tuesday’s Commerce Department report also showed stockpiles at wholesalers increased 0.5%. Retail inventories fell 0.1% last month, reflecting a decline at car dealers.