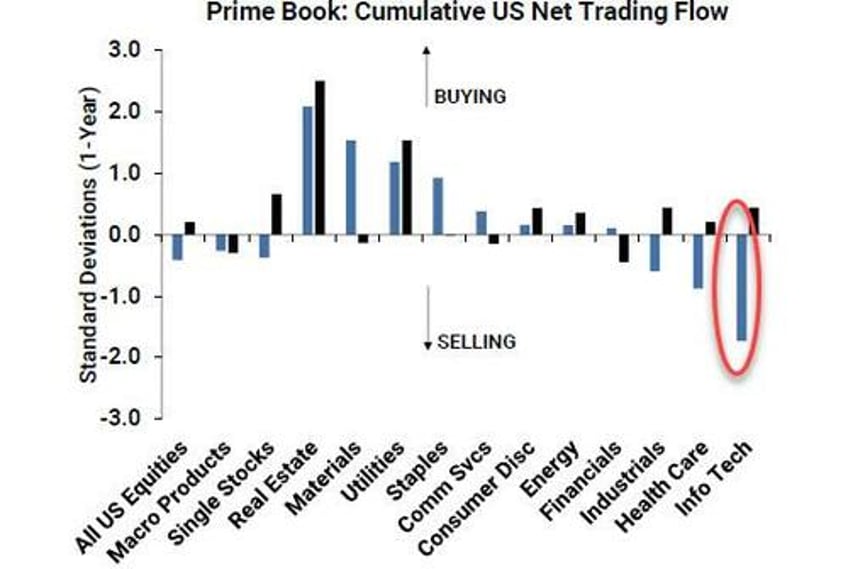

Back in late February, we first pointed out something concerning for the neverending tech meltup: after a 6-week buying streak, hedge funds "unloaded Tech stocks at the fastest pace in 7+ months, as the sector was net sold for 4 straight sessions including Thurs post NVDA results." Not only did they sell, they couldn't wait to do it, and the intensity of the selling ranked in the 98th percentile of the past five years according to Goldman Prime.

To Bloomberg, which picked up on the Goldman note shortly after us, the data suggests that "traders are booking profits on their tech wagers after a six-week buying streak and putting that extra cash into less volatile stocks", such as consumer staples. Companies that make household products saw the most net buying in 10 weeks, according to Goldman’s prime brokerage.