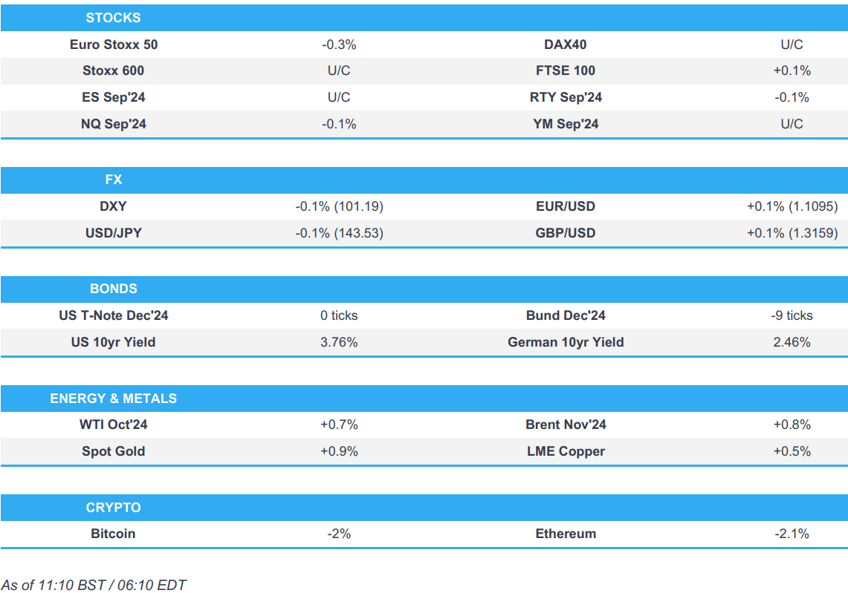

- European equities are mixed; US futures trade tentatively on either side of the unchanged mark

- Dollar is slightly lower, JPY once again on a firmer footing, EUR saw modest strength on strong German Industrial Orders

- USTs are flat ahead of today’s US data deluge, Bunds edge lower

- Crude is firmer, XAU benefits from the softer Dollar and base metals are mixed

- Looking ahead, US Challenger Layoffs, ADP National Employment, IJC, ISM Services

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (U/C) began the session entirely in the red, but sentiment improved soon after the cash open, with indices now displaying more of a mixed picture.

- European sectors are mixed, having opened with a negative bias. Utilities takes the top spot, alongside Real Estate whilst Consumer Products lags.

- US Equity Futures (ES U/C, NQ -0.1%, RTY -0.1%) are mixed, but with sentiment seemingly stabilising after this week's glum price action. Today’s docket is packed with key US data; jobs (Challenger Layoffs, ADP, IJC), activity (PMIs, ISM Services).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is slightly lower and trading within a narrow 101.14-35 range and towards the bottom end of the prior day’s confines. A busy US data slate ahead; US Challenger Layoffs kicks things off, ahead of ADP Employment, IJC, PMI (F) and the key ISM Services data

- EUR is incrementally firmer and trading towards the upper end of today’s 1.1076-1.11 range. Today’s much stronger-than-expected Industrials Orders sparked modest strength in the Single-Currency, whilst EZ Construction PMIs passed through without having an impact.

- GBP is trading on a slightly firmer footing and near today’s high at 1.3172; UK-specific newsflow light.

- JPY is slightly firmer, having pared most of its early morning strength, largely a factor of a more improved risk-tone vs the prior 2 sessions. Overnight strength was also a factor of a higher-than-expected Labour Cash Earnings print.

- Antipodeans are flat/firmer, in what has been a lacklustre session for the pair thus far.

- PBoC set USD/CNY mid-point at 7.0989 vs exp. 7.1010 (prev. 7.1148); strongest level since Apr 15th

- Reuters Poll, FX: bullish bets have increased for most Asian FX.

- Click for a detailed summary

FIXED INCOME

- USTs are flat ahead of a packed and potentially pivotal afternoon agenda. From which, the labour market data points will take centre stage and be scrutinised in the context of Friday’s Payrolls. USTs are just off Wednesday’s JOLTS-driven highs at 114-18.

- Bunds ultimately trade lower, but with price action choppy. Modest two-way action was seen on the latest German Industrial Orders, which came in significantly above forecasts. Bunds are yet to make much headway above the 134.00 mark, current high at 134.26.

- Gilts are slightly firmer, but ultimately rangebound ahead of the busy data docket. A strong UK auction had little impact on the benchmark. Gilts are holding just above Wednesday’s 99.53 high.

- OATs were weighed on by a hefty supply docket from both France and Spain; both passed without any real reaction.

- Spain sells EUR 6bln vs exp. EUR 5-6bln 2.50% 2027, 3.50% 2029, 3.45% 2034 Bono & EUR vs exp. EUR 0.25-0.75bln 1.00% 2030 I/L:

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 3.29x (prev. 2.87x), average yield 3.811% (prev. 3.854%) & tail 0.9bps (prev. 0.9bps)

- France sells EUR 11.99bln vs exp. 10-12bln 3.0% 2034, 1.25% 2036, 0.5% 2040 and 3.25% 2055 OATs:

- Click for a detailed summary

COMMODITIES

- Crude is firmer, having found a bit of a floor from the marked declines WTD. A slight recovery was assisted by the private inventory report last night. Brent'Nov as high as USD 73.46/bbl.

- Spot gold is back above USD 2500/oz, benefitting from pressure in the USD and the relatively contained yield environment/risk tone in western markets; notable, further support stemming from China where yields are pressured by RRR talk from the PBoC.

- Base metals are benefitting from the steady risk tone and softer USD. Though, as with precious peers, it remains to be seen what the macro backdrop will be following the afternoon’s US data deluge.

- US Private Inventory (bbls): Crude -7.4mln (exp. -1.0mln), Distillate -0.4mln (exp. +0.5mln), Gasoline -0.3mln (exp. -0.7mln), Cushing -0.8mln (prev. -0.49mln).

- Russian President Putin on expiration of deal on Russian gas to Europe via Ukraine after Dec 31 2024, "we do reject this transit, seek to maintain gas supply contracts, if Ukraine ditches this transit we cannot force it to keep it"

- UAE's ADNOC sets the October Murban OSP at USD 77.94/bbl.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Industrial Orders MM (Jul) 2.9% vs. Exp. -1.5% (Prev. 3.9%)

- EU HCOB Construction PMI (Aug) 41.4 (Prev. 41.4); Italian HCOB Construction PMI (Aug) 46.6 (Prev. 45.0); French HCOB Construction PMI (Aug) 40.1 (Prev. 39.7); German HCOB Construction PMI (Aug) 38.9 (Prev. 40.0)

- UK S&P Global Construction PMI (Aug) 53.6 vs. Exp. 54.9 (Prev. 55.3)

- EU Retail Sales MM(Jul) 0.1% vs. Exp. 0.1% (Prev. -0.3%, Rev. -0.4%); Retail Sales YY (Jul) -0.1% vs. Exp. 0.1% (Prev. -0.3%, Rev. -0.4%)

NOTABLE EUROPEAN HEADLINES

- ASML (ASML NA) CEO repeated 2024 and 2025 guidance and said the chip market recovery is uneven.

- BoE Monthly Decision Maker Panel data August 2024; inflation expectations 1-yr 2.7% (prev. 2.7%); 3-yr 2.7% (prev. 2.7%)

NOTABLE US HEADLINES

- US President Biden is due to speak on economic policy on Thursday 5th September at 16:00 ET/ 21:00 BST.

- Japan-US business council says they are very alarmed by any attempts to politicise the committee on foreign investments in the US review process, regarding US Steel (X) and Nippon (5401 JT)

- Verizon (VZ) to acquire Frontier Communications (FYBR); deal valued at USD 20bln, all-cash

GEOPOLITICS

- White House reportedly scrambling to put forward a new Israel-Hamas proposal; draft accord could come next week or sooner; there is a strong perception that a ceasefire is slipping away, according to Reuters sources.

CRYPTO

- Bitcoin continues to dip lower, this time beneath USD 57k; Ethereum goes as low as USD 2.4k.

APAC TRADE

- APAC stocks eventually traded mixed following the earlier mild regional gains, with the overall market tone tentative ahead of a slew of US data ahead of NFP on Friday.

- ASX 200 was kept afloat by its Tech and Real Estate sectors whilst Energy resided at the bottom.

- Nikkei 225 was choppy on either side of 37k as it saw initial pressure amid the stronger JPY, with the index later entirely trimming losses, only to falter once again.

- Hang Seng and Shanghai Comp were mixed for most of the session, Hang Seng initially saw modest gains with Banks and Real Estate initially supported following reports China mulls cutting mortgage rates in two steps to shield banks, via Bloomberg sources. That being said, the mood later waned despite a lack of catalysts, although pre-market reports suggested JPMorgan cut China stocks to Neutral from Overweight.

NOTABLE ASIA-PAC HEADLINES

- PBoC official says there is still some room for cutting the RRR. Face some constraints in further cutting deposit/lending rates. Will reasonably set the strength and pace of policy adjustments based on the economic recovery.

- JPMorgan cut China stocks to Neutral from Overweight.

- PBoC injected CNY 63.3bln via 7-day Reverse Repo at maintained rate of 1.70%

- BoJ Board Member Takata said Japan's economy is recovering moderately, though some weak signs are evident; notes significant volatility in stock and FX markets but maintains that achieving the inflation target remains within reach, and BoJ must be vigilant to the chance of renewed wave of price hikes, while taking into account impact of yen rise in early August, according to Reuters. He noted it is hard to debate at this stage to what degree BoJ can shrink its balance sheet, and hard to pin down the precise level of Japan's natural rate of interest. He said Japan's current real interest rate is below the estimated natural rate of interest, which means monetary conditions remain accommodative and the fallout from market turbulence in early August remains, "so we must scrutinize the impact for the time being". He noted the BoJ must adjust monetary conditions by 'another gear' if we can confirm that firms will continue to increase capex, wages and prices, and won't hike policy rates with a pre-set level of neutral interest rate in mind. BoJ's decision to reduce bond buying won't hugely affect the impact of monetary easing, but marks a big turning point from when the central bank had YCC in place, and markets stabilizing after some turbulence, but must watch market developments with a very strong sense of urgency.

- BoJ to hold meeting on market operations on October 16th from 17:30 local time, according to Reuters.

- RBA Governor Bullock repeated that it is premature to be thinking about rate cuts; as of now, the board does not expect to be in a position to cut rates in the near term. She noted the RBA's highest priority has been and remains to bring inflation down, and the Board remains vigilant to upside risks to inflation, whilst the RBA's full employment goal is not served by letting inflation stay above target indefinitely. She noted substantial uncertainty around the central outlook, with risks on both sides and if circumstances change, the board will respond accordingly. Bullock said the labour market remains relatively tight, expected to ease gradually, and labour cost growth is strong reflecting wage increases, and weak productivity. She warned key drivers of elevated inflation are housing costs, market services, and CPI rents inflation is likely to be high for some time. Bullock said need to see results on inflation before lowering rates; board is not going to focus on one inflation number, and slightly elevated AUD is positive for inflation fight.

- UMC (2303 TW) August Sales (TWD): Revenue 20.6bln (prev. 18.96bln), +8.94% Y/Y

- Foxconn (2317 TT) August revenue +32.8% Y/Y (prev. +21.9% Y/Y in July).

- Nio (NIO/9866 HK) Q2 (USD) EPS -0.30 (exp. -0.31), Total Revenue 2.4bln (exp. 2.43bln); vehicle deliveries 57,373 in Q2; Sees Q3 Revenue 2.63bln-2.70bln

DATA RECAP

- Japanese Labour Cash Earnings YY (Jul) 3.6% vs Exp. 3.0% (Prev. 4.5%)

- Japanese Overtime Pay (Jul) -0.1% (Prev. 1.3%, Rev. 0.9%)

- Japanese Foreign Invest JP Stock w/e -824.4B (Prev. -438.3B, Rev. -442.6B)

- Japanese Foreign Bond Investment w/e 1.6405T (Prev. 1.543T, Rev. 1.556T)

- South Korea GDP Growth QQ Revised (Q2) -0.2% (Prev. -0.2%)

- South Korea GDP Growth YY Revised (Q2) 2.3% (Prev. 2.3%)