Increasing power and raw-material demand from new technology such as generative AI and EVs is likely to be a secular tailwind for commodities and thus an impediment to a return to a low-and-stable inflation regime. Energy stocks are likely to outperform.

Tech is hungry for power.

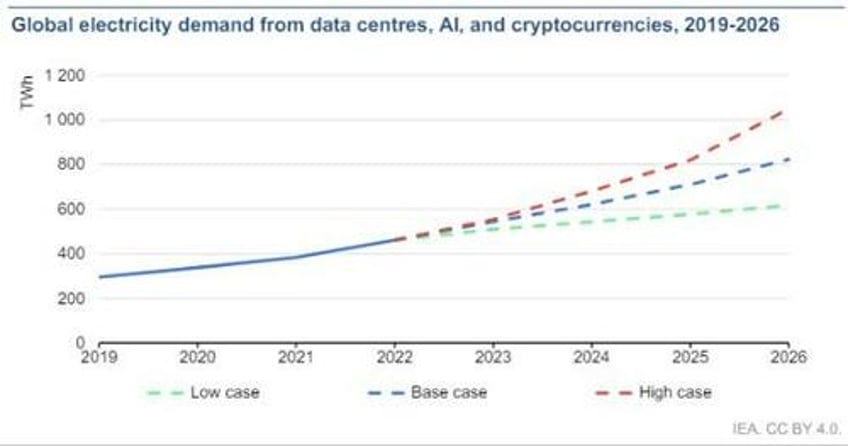

Figuratively speaking, arguably many of the largest firms presiding over monopolies already have a lot of it. But literally, the need for power to run AI models and data centers is rising rapidly. The IEA estimates global electricity demand from AI and traditional data-centers plus cryptocurrencies could almost double in their base case and see almost a 150% rise in their high case by 2026.

Source: IEA

This will put tremendous strain on Western power grids which are already running at close to capacity, as well as increasing demand for oil and gas.

Compounding the problem is many of the top tech firms’ commitment to being carbon free by 2030 (several are already carbon neutral). That means they require a rising share of their power from renewable sources, such as wind and solar, putting pressure under commodity prices such as copper and silver.

Commodities are already on the rise this year. The Bloomberg Commodities Index is up almost 12% since February, while almost all major exchange-traded commodity futures have risen over the last three months. Non-exchange traded commodities have begun to rise too.

We may be soon on the cusp of the another commodity-driven increase in inflation similar to 2020/2021 if the price increases continue.

That’s also likely to be beneficial for energy stocks.

The biggest rises in CPI over the past 80 years, in the 1940s, the 1970s, and the 2020s, have seen the energy equity sector leading the market.

Better efficiencies with energy production and power usage may ameliorate some of the expansive demand expected from tech companies. But as the recent supply-driven short-squeeze in copper shows, bottlenecks are an ongoing risk across the commodity complex.

With CPI already elevated and price-growth expectations rising, it wouldn’t take much for central banks’ inflation headache to develop into a migraine.