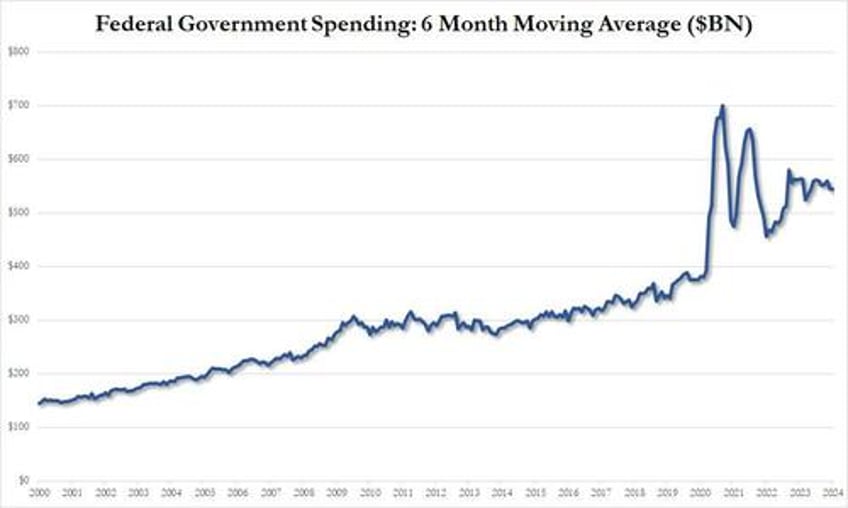

Anyone who has been following the monthly data on government receipts and outlays will know that while US government spending has "stabilized" around half a trillion every month, a staggering amount for a nation that now spends more than a trillion every year on interest expense alone, and which will grow to $1 trillion per month in ten years at the current rate...

... has probably expressed great concern at the unexpected collapse in government receipt (remember when this was supposed to "normalize" last November when California taxes were supposed to finally come in but didn't, good times) which according to the latest budget statement are down a staggering 6.2% YoY. Two things here: i) every time US tax receipts have declined, the US was in, or about to enter, a recession; and ii) the last three times tax receipts fell this low, was after the tech bubble and the credit bubble burst, and after Covid shut down the global economy for 3 months.